CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices narrowly pierce resistance, rise to three-month high

- Gold prices fall short of breakout, chart setup warns of topping ahead

- Trade war headlines might overshadow EIA drilling data, Fed-speak

Crude oil prices marked time Monday, with participation and conviction understandably in short supply in a session shortened by the US Presidents Day holiday. Gold prices managed to build on Friday’s gains as the US Dollar continued to weaken, boosting the appeal of the standby anti-fiat alternative.

TRADE WAR NEWS MAY OVERSHADOW EIA REPORT, FED-SPEAK

From here, the EIA Drilling Productivity report may stoke oil oversupply worries, signaling that US output continues to swell even as demand prospects fizzle alongside falling global growth projections. Meanwhile, gold will size up comments from typically hawkish Cleveland Fed President Loretta Mester.

The EIA data may apply a bit of pressure on crude prices but a narrative similar to the worried tone of recent IEA and OPEC reports may be mostly priced-in already. Meanwhile, Ms Mester’s remarks might pass without fireworks as markets look ahead to the upcoming release of minutes from January’s FOMC meeting.

On balance, that might see broad-based sentiment trends emerge as the go-to driver for commodities. Bellwether S&P 500 futures are trading flat in Asia Pacific trade however, so a clear lead is absent for now. Incoming headline flow – especially on the trade war front – may be decisive.

US-China trade talks enter another phase this week, with officials from Beijing due in Washington. While the rhetoric has been somewhat upbeat, the Trump administration may be preparing a spoiler by way of raising tariffs on auto imports.

See our guide to learn about the long-term forces driving crude oil prices !

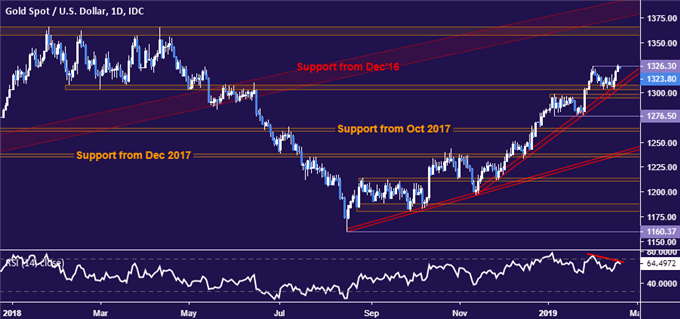

GOLD TECHNICAL ANALYSIS

Gold prices set a 10-month high but fell short of breaching resistance at 1326.30, the January 31 high. Negative RSI divergence now hints at ebbing upside momentum, which might precede a downturn. A dense support region capped at 1294.10 is ahead. A daily close below its lower boundary exposes 1276.50 next. Alternatively, a successful push through resistance targets the pivotal 1357.50-66.06 zone next.

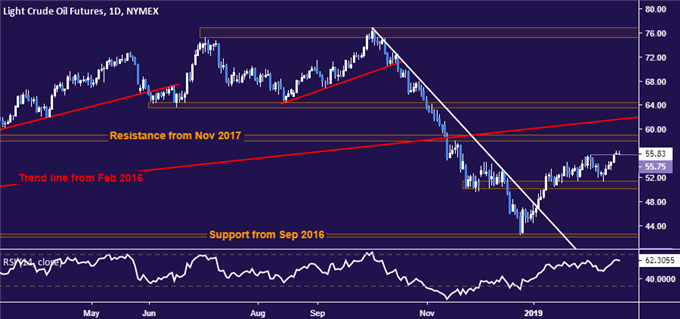

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices narrowly edged past resistance marked by the February 4 high at 55.75, seemingly opening the door for a move higher to challenge the 57.96-59.05 area. A further break above that eyes trend line support-turned-resistance set from early 2016, now at 61.66. Alternatively, a convincing reversal back below 55.75 may bring a retest of the 50.15-51.33 zone.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter