Australian Dollar Talking Points

AUD/USD extends the decline following the Reserve Bank of Australia (RBA) meeting, with the exchange rate now at risk of testing the 2018-low (0.7085) as it carves a fresh series of lower highs & lows.

AUD/USD Rate Eyes 2018-Low as Lower Highs & Lows Emerge

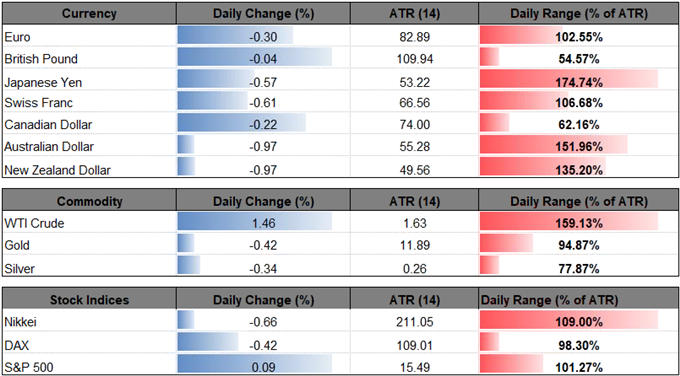

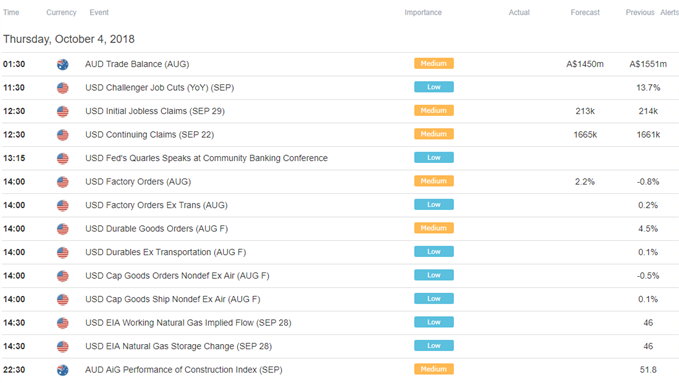

The diverging paths for monetary policy may continue to influence AUD/USD as the RBA shows little to no interest to lift the official cash rate (OCR) off of the record-low, and the exchange rate may exhibit a more bearish behavior over the days ahead as Fed officials strike a hawkish tone, with Richmond Fed President Thomas Barkin, a 2018-voting member on the Federal Open Market Committee (FOMC), noting that ‘the gradual path fits that so long as the data fit that.’

It seems as though the FOMC will continue to prepare U.S. households and businesses for a less accommodative stance as the central bank largely achieves its dual mandate for full-employment and price stability, and Chairman Jerome Powell & Co. appear to be on track to deliver another 25bp rate-hike at the next quarterly meeting in December as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

In turn, expectations for higher U.S. interest rates are likely to keep AUD/USD under pressure as there appears to be little in the way of deterring the FOMC from its hiking-cycle, and recent price action raises the risk for a further decline in the exchange rate as it carves a fresh series of lower highs & lows. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

- Broader outlook for AUD/USD remains tilted to the downside as the exchange rate continues to track the bearish trends from earlier this year,and the rebound from the 2018-low (0.7085) may continue to unravel following the failed attempt to push back above the 0.7320 (50% expansion) to 0.7340 (61.8% retracement) region.

- The 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) area now sits on the radar as it lines up with the 2018-low (0.7085), with a break/close below the Fibonacci overlap opening up the next downside hurdle around 0.7020 (50% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.