Trading the News: Australia Employment Change

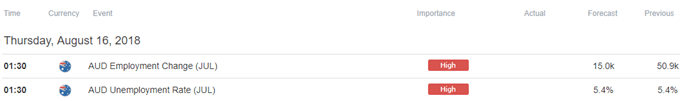

Australia’s Employment report may curb the recent decline in AUD/USD as the economy is anticipated to add another 15.0K jobs in July.

Another positive outcome may spark a bullish reaction in the Australian dollar as it boosts the outlook for growth and inflation, and the Reserve Bank of Australia (RBA) may come under pressure to lift the official cash rate (OCR) off of the record-low as ‘the rate of wages growth appears to have troughed and there are increased reports of skills shortages in some areas.’

As a result, an above-forecast employment report may encourage the RBA to change its tune over the coming months, and Governor Philip Lowe & Co. may adopt a more hawkish tone over the remainder of the year as ‘the central forecast is for inflation to be higher in 2019 and 2020 than it is currently.’

However, a batch of dismal data prints is likely to keep AUD/USD under pressure as it encourages the RBA to retain a wait-and-see approach for monetary policy, with recent price action warning of further losses as it extends the series of lower highs & lows carried over from the previous week. Sign up and join DailyFX Junior Currency Analyst Daniel Dubrovsky LIVE to cover the reaction to Australia’s employment report.

Impact that Australia Employment report has had on AUD/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2018 | 07/19/2018 01:30:00 GMT | 16.5K | 50.9K | +26 | -44 |

June 2018 Australia Employment Change

AUD/USD 5-Minute Chart

The jobless rate in Australia held steady at 5.4% per annum even as the economy added 50.9K jobs in June as the Participation Rate unexpectedly widened to 65.7% from 65.5%, with the figures highlighting an improved outlook for the economy as discouraged workers return to the labor force. A deeper look at the report showed the gains were led by a rebound in full-time positions, with the figure increasing 41.2K after contracting a revised 19.9K in May, while part-time employment increased 9.7K during the same period.

The Australian dollar gained ground following the employment report, with AUD/USD spiking to a high of 0.7442, but the reaction was short-lived as the exchange rate closed the day at 0.7355. Learn more with the DailyFX Advanced Guide for Trading the News.

AUD/USD Daily Chart

- Broader outlook for AUD/USD remains tilted to the downside as price & the Relative Strength Index (RSI) track the downward trends from earlier this year, with recent developments in the momentum indicator highlighting the risk for a further decline in the exchange rate as the oscillator snaps the bullish formation carried over from June.

- Will keep a close eye on the RSI as it approaches oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate as it suggests the bearish momentum is gathering pace.

- Need a break/close below the 0.7180 (61.8% retracement) to 0.7230 (61.8% expansion) region to open up the next downside hurdle around 0.7090 to 0.7110 (78.6% retracement).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.