Talking Points:

- Crude oil prices continue to hover at trend-defining chart support

- API inventory flow data in focus as supply trends remain clouded

- Gold prices eye Fed-speak having hit 1-month high on AHCA fail

Crude oil prices marked time in now-familiar territory absent fresh news flow informing the clouded supply outlook. A tug of war between the supportive influence of an OPEC production cut accord and downward pressure from swelling swing output – particularly in the US – continues to confound investors. The weekly APIinventory flow report is now in focus as the markets search for clear-cut direction cues.

Gold prices continued to rise as the aftermath of last week’s failure of the AHCA healthcare reform bill continued to define price action. The metal rose to a one-month high as ebbing confidence in the “Trump trade” weighed against Fed rate hike speculation, boosting the relative appeal of non-interest-bearing and anti-fiat assets.

The spotlight now turns to Fed-speak. Comments from Fed Chair Janet Yellen and Governor Jerome Powell as well as Esther George and Robert Kaplan – Presidents of the central bank’s Kansas City and Dallas branches – are due to cross the wires. Game-changing rhetoric seems unlikely however, with Fed officials as much at the mercy of US fiscal policy uncertainty as the markets at large.

Have a question about trading gold and crude oil? Join a Q&A webinar and ask it live!

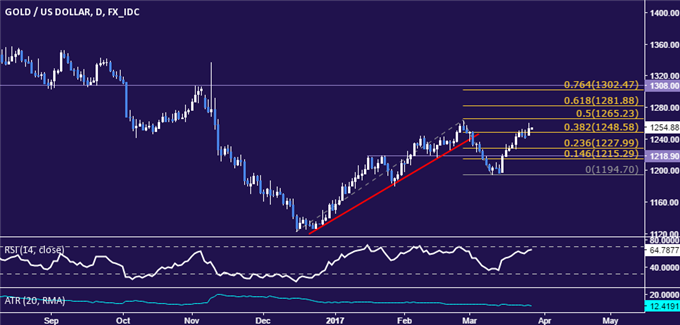

GOLD TECHNICAL ANALYSIS – Gold prices are poised to challenge major resistance in the 1263.87-65.23 area (February 27 high, 50% Fibonacci expansion) after breaching the 38.2% levelat 1248.58. A daily close above this barrier exposes the 61.8% Fib at 1281.88. Alternatively, a move back below 1248.58 opens the door for a retest of the 23.6% expansion at 1227.99.

Chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to hover above trend-defining support at 47.22 (50% Fibonacci retracement, rising trend line). A daily close below it initially exposes the 61.8% levelat 45.33. Alternatively, a reversal back above the 38.2% Fibat 49.11 paves the way for another test of the 23.6% retracementat 51.44.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak