- USD/JPY testing near-term resistance – threat remains for larger correction sub-111.37

- Check out our new 3Q projections in our Free DailyFX USD/JPY Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Japanese Yen is has been paring gains against the US Dollar since the start of the week with USD/JPY testing initial resistance today in early US trade. Here are the updated targets and invalidation levels that matter on the USD/JPY charts. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

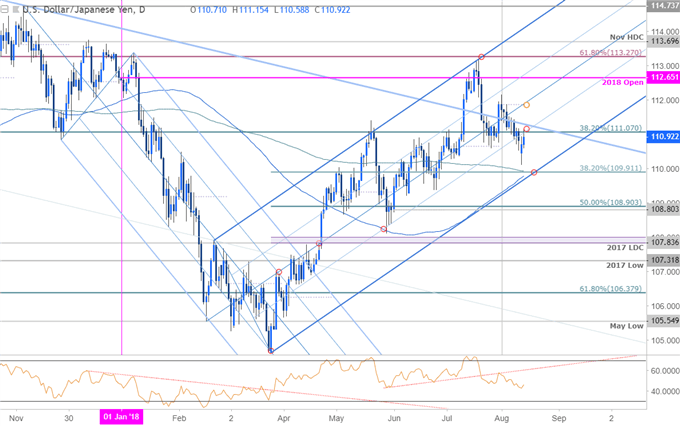

USD/JPY Daily Price Chart

Technical Outlook: In last month’s Technical Perspective on the Japanese Yen, we noted that price was testing, “yearly open resistance and could get some kickback but the focus remains weighted to the topside towards confluence resistance just above the 113-handle. From a trading standpoint, look to reduce long-exposure heading into this regions and be on the lookout for possible near-term exhaustion short-entries late in the month.”

USD/JPY registered a high at 113.18 just two days later before turning sharply lower with an RSI trigger break further validating the price reversal. Critical daily support rests at 109.80/91 where the 100 & 200-day moving averages converge on the 38.2% retracement of the March advance and pitchfork support.

New to Forex Trading? Get started with this Free Beginners Guide

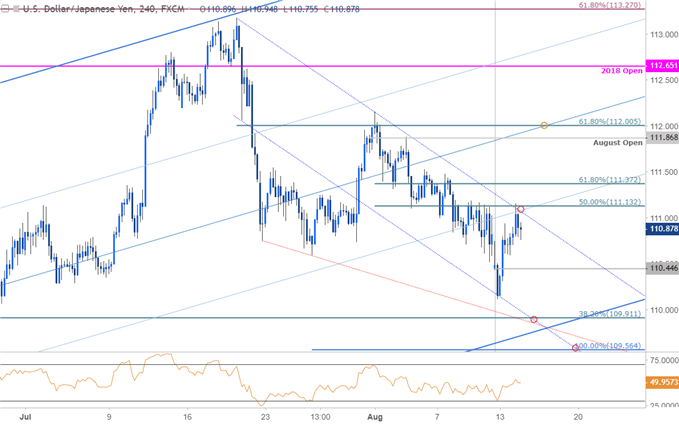

USD/JPY 240min Price Chart

Notes: A closer look at USD/JPY price action highlights a near-term resistance at 111.13- IF prices are indeed heading lower, advances should be capped by 111.37 with support targets eyed at the weekly open at 110.45 backed by 109.80/91 and the 100% extension at 109.56. Ultimately a breach above the monthly open / 61.8% retracement at 112 would be needed to mark resumption of the broader up-trend.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: The threat remains for a larger correction off the yearly highs while below 111.37. From a trading standpoint, the focus remains on a drive lower towards key confluence support around 109.90s OR on a breach above 112 to shift the focus back to the long-side. Keep in mind we get the release of US Advanced Retail Sales tomorrow with University of Michigan confidence surveys on tap this Friday.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

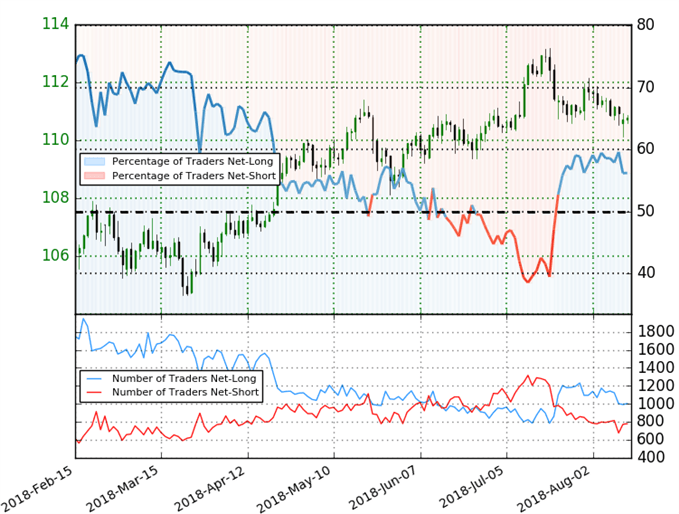

USD/JPY Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long USD/JPY - the ratio stands at +1.29 (56.2% of traders are long) – weak bearish reading

- Traders have remained net-long since July 23rd; price has moved 0.6% lower since then

- Long positions are5.1% lower than yesterday and 14.5% lower from last week

- Short positions are 2.5% higher than yesterday and 2.4% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week and the recent changes in positioning warn that the current USDJPY price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in USD/JPY retail positioning are impacting trend- Learn more about sentiment!

---

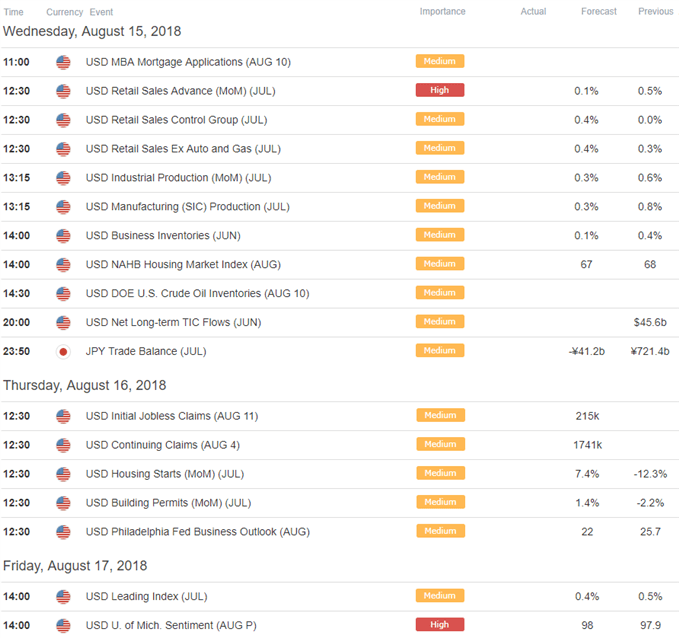

Relevant USD/JPY Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- GBP/USD Price Analysis: British Pound Testing Downtrend Support

- XAU/USD Technical Outlook: Gold Prices Digest Recent Losses

- AUD/USD Price Analysis: Aussie Consolidation in Focus ahead of RBA

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com