EURUSD Analysis and Talking Points

- ECB’s Draghi sets the Tone for Next Week’s Meeting

- Fed Hawks Follow the Doves

DailyFX Q1 2019 Trading Forecasts for EURUSD

ECB’s Draghi sets the Tone for Next Week’s Meeting

In light of the deterioration in the global growth outlook, President Draghi provided some more dovish signals in yesterday’s speech, consequently placing the Euro on the backfoot. President Draghi noted that recent economic developments have been weaker than expected. As a reminder, yesterday saw growth in Germany dropping to the lowest level in 5yrs, albeit narrowly avoiding a technical recession. Aside from the growth aspect, inflation pressures have eased amid the plunge in oil prices. As such, the ECB President highlighted a significant amount of monetary policy is still needed (alluding to forward guidance on interest rates and reinvestments).

Most notably, Draghi stated that there is no room for complacency, subsequently opening the door to a dovish statement at next week’s ECB meeting. Risks to the economic outlook is tilted to the downside, despite the ECB’s insistence that growth risks remain broadly balanced.

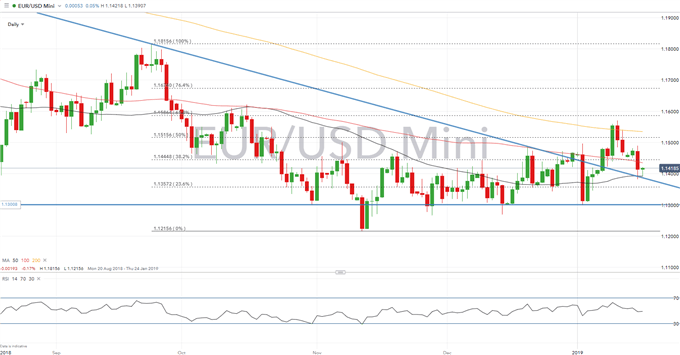

EURUSD Price Chart: Daily Time Frame (Aug 2018 – Jan 2019)

EURUSD continues to remain with the broad 1.13-1.15 range with extremes being faded. For the time being this may continue, with little to suggest that there will be a firm range break in the near-term. Elsewhere, German bund yields are negative out to 9yrs, however, the spread has narrowed against US treasuries with the 2yr spread at -315bps from the low of -361bps.

Fed Hawks Follow the Doves

The Federal Reserve’s most notable hawk, Ester George, joined the doves of the Fed after making the case that the central bank can be patient when looking at making further adjustments to interest rates. Fed’s George added that a pause in the normalisation process would provide time to assess the economy. As such, this supports the general view of the Fed that they may pause until June.

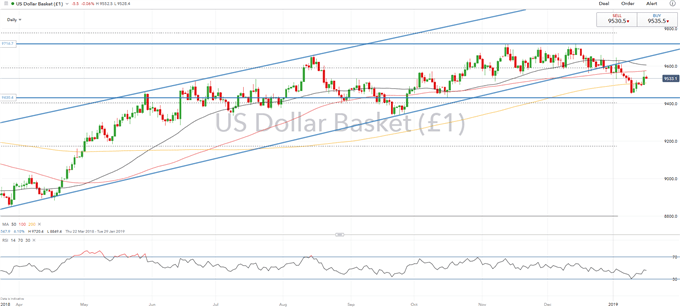

USD Price Chart: Daily Time Frame (Mar 2018 – Jan 2019)

TRADING RESOURCES:

- US Dollar: What Every Trader Needs to Know

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX