Talking Points:

- Crude oil prices wait on rig count, positioning data at key support

- Gold prices snap six-day win streak before US House AHCA vote

- Fate of healthcare reform may alter Fed interest rate hike outlook

Crude oil prices drifted to the bottom of their near-term range but the absence of top-tier news flow meant the absence of momentum needed for a conclusive breakdown or a spirited rebound. Fresh insight into supply dynamics may help break the stalemate as Baker Hughes rig count data comes across the wires.

Last week, the figures showed that the number of active oil extraction installations rose to the highest since September 2015. Another increase may fuel speculation that swelling swing supply will offset and possibly even overwhelm upside pressure from an OPEC production cut scheme.

The markets appear increasingly friendly to this view. The CFTC reportedthat large speculators cut long WTI crude oil futures bets by the most in at least 11 years last week. Meanwhile, short exposure grew by the most in nearly five months. More of the same in this week’s positioning update may prove self-fulfilling.

Gold prices snapped a six-day winning streak as US Treasury bond yields rose, tarnishing the appeal of non-interest-bearing assets. The metal had enjoyed a brisk recovery after last week’s FOMC rate decision. Its turn may reflect pre-positioning ahead of a vote on healthcare reform in the US House of Representatives.

The fate of the AHCA – a Republican replacement for so-called “Obamacare” – has emerged as a referendum on the Trump administration’s ability to enact policy. Failure may dim hopes for tax cuts, deregulation and infrastructure spending. That may flatten the projected Fed rate hike path, boosting gold.

Retail traders are net buyers of gold. What does this hint about the price trend? Find out here !

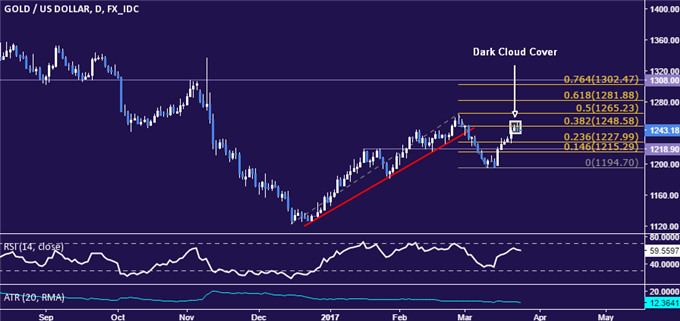

GOLD TECHNICAL ANALYSIS – Gold prices put in a bearish Dark Cloud Cover candlestick pattern, hinting a turn lower may be ahead. A reversal below the 23.6% Fibonacci expansionat 1227.99 opens the door for retest of the 14.6% level at 1215.29. Alternatively, a daily close above resistance at 1248.58, the 38.2% Fib, exposes the 50% expansionat 1265.23.

Chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to push up against key support at 47.22 (50% Fibonacci retracement, rising trend line) but a confirmed break remains elusive. A daily close below this barrier initially exposes the 61.8% levelat 45.33. Alternatively, a reversal above resistance at 49.11, the 38.2% Fib, targets the 23.6% retracementat 51.44 next.

Chart created using TradingView

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak