Talking Points:

- AUD/USD little changed as China’s June trade data crossed the wires

- Exports rose by 1.3% in CNY terms

- Trade Balance printing 311.20b vs 323.00b expected (CNY)

Learn good trading habits with the “Traits of successful traders” series

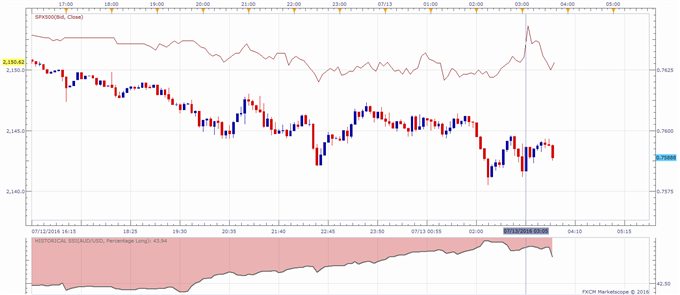

The Australian Dollar and correlated risk assets (such as the SPX 500) were little changed as June’s China trade balance figures hit the wires on London open.

The data showed exports rose 1.3% year-on-year in June, above expectations calling for a 0.3% increase, and the prior 1.2% print (in CNY terms).

Imports fell 2.3% year-on-year, below the 1.2% drop envisioned by economists ahead of the release (in CNY terms) - a sharp decrease after the +5.0% print seen in May.

Taken together, these figures saw the CNY denominated trade balance print a 311.20b figure, below the consensus forecast of 323.00b.

China continues to be a major concern in the context of slowing global growth, and indeed commentary by the Chinese Customs hitting the wires following the figures release signaled that world trade is expected to remain subdued in Q3, and the “Brexit” situation will add to uncertainties in the global economy.

Taking this into consideration, the upcoming BoE rate decision Thursday might have inspired the market to be more “Brexit” oriented, and the China GDP figures Friday might have added to the overall uninspiring reaction by the market to the figures.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 43.9% of traders are long the AUD/USD at the time of writing. The SSI is mainly used as a contrarian indicator, implying possible strength ahead for the AUD/USD.

You can find more info about the DailyFX SSI indicator here.

AUD/USD 5-Minute Chart with SPX 500 Overlay: July 13, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com