Talking Points:

- Developing a Strategy Can be Broken in to Three Steps

- A Series of Moving Averages Can Help Determine Market Retracements

- Don’t Forget to Manage Risk

New to trading? You may enjoy our trading guides

Developing a trading plan can be a difficult process for new traders. The good news is that trading the trend can be broken into three manageable steps. In this webinar we cover all three steps so you can begin writing your own unique trading methodology.

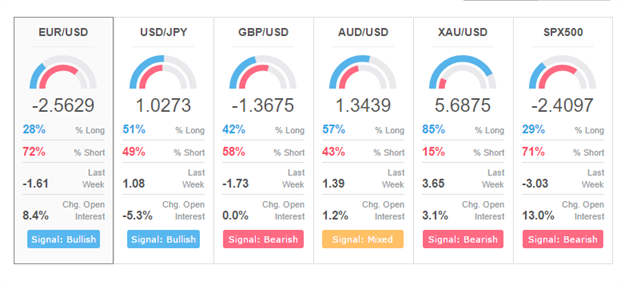

First, traders will need to find the trend. This step is important because traders should look to buy as prices rise in an uptrend, or sell in a declining downtrend. Typically this can be done using a combination of price action, technical indicators, and sentiment analysis. While there are many options that traders can select from for this process, the good news is once market direction is found traders may immediately move on to the final two steps of their trading plan.

Tools like IG Client Sentiment can help traders find the trend

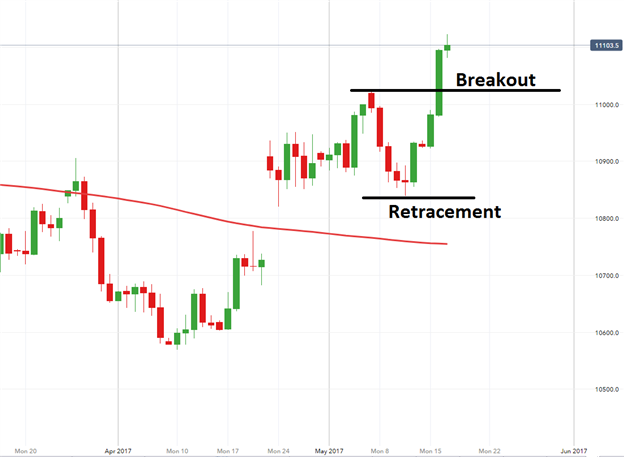

Next, traders will need to time their market entries. For this step, traders need to decide if they will be trading breakouts or retracements. A breakout trader will look to buy above values of resistance in an uptrend and sell below support in a downtrend. This differs from retracement traders that will look for pull backs or dips in the trend before entering into the market. It’s important to remember that both breakout and retracement strategies have their Pros and Cons. So take some time here to pick the method that works for you. The key with any strategy is consistency!

EUR/USD Daily Chart with Breakout & Retracement

Lastly, traders will need to have a plan to manage their risk. When the trend turns, traders should be prepared to take their losses at a specific point on the chart. Typically this can be done by placing stops using a price action swing high or low. Traders may also consider using a technical indicator here to help determine their analysis invalidation point. Regardless of your decision, sticking to your risk management plan is critical. Remember, knowing when to exit the market is just as important as your entry!

This concludes our look at the three step trading plan!

Interested in Joining Our Analysts, Instructors, or Strategists For a Free Webinar? Register Here

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.