GOLD & CRUDE OIL TALKING POINTS:

- Gold prices break 2-month support before Powell testimony, FOMC minutes

- Crude oil prices pop as BP tanker ducks Iran seizure threat, but rally fizzles

- EIA short-term energy outlook, API oil inventory flow figures on tap ahead

Gold prices edged lower as the US Dollar rose for a third consecutive day, sapping the appeal of anti-fiat alternatives including the yellow metal. The currency rose as stocks retreated, hinting the move reflected diminishing Fed rate cut bets following Friday’s impressive US jobs report. Hopes for big-splash stimulus have both weighed on the Greenback and buoyed risk shares recently.

Crude oil prices idled. Prices briefly spiked higher intraday amid reports that a BP-operated oil tanker, the British Heritage, aborted a voyage from Iraq to Europe and sheltered in the Persian Gulf amid reports it might be seized by Iran. The move was feared to be retaliation after an Iranian tanker was detained by the British Royal Marines near Gibraltar last week. The broader risk-off mood saw gains quickly fizzle however.

FED RATE CUT BETS IN FOCUS, EIA OIL OUTPUT AND API INVENTORY DATA DUE

Looking ahead, another quiet day on the data docket may be ahead as traders withhold directional commitment before testimony from Fed Chair Powell and the release of June FOMC meeting minutes on Wednesday. Pre-positioning in the runup to these developments may be marked by de-risking amid worries about reduced scope for Fed easing however. Indeed, S&P 500 futures are pointing tellingly lower.

The EIA Short Term Energy Outlook report as well as API inventory flow data is due to cross the wires. The former may reiterate that US output remains near a record high above 12 million barrels per day while even as stockpiles hover just shy of the two-year high recorded in early June. That bodes ill prices. Last week is expected to have seen a modest 1.53-million-barrel drawdown.

Get the latest crude oil and gold forecasts to see what will drive prices in the third quarter!

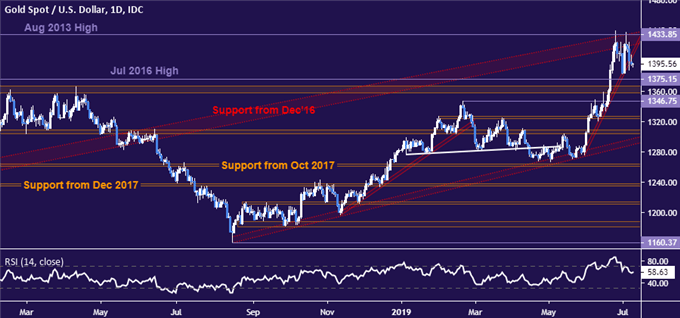

GOLD TECHNICAL ANALYSIS

Gold prices appear to have broken support guiding them higher since late May. That appears to shift the near-term bias in the dovish direction. Support begins at 1375.15, with subsequent back-to-back levels running down through 1346.75. Critical resistance remains at 1433.85, marked by the August 2013 top and the underside of previously broken support dating back to December 2016.

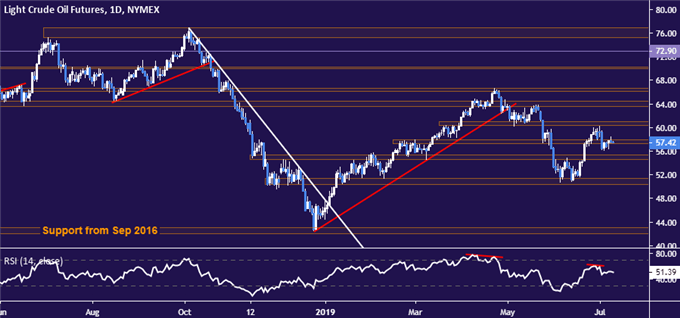

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned to support-turned-resistance in the 57.24-88 area. A daily close back above that targets the 60.39-95 zone. Alternatively, a push below support at 54.55 paves the way for another challenge of the 50.31-51.33 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter