Talking Points:

- The final Q4’18 US GDP report will be released on Thursday, March 28 at 12:30 GMT.

- According to Bloomberg News, consensus forecasts are calling for US growth to have settled at a 2.4% annualized rate; however, growth expectations for Q2’18 are below 1%.

- Retail traders are net-long USDJPY and recent changes in positioning suggest a bearish bias.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

03/28 THURSDAY | 12:30 GMT | USD GROSS DOMESTIC PRODUCT (4Q T)

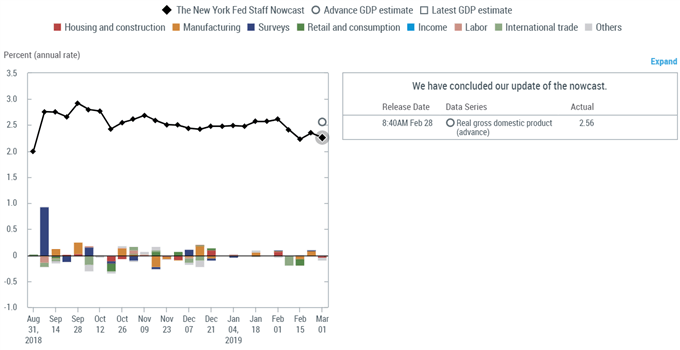

Growth expectations for the final Q4’18 US GDP have been tempered thanks to the shutdown. The US Congressional Budget Office estimated that the economy lost at least -0.1% of GDP last quarter and -0.2% in Q1’19 as a result of the shutdown. The NYFed Nowcasting estimate sees growth due in at a more modest 2.6% annualized. Meanwhile, the consensus forecast, according to Bloomberg News, calls for headline growth in at 2.4%.

The future doesn’t appear any brighter. The increasingly difficult global macro environment due to the US-led trade wars as well as the fading effect of the Trump tax plan on the domestic macro environment, expectations are for the US economy to continue to see slower rates of growth for the foreseeable future. The NYFed Nowcasting estimate for Q1’19 shows growth at 1.29% while the Atlanta Fed GDPNow estimate is at 1.2%.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

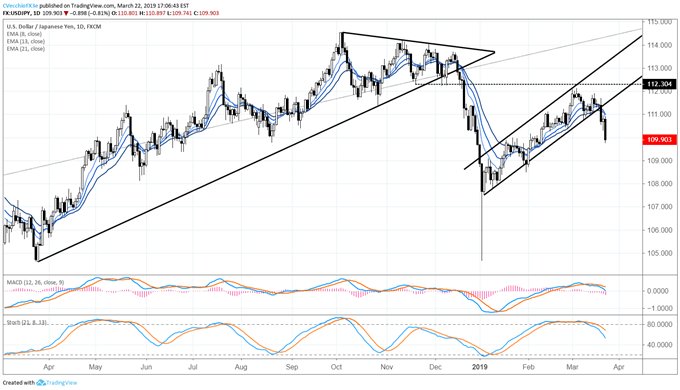

USDJPY Price Chart: Daily Timeframe (March 2018 to March 2019)

The rally by USDJPY since the Yen flash-crash at the start of 2019 may be finished. With the bearish outside engulfing bar developing on March 20, the uptrend from the post-flash crash low was breached. Price action since Wednesday has been showing signs of significant follow through to the downside. Having cleared out the early-March swing low at 110.75, the probability of more downside in the near-term has increased.

To this end, USDJPY price is now below the daily 8-, 13-, and 21-EMA envelope while both daily MACD and Slow Stochastics are trending lower, having fallen out of overbought conditions. A near-term bearish bias may be appropriate unless the March 20 bearish outside engulfing bar high of 111.69 is breached.

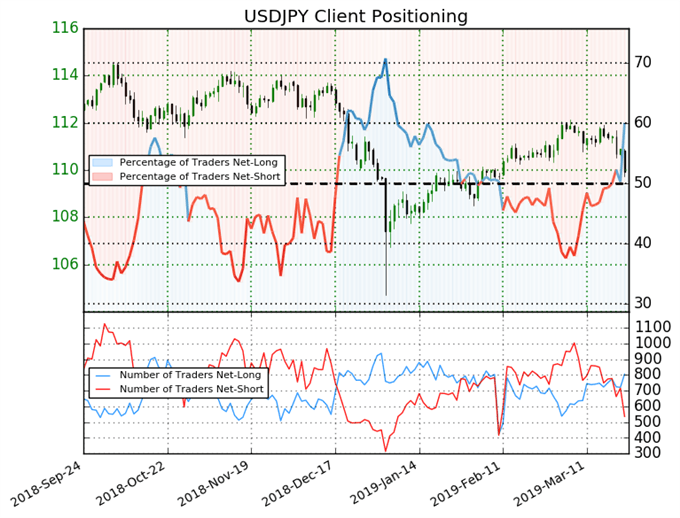

IG Client Sentiment Index: USDJPY (March 22, 2019)

Retail trader data shows 60.0% of traders are net-long with the ratio of traders long to short at 1.5 to 1. The percentage of traders net-long is now its highest since Jan 08 when USDJPY traded near 108.749. The number of traders net-long is 15.7% higher than yesterday and 12.7% higher from last week, while the number of traders net-short is 26.3% lower than yesterday and 32.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

Read more: Top 5 FX Events: March RBNZ Meeting & NZDUSD Price Outlook

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX