AUD/USD, RBA Minutes Talking Points

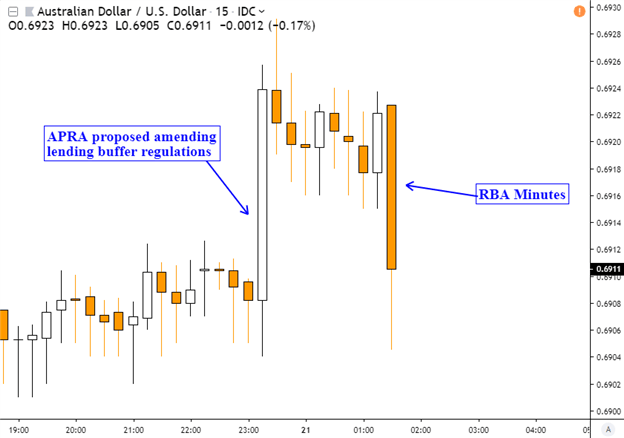

- AUD/USD falls on RBA minutes, erasing earlier gains on APRA news

- Policymakers see a rate cut as likely if no gains made in labor market

- AUD/USD decline may extend on RBA Governor Philip Lowe speech

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

The Australian Dollar finds itself back to square one following the minutes of the RBA interest rate decision, which sent AUD/USD lower. Earlier in the session, the Australian Prudential Regulation Authority (APRA) proposed amending mortgage buffer laws. This lowered RBA rate cut bets as local front-end government bond yields rallied, sending AUD higher.

This reversed on the RBA minutes which revealed that policymakers saw a rate cut as “likely appropriate” if there are no further improvements in the labor market. As a reminder, in May the central bank unexpectedly left benchmark lending rates unchanged. That caught markets off-guard and sent AUD/USD rallying. However, the RBA brought up concerns on unemployment trends.

Last week this was underpinned when the Australian unemployment rate unexpectedly climbed alongside an uptick in the labor force participation. While the nation added overall more jobs than expected, this was due to gains in part-time positions while more favorable full-time ones contracted.

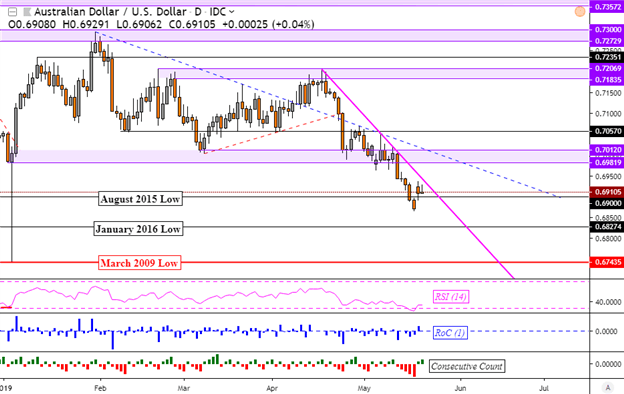

With that in mind and with AUD/USD back to square one on the chart below, whether or not it can make or break its direction falls onto the shoulders of RBA Governor Philip Lowe. He will be hosting a speech later today at 3:10 GMT. If he highlights concerns over last week’s jobs report, the Aussie Dollar risks extending losses.

AUD/USD Price Reaction to RBA Minutes

Chart Created in TradingView

AUD/USD Technical Analysis

As noted in this week’s Australian Dollar technical forecast, AUD/USD may be targeting 2009 lows in the medium-term. On the daily chart below, the pair finds itself being guided lower by a falling resistance line from the middle of April. If it holds, the pair may take our August 2015 and January 2016 lows ahead. You can follow me on Twitter for the latest updates in AUD here at @ddubrovskyFX.

AUD/USD Daily Chart

Chart Created in TradingView

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Aussie is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter