Talking Points

- Bitcoin price swings across exchanges allow fleet-footed traders to benefit.

- Bitcoin futures should eventually help to even out volatility and price differentials.

- Ethereum, Litecoin and other altcoins soar on diversification.

You can get the new Introduction to Bitcoin Trading guide here.

Bitcoin and the Algorithms

The recent volatile price action in Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) among others has thrown up a range of trading price disparities, allowing fleet-footed arbitrage traders to profit from market inefficiencies. Tuesday’s hectic trading saw the price of Bitcoin differ by between 5% and 15% across different exchanges, leaving free money on the table for traders who have multiple accounts. And these market inefficiencies will have been picked up by algorithm-based funds and trading houses who are able to detect and trade different prices across different exchanges at breakneck speed. In the short-term while these computer programs may cause exchanges to suffer due to constant, speed-driven trading, eventually these algos will cause markets to become more efficient and for prices to move inline.

Bitcoin Futures will Mature and Temper Price Action

Last Sunday’s BTC future launch on the CBOE, and next week’s launch on the CME, has added another layer of respectability to the cryptocurrency market. While initial futures trading saw low turnover and sluggish trade, investors will increasingly use this leveraged, regulated product instead of the cash market, causing volumes to increase and price action to become less volatile. And Bitcoin ETFs are likely to be launched next year - based on the futures market – pulling in more retail, and longer-term, money.

We discussed BTC’s price action at this week’s webinar – available above. If you would like to join us every Wednesday at 12:00pm for updated news and views, please click here.

Chart: Bitcoin (BTC) 15 Minute Timeframe (December 12 - 13, 2017)

Ethereum, Ripple and Litecoin Lead the Altcoin Charge

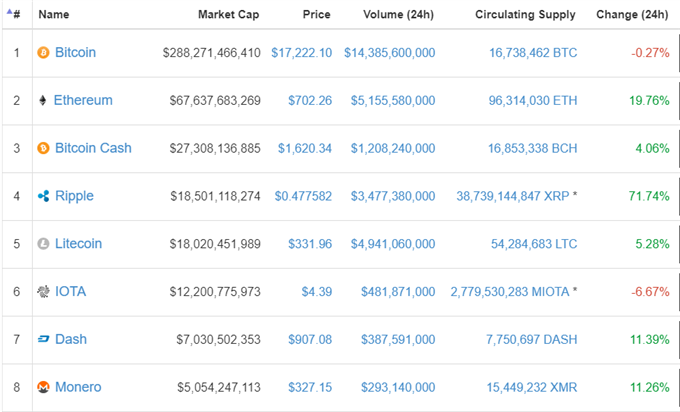

While Bitcoin continued to hog the headlines, a wide variety of other altcoins recorded sharp gains. These record highs helped to push the total market valuation to in excess of $500 billion, up from $18 billion at the start of the year. Among the movers, Ethereum (ETH), Ripple (XRP) and Litecoin (LTC) all hit new highs as money started to diversify across the cryptocurrency space. Ethereum has doubled in the last week, Ripple tripled at one stage, while Litecoin is up in excess of 325% in the last seven days.

Market Moves/Top 8 Capitalizations – December 13, 2017

If you are interested in trading digital pairs and would like to practice trading either BTC or ETH, you can create a Quick and Free Demo Account Here

--- Written by Nick Cawley, Analyst.

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1