Trading the News: Australia Wage Price Index (WPI)

Updates to Australia’s Wage Price Index (WPI) may keep AUD/USD under pressure as the gauge for household earnings is expected to hold steady at 2.1% per annum for the fourth consecutive quarter.

Signs of subdued wage growth should keep the Reserve Bank of Australia (RBA) on the sidelines as ‘household income has been growing slowly and debt levels are high,’ and Governor Philip Lowe & Co. may merely attempt to buy more time at the next meeting on September 4 as ‘the low level of interest rates is continuing to support the Australian economy.’

The wait-and-see approach for monetary policy may continue to foster a long-term outlook for AUD/USD especially as the Federal Reserve appears to be on track to deliver four rate-hikes in 2018, but an unexpected pickup in Australia wage growth may spur a bullish reaction in the aussie-dollar exchange rate as it puts pressure on the RBA to lift the official cash rate (OCR) off of the record-low. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Impact that Australia WPI has had on AUD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

1Q 2018 | 05/16/2018 01:30:00 GMT | 2.1% | 2.1% | -10 | +41 |

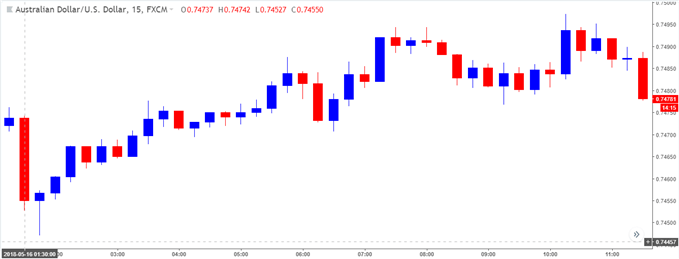

1Q 2018 Australia Wage Price Index (WPI)

AUD/USD 15-Minute Chart

Wage growth in Australia was largely unchanged during the first three-months of 2018, with the headline reading increasing 2.1% per annum for the third consecutive quarter. Signs of subdued wage growth is likely to keep the Reserve Bank of Australia (RBA) on the sidelines throughout 2018 as ‘one continuing source of uncertainty is the outlook for household consumption,’ with the Australian dollar at risk of facing headwinds over the coming months as the central bank remains in no rush to lift the official cash rate (OCR) off of the record-low.

Nevertheless, the market reaction was short-lived, with AUD/USD climbing back above the 0.7500 handle to end the day at 0.7515. Learn more with the DailyFX Advanced Guide for Trading the News.

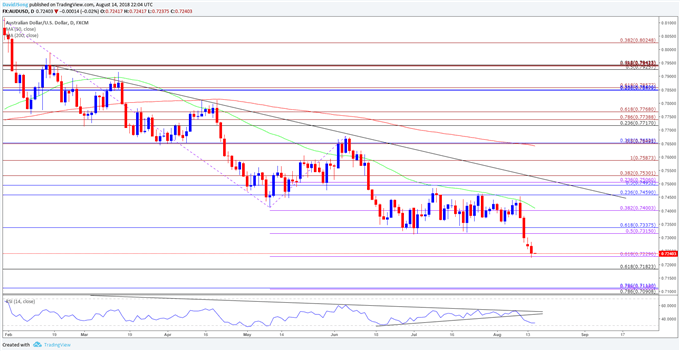

AUD/USD Daily Chart

- Keep in mind, broader outlook for AUD/USD remains tilted to the downside as price & the Relative Strength Index (RSI) track the downward trends from earlier this year, with recent developments in the momentum indicator highlighting the risk for a further decline in the exchange rate as the oscillator snaps the bullish formation carried over from June.

- Will keep a close eye on the RSI as it approaches oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate as it suggests the bearish momentum is gathering pace.

- Need a break/close below the 0.7180 (61.8% retracement) to 0.7230 (61.8% expansion) region to open up the next downside hurdle around 0.7090 to 0.7110 (78.6% retracement).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.