Talking Points:

- S&P 500 looks headed higher but could still range; several ‘high’ impact events

- DAX trying to find its footing; German employment on Wednesday

- FTSE trying to hang on below key level; no major data releases on the calendar

For a longer-term outlook on major markets and currencies, see the Q1 DailyFX Forecast.

S&P 500

In the week ahead, there are a few items on the calendar worth paying attention to; Advanced Goods Trade Balance, Durable Goods Orders, and Consumer Confidence on Tuesday, Wednesday brings GDP and the Fed’s Powell testimony before the House of Financial Services Committee, followed by Core PCE and ISM Manufacturing on Thursday. With the market undergoing stress lately, there has been larger reactions on news events, so more of that could be in store in the week ahead. For timing & estimate details, check out the economic calendar.

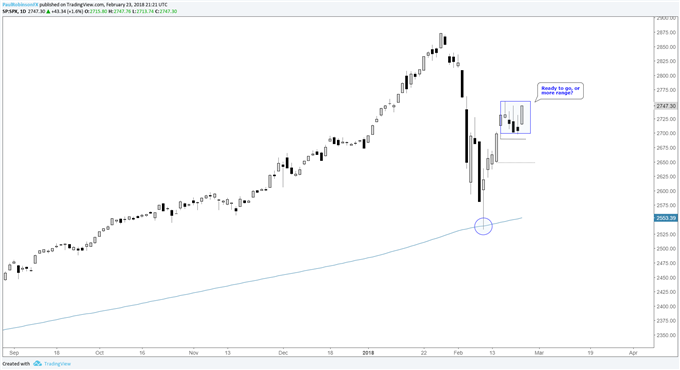

Four days in a row, starting the Friday before last, the market has been unable to hold a rally intra-day. This had the market looking lower, until Friday’s big rally, which engulfed the price action from the days before. The ability for the market to finally hold onto a rally suggests we could soon see higher prices, but we can’t rule out the possibility of more sideways price action first. The bottom and top of the range (2698-2754) will be used to determine whether we see more range or a breakout. A closing bar outside will be needed as confirmation, not just an intra-day breakout.

S&P 500: Daily

DAX

Next week brings German CPI on Tuesday and February employment data for Germany and Eurozone CPI on Wednesday. The one-month correlation between the DAX and euro is around +40% when it has typically been negative, how much longer that will last is anyone’s guess. But keep an eye on the relationship as it may return to ‘normal’, either helping or hurting Eurozone stocks.

The DAX has seen some volatile days of late, but resulting in little net movement. The index made a jab lower on 2/14 and rebounded sharply, also finding buyers on a sharp dip on Thursday. We may soon see the index try and carve out higher levels, with the area in the mid-12700s seen as big resistance. A drop back lower will bring 12283 into focus, and needs to hold if the slow recovery is to stay intact. Below there, a retest or worse may be in store.

Check out this guide for 4 ideas on how to Build Confidence in Trading.

DAX: Daily

FTSE

Next week brings a light calendar in terms of ‘high’ impact data events, so the focus as its been for some time will be on ‘Brexit’ headlines. Risk trends in general will also be impactful should we see a one-way move develop.

The FTSE found solid opposition up against the 7300-level, and this level will continue to be in play as strong resistance. A couple of forceful rejections lately have been met with buying, this coming week another breakout attempt to could evolve, but needs to hold above resistance to consider it reclaimed. On the downside if the market can’t get into gear soon, the 7100-level and Feb 2016 trend-line could come under assault again.

FTSE: Daily

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX