GBPUSD Analysis and News

- UK Manufacturing Shows Surprise Jump

- History Suggests GBP Could Drop on Tory Party Conference

Check out our Brand New Fundamental and Technical Q4 forecast guide for GBPUSD

UK Manufacturing Output Surprises to the Upside

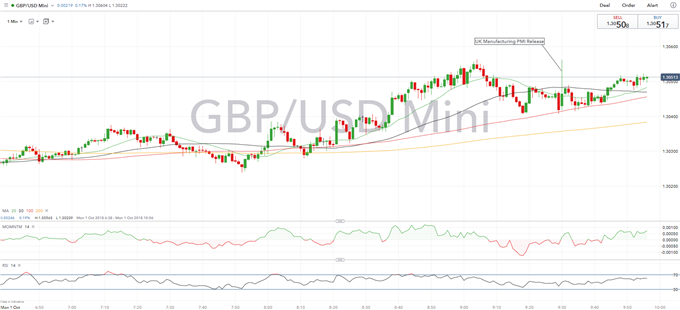

UK Manufacturing PMI saw a surprise boost in September, putting an end to 3-months of slowing growth. The headline figure rose 53.8, above the expected 52.5, while the prior month saw a revision higher to 53 from 52.8. IHS Markit highlighted that export order books rose from its first decline in more than two years, alongside this, output expanded at the fastest pace in four months. However, GBP saw a relatively muted reaction to the PMI report, given that the broader continues to remain subdued as factory output rose only moderately.

Focus on Tory Party Conference

With the annual Tory party conference now underway, the question will be whether history will repeat itself this week. UK PM May will give a keynote speech at the conference on Wednesday, 2-weeks before the EU summit which will be dominated by Brexit negotiations. As a reminder, at the two previous party conference speeches made by Theresa May the Pound has fallen an average of 1% in the following week.

GBPUSD PRICE CHART: 1-MINUTE TIME FRAME (INTRADAY October 1, 2018)

What Does Positioning Tell us About the Direction in GBPUSD?

Data shows 56.3% of traders are net-long with the ratio of traders long to short at 1.29 to 1. The number of traders net-long is 1.7% higher than yesterday and 66.2% higher from last week, while the number of traders net-short is 4.2% higher than yesterday and 43.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX