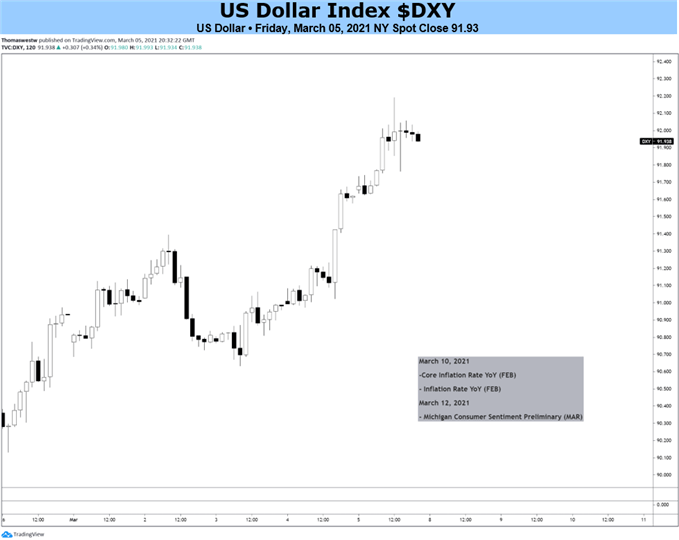

Chart created with TradingView

US Dollar Fundamental Forecast: Bullish

- Federal Reserve Chair Powell unfazed by Treasury market volatility

- US Dollar boosted by blowout NFP as US economic outlook strengthens

- US Inflation data on tap for next week may direct US Dollar’s path ahead

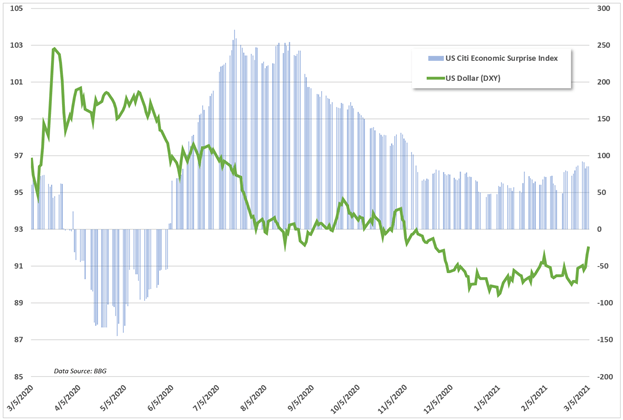

The US Dollar moved higher after an impressive Non-farm payrolls report for February crossed the wires Friday morning at 379k versus an expected 182k, according to the DailyFX Economic Calendar. US Dollar strength accelerated following the report, reflecting the economy’s strength amid a reopening as vaccination distribution accelerates. Economic data in the US has been consistently beating expectations to the upsides, evidenced through the US Citi Economic Surprise Index.

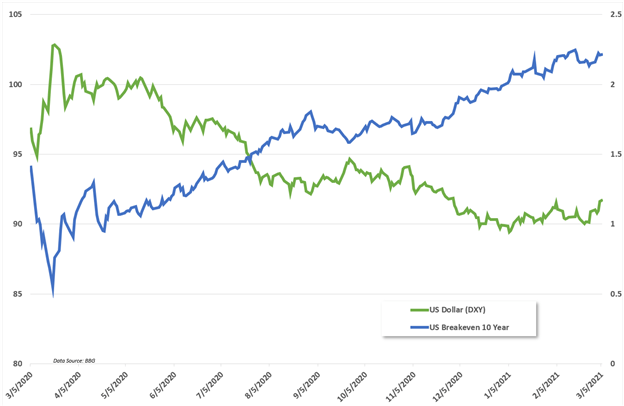

Treasury yields marched higher following the report but subsequently faded lower. Still, the Treasury curve has steepened significantly as economic conditions improve and new Treasury issuances to fund stimulus measures are expected. The US Dollar has started to track higher with rising yields more recently and that trend may continue as the outlook for the US economy brightens.

Federal Reserve Chair Jerome Powell this week appeared unconcerned with bond market volatility. However, Governor Lael Brainard stated that she had her eye on developments in the bond market and is “paying close attention.” The benchmark 10-year yield slipped lower after the jobs report although it remains near multi-month highs.

Next week may provide further direction for the Greenback, with US inflation data on tap. Analysts expect inflation on a year-over-year basis to increase to 1.7% from the prior 1.4%, although core inflation – which excludes energy prices and other volatile items – is forecasted to remain at 1.4%. The rise in crude oil and other energy commodities is one reason analysts are expecting the higher figure.

That said, a beat on next week’s inflation data may inspire additional confidence in the US economic recovery - underpinning the USD further. Markets will also get a read on consumer sentiment data through the University of Michigan’s consumer sentiment survey. Again, a better-than-expected print may bolster the economic outlook and push the US Dollar higher. Inflation expectations through breakevens have been on the move higher as the US outlook strengthens.

US Dollar Index (DXY) vs US 10-year Breakeven Inflation Rate

US Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter