Talking Points:

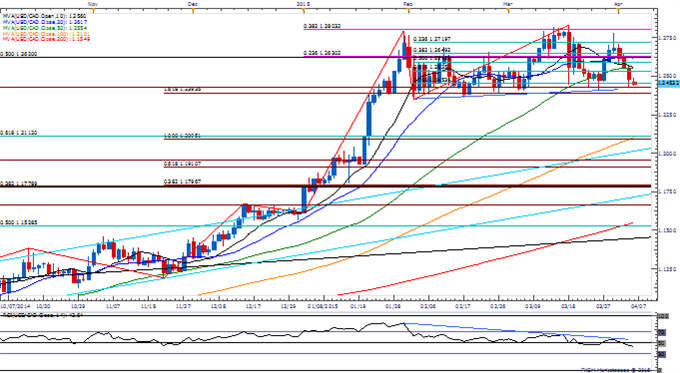

- USD/CAD Retail FX Crowd Flips Net-Long; 1.2400 Support Stands Despite Dismal Ivey PMI.

- AUD/USD Rebound Vulnerable to RBA Rate Cut, Toughened Verbal Intervention.

- Ascending USDOLLAR Channel at Risk as Bearish RSI Momentum Gathers Pace.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- 1.2390 (161.8% expansion) to 1.2420 (161.8% expansion) support zone in focus for USD/CAD despite the dismal Ivey Purchasing Manager Index (PMI), which shows a larger-than-expected contraction in March.

- Even though USD/CAD looks largely range-bound, risk remains skewed to the downside as the bearish momentum in the Relative Strength Index (RSI) gathers pace ahead of Canada’s Employment report, which is expected to show a flat reading for March following a 1.0K contraction the month prior.

- Nevertheless, the DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd has flipped to net-long USD/CAD coming into the first full-week of April, with the ratio currently standing at +1.06.

AUD/USD

- Despite expectations for another Reserve Bank of Australia (RBA) interest rate cut, the forward-guidance for monetary policy may have the greatest impact on AUD/USD; will Governor Glenn Stevens implement a toughened verbal intervention on the aussie?

- Bullish RSI momentum may continue to generate string of closes above 0.7570 (50% expansion) to 0.7590 (100% expansion) and highlight a more meaningful rebound from 0.7532.

- May see a more meaningful run at former support around 0.7720 (161.8% expansion) to 0.7740 (78.6% expansion) should we get more of the same from the RBA and the central bank endorses a wait-and-see approach.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

COT-Records in Euro Commercial Longs and Speculative Shorts

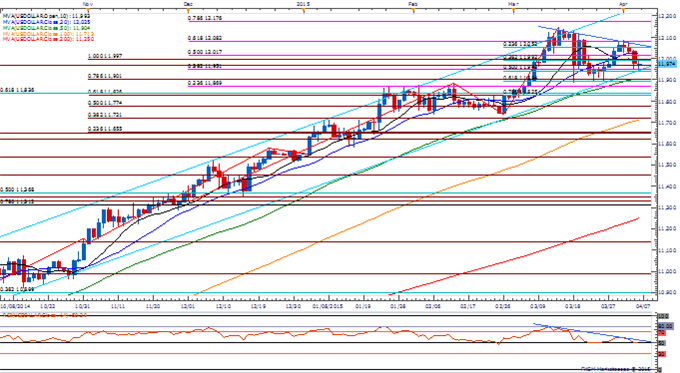

USDOLLAR(Ticker: USDollar):

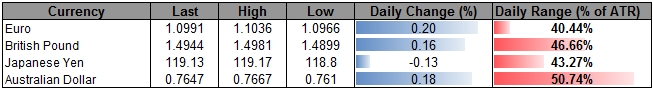

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11974.69 | 11992.97 | 11953.01 | -0.06 | 46.24% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar index remains at risk of facing a delayed reaction to the dismal U.S. Non-Farm Payrolls (NFP) report as market participation returns from the holiday weekend; keeping a close eye on the monthly opening range with the Federal Open Market Committee (FOMC) Minutes due out on April 8.

- Bullish channel carried over from July 2014 remains at risk as the bearish RSI formation continues to take shape; may see the FOMC further delay the normalization cycle as New York Fed President William Dudley highlights the downside risk brought by dollar strength along with the cautious outlook surrounding the economy.

- Will continue to watch the 50-Day SMA (11,904) along with the 11,894 (61.8% retracement) to 11,901 (78.6% expansion) for near-term support.Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Markit Purchasing Manager Index- Services (MAR F) | 13:45 | 58.6 | 59.2 |

| Markit Purchasing Manager Index- Composite (MAR F) | 13:45 | -- | 59.2 |

| ISM Non-Manufacturing (MAR) | 14:00 | 56.5 | 56.5 |

| Labor Market Conditions Index (MAR) | 14:00 | -- | -0.3 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums