TALKING POINTS – YEN, US DOLLAR, TRADE WAR, CHINA, AUTO TARIFF

- Yen and US Dollar down, commodity FX up as China talks up US trade talks

- Thin data docket, US holiday closures may make for quiet start to trading week

- Potential for tariffs on US auto imports may stoke trade war escalation fears

The anti-risk Japanese Yen and US Dollar traded lower while the sentiment-geared Australian and New Zealand Dollars rose with stocks as Asia Pacific bourses picked up on Friday’s risk-on lead from Wall Street. Regional shares added over 1 percent on average amid reports of progress in US-China trade talks.

For its part, Beijing claimed that it has reached an agreement in principle with Washington DC on how to proceed with resolving key differences. US President Donald Trump echoed the upbeat mood, saying the talks have been “very productive”.

TRADE WAR ESCALATION FEARS MAY SOUR MARKET MOOD

Looking ahead, a lull in top-tier event risk and US market closures for the Presidents Day holiday might make for a quiet, consolidative session. Still, potential for headline-driven volatility remains acute, especially against the backdrop of diminished participation.

Impetus can come from a variety of sources. Further encouragement from China or a longshot breakthrough in Brexit talks might buoy sentiment. Fears trade war escalation may send the opposing signal however after President Trump received a report on whether imported autos pose a national security threat.

The White House has used a similar process to set the stage for raising aluminum and steel tariffs. Commerce Secretary Wilbur Ross – a vocal trade hawk – has now issued a formal opinion on the matter. It is unclear yet what this means. Allies like the Eurozone and Japan may be targets of any new penalties.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

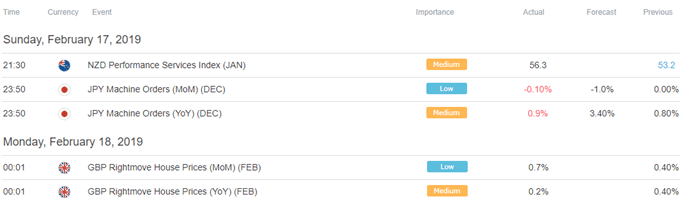

ASIA PACIFIC TRADING SESSION

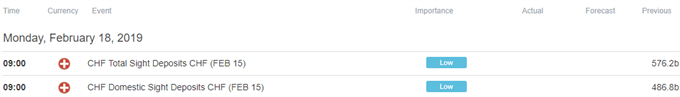

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter