US Dollar, Beijing Coronavirus Cases, Powell, India-China Tension – TALKING POINTS

- US Dollar ended the day higher after Powell testimony, US retail sales statistics

- India-China, North-South Korean geopolitical tensions could extend USD gains

- AUD/USD selling pressure may accelerate after key resistance stood its ground

Wall Street ended the day on a happy note with the Dow Jones, S&P 500 and Nasdaq indices ending 2.0, 1.9 and 1.8 percent higher, respectively. The upbeat tune in North American equity markets was supported by better-than-expected retail sales data, which saw a 17.7 percent increase on a month-on-month basis for May. The difference between the actual figures and the estimate at 8.4 percent buttressed the notion of a recovery.

Federal Reserve Chairman Jerome Powell also spoke on the subject of an economic bounce back during his testimony in front of the Senate Banking Committee. He acknowledged that while the outlook remains uncertain, preliminary data seems to suggest that the US is in the recovery phase. Monetary authorities expect unemployment to decline and employment to increase over time.

Having said that, the Chairman warned that there remains “tremendous” volatility in labor market reports, urging patience in what will likely be a long road to recovery. He said it is a reasonable probability that more stimulus from the Fed and Congress will be needed, and reiterated the central bank’s stance on holding interest rates near zero until the economy is back on track.

Mr. Powell added that officials are in the early stages of evaluating yield curve control, and stressed a strong reluctance to deploy negative rates as a policy measure. Monetary authorities at this time are not thinking about raising interest rates in light of significant uncertainty on the timing and strength of the economic recovery. Weak growth prospects in Europe are also expected to weigh on domestic activity.

He added that congress should continue support for workers in some form, but stopped short of directly advising on policies, citing the central bank’s neutrality in the realm of politics. His commentary trimmed some of the gains equity markets acquired after US economic data was released with foreign exchange markets reflecting somewhat risk-off tilt too. The anti-risk USD climbed while the cycle-sensitive AUD and NZD fell.

Wednesday’s Asia-Pacific Trading Session

Without a major economic catalyst in the data docket, Asia-Pacific traders will likely continue to focus on macro-fundamental themes. The US Dollar may extend its gains on growing concerns of an increase of Covid-19 cases in Beijing and escalating geopolitical tensions in the region. In this environment, the cycle-sensitive AUD and NZD may be in for a rough session ahead while USD and JPY may prosper.

China-India relations are deteriorating after a skirmish on the border left casualties on both sides and pushed the USD/INR exchange rate higher at the expense of the Nifty 50 index. News of North Korea blowing up the inter-Korean office could put KRW and the Kospi index at risk in the session ahead. To learn more about the impact of geopolitical risks on financial markets, be sure to follow me on Twitter @ZabelinDimitri.

AUD/USD Technical Analysis

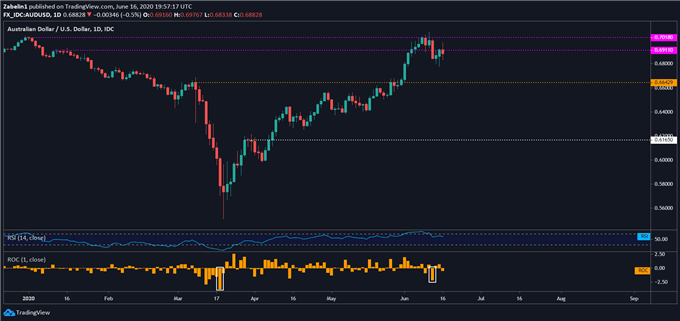

AUD/USD’s failure to puncture the lower cusp of the 0.7018-0.6911 resistance range with follow-through could inspire liquidation if its capitulation is viewed as a bearish signal. The pair has already failed to break the upper tier, and the short-bodied nature of the candle, combined with the extended wick suggests a desire to climb higher but a lack of confidence to do so.

AUD/USD – Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter