- Australia Wage Price Index (WPI) to Hold Steady at Annualized 2.0%.

- Will the RBA Continue to Endorse a Wait-and-See Approach in March?

Trading the News: Australia Wage Price Index (CPI)

Another 2.0% reading for Australia’s Wage Price Index (WPI) may spark near-term headwinds for the Australian dollar as it encourages the Reserve Bank of Australia (RBA) to keep the cash rate at the record-low.

Evidence of subdued household earnings may keep the RBA on the sidelines as ‘growth in the wage price index in the September quarter had been weaker than expected and wage growth outcomes associated with new enterprise agreements had been lower than the percentage increases incorporated in agreements they were replacing.’As a result, AUD/USD may exhibit a more bearish behavior ahead of the RBA’s next meeting on March 6, and Governor Philip Lowe and Co. may continue to tame expectations for an imminent rate-hike as ‘household debt levels remained elevated and members agreed that household balance sheets still warranted careful monitoring.’

However, a positive development may trigger a bullish reaction in AUD/USD as it instills an improved outlook for growth and inflation, and the RBA may gradually change over the coming months as the central bank head warns ‘it is more likely that the next move in interest rates will be up, rather than down.’

Impact that Australia Wage Price Index (WPI) has had on AUD/USD during the previous quarter

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

3Q 2017 | 11/15/2018 00:30:00 GMT | 2.2% | 2.0% | -40 | -40 |

3Q 2017 Australia Wage Price Index (WPI)

AUD/USD 30-Minute Chart

Australia’s Wage Price Index (WPI) climbed an annualized 2.0% in the third-quarter of 2017 after expanding 1.9% during the three-months through September. The quarterly print also fell short of market expectations as the reading held steady at 0.5% amid projections for a 0.7% reading.

The Australian dollar came under pressure following the lackluster developments, with AUD/USD slipping below the 0.7600 handle to end the day at 0.7588. New to trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

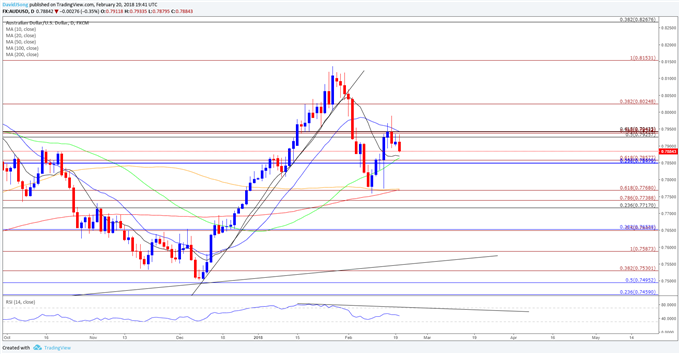

AUD/USD Daily Chart

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

- The recent rebound in AUD/USD appears to be abating as it snaps the series of higher highs from earlier this month, with the pair at risk for further losses following the failed attempt to test the February-high (0.8067).

- Break/close below the 0.7930 (50% retracement) to 0.7940 (61.8% retracement) region brings the downside targets back on the radar, with the former-resistance zone around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion) in focus as it largely lines up with the monthly-low (0.7759).

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.