EURUSD Analysis and Talking Points

- Fed Chair Powell will be delivering his Semi-Annual Testimony before the Senate Panel at 14:00GMT

- An upbeat testimony could see EURUSD retest rising trendline

See our Q3 EUR forecast to learn what will drive the currency through the quarter.

Fed Chair to Re-emphasise Current Economic and Rate Outlook

Fed Chair Powell will be delivering his Semi-Annual Testimony before the Senate Panel at 14:00GMT, which will be the biggest focus for FX traders today. Since his appointment, Powell has largely avoided to cause a stir in the markets during his public addresses, as such there is possibility that the Fed Chair could re-emphasis the themes from the June FOMC meeting minutes by supporting the Fed’s current economic and rate path, whereby two more rate rises are seen this year.

Alongside this, the Fed Chair stated in an interview last week that the US economy is in a “good place” given the recent government tax and spending programs, consequently, this upbeat assessment is unlikely to change. Additionally, with Fed Fund futures only pricing in 74bps worth of tightening in 2019, compared the Fed’s projection of 125bps, there is scope for USD upside. If Powell reaffirms the case that the Fed will hike two times next year, this may prompt an unwind of the recent US/German yield spread tightening from the widest point in 30yrs, pushing the EURUSD rate lower.

Trade War Risk

Undoubtedly, one of the key subjects will be on the Fed’s thinking in regard to trade wars and its economic implications. In the FOMC’s June minutes, the Fed were cognizant about global trade risks, noting that these risks had intensified and were concerning, Powell also noted that trade disputes or high tariffs will be negative for the economy. As such, any hints that this would derail from its current rate path trajectory could lead to a sell-off in the USD-index.

Flattening Yield Curve Sending Recession Warnings

The narrowing 2/10yr US bond spread has provided some concerns for many investors with the spread now a mere 26bps. Typically, a flattening yield curve, which inverts normally signals that a recession is on horizon, as was the case before the financial crisis. Consequently, focus will be also be placed on Powell’s view on the flattening curve.

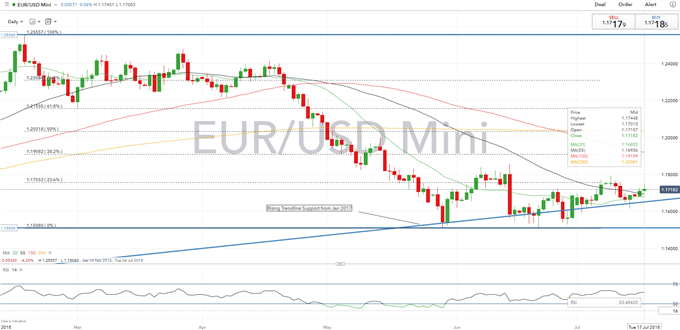

EURUSD PRICE CHART: Daily Time Frame (February 2018- July 2018)

EURUSD Technical Levels

The rising trendline from January 2017 continues to offer support for the pair, which sits at 1.1650. An upbeat Fed Chair Powell testimony could see this tested. On the upside, initial targets are seen at 1.1753, which marks the 23.6% Fibonacci Retracement of the 1.2555-1.1508 fall.

IG Client Positioning Sentiment states that 51.8% of traders are net-long, suggesting that prices may continue to fall.

Additional analysis on Fed Chair Powell’s Testimony

- US Dollar Analysis: Fed Chair Powell Likely to Re-Invigorate USD by Market Analyst Nick Cawley.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX