Asia Pacific Markets Wrap Talking Points

- Asia stocks traded mixed, like S&P 500 reaction to FOMC

- ASX 200 fell as local jobs report reduced dovish RBA bets

- GBP/USD, FTSE 100 eye Bank of England and Brexit saga

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Asia Pacific markets lost most of their upside momentum heading into the European trading session. This followed a decidedly more dovish Fed rate decision which resulted in a mixed reaction on Wall Street. In the end, the S&P 500 closed to the downside as markets balanced a pause in tightening with pessimistic economic projections.

Japan’s Nikkei 225 rallied as much as 0.6%, but then trimmed gains heading towards the close. China’s Shanghai Composite fared better, with gains sustaining above 0.5%. South Korea’s KOSPI traded little changed. In Australia, the ASX 200 was down over 0.4%. This may have been due to February’s Australian jobs report.

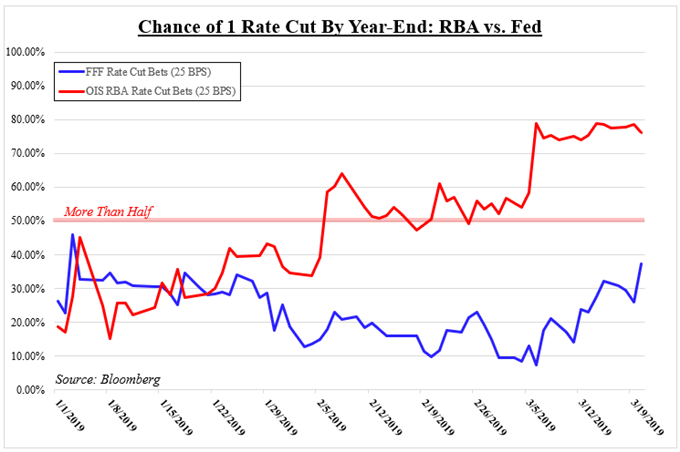

Despite a rather lackluster outcome, where the nation added fewer jobs as the unemployment rate fell for potentially the wrong reasons, AUD/USD soared with rising front-end government bond yields. This reflected ebbing RBA rate cut bets, which bodes ill for Australia’s benchmark stock index. With that in mind, it will probably take significantly more dismal local economic data to revive dovish expectations (see chart below).

S&P 500 futures are little changed as markets now face the Bank of England monetary policy announcement. Given the reaction today to the Fed, it is unclear what a more cautious central bank could mean for equities. Meanwhile, let’s not forget that GBP/USD and FTSE 100 are also overshadowed by the ongoing Brexit saga which has lately taken a toll on it.

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter