TALKING POINTS – FRANC, YEN, US DOLLAR, AUSSIE DOLLAR

- Yen, Franc vulnerable as risk appetite swells around financial markets

- US Dollar may rise as yield-seeking flows eye Fed vs. G10 divergence

- Australian Dollar cautiously lower before RBA policy announcement

A lackluster offering of US and European economic data offers few obvious catalysts for financial markets as the trading week gets underway. That may open the door for sentiment trends to take the lead. Asia Pacific shares rose – echoing gains on Wall Street Friday – and positive cues in futures tracking the FTSE 100 and S&P 500 hint at more of the same ahead.

On balance, that probably bodes ill for standby anti-risk currencies like the Japanese Yen and Swiss Franc. Meanwhile, the US Dollar may edge up as the chipper mood keeps the spotlight on returns. That seems likely to speak to the benchmark currency’s appeal considering the Fed is on pace to lead all of its G10 counterparts on the policy tightening front in the months ahead.

Despite the upbeat mood overnight, the Australian Dollar underperformed. The move may have reflected pre-positioning ahead of the upcoming RBA monetary policy announcement. Governor Lowe and company are widely expected to keep the benchmark cash rate unchanged and signal standstill will continue for some time yet. A hike is not priced in at least until August 2019.

See our free guide to learn how to use economic news in your trading strategy !

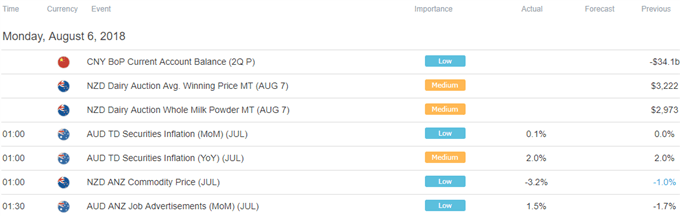

ASIA PACIFIC TRADING SESSION

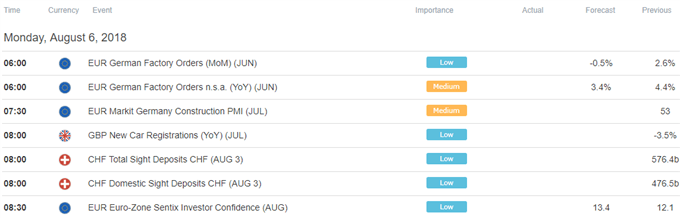

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter