Talking Points:

- Cautious February FOMC minutes boosts the appeal of the NZ Dollar

- US Dollar may rebound as fresh Fed-speak keeps March hike in play

- Crude oil bounce boosts Canadian Dollar, Aussie falls on capex data

The New Zealand Dollar outperformed in overnight trade, with gains tracing the inverse path of the benchmark 10-year US Treasury bond yield. This hints that the Kiwi as able to capitalize on its relatively rosy monetary policy outlook as Fed tightening bets eased following the release of minutes from February’s FOMC meeting. The RBNZ is the only G10 central bank expected to raise rates over the coming 12 month besides the US monetary authority.

Not surprisingly, the same dynamic put the US Dollar under pressure. The Minutes document painted Fed officials as more cautious than the fiercely hawkish rhetoric on offer recently. This seemed to pour a bit of cold water on the likelihood that a hike will materialize in March, although the priced-in probability of one didn’t budge from the 34 percent reflected in Fed Funds futures ahead of the release.

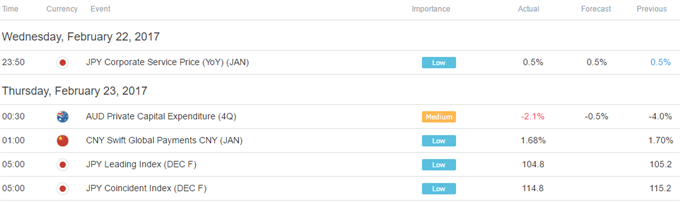

The Canadian Dollar rose alongside crude oil prices. The WTI benchmark rose after API reported that inventories fell by 884k barrels, snapping a six-week streak of back-to-back gains. The Australian Dollar swooned following disappointing capex data. Firms spent 2.1 percent less in the fourth quarter than they did in the third, disappointing bets on a smaller 0.5 percent retreat.

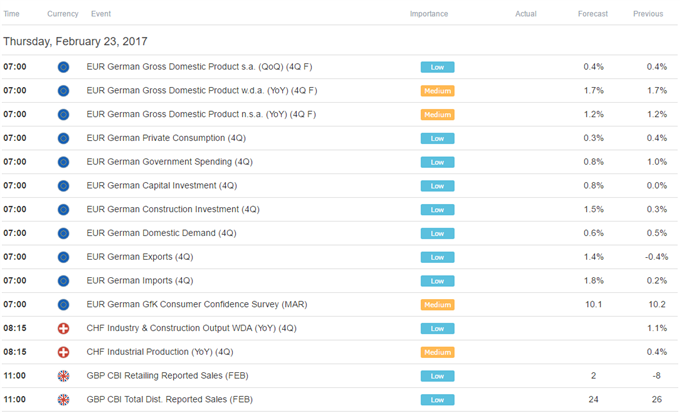

A tame European data docket will probably yield the spotlight to Fed policy speculation yet again. Comments from Dennis Lockhart and Robert Kaplan, Presidents of the Atlanta and Dallas Fed branches, are on tap. If they echo the more confident tone of other US central bank officials in recent weeks, the greenback may rebound as markets dismiss the Minutes publication as stale compared to the FOMC’s current disposition.

Have a question about trading the financial markets? Join a webinar and ask it live!

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak