Talking Points:

- NZD/USD Retail FX Crowd Remains Net-Long Ahead of RBNZ Policy Meeting.

- USD/CAD Range Remains in Focus Amid Failed Test of Opening Monthly Range.

- USDOLLAR Outlook Hinges on NFP Report- IMF Favors Fed Rate Hike in 2016.

For more updates, sign up for David's e-mail distribution list.

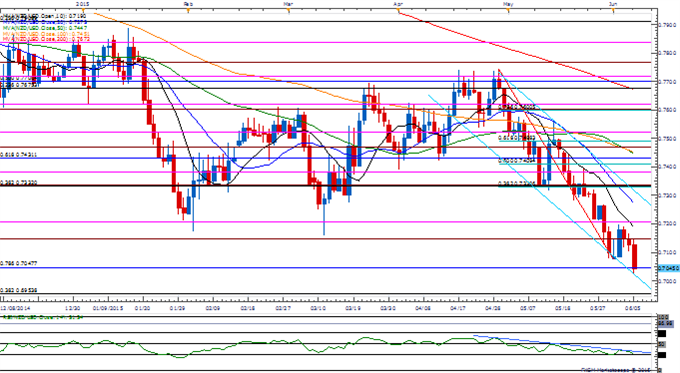

Chart - Created Using FXCM Marketscope 2.0

- NZD/USD remains at risk a for a further decline as the bearish formation continues to take shape; close below 0.7040-50 (78.6% retracement) may open the door for a move towards 0.6950-60 (38.2% retracement).

- According to a Bloomberg News survey, 10 of the 16 economists polled forecast the Reserve Bank of New Zealand (RBNZ) to keep the benchmark interest rate on hold at 3.50%; will keep a close eye on the forward-guidance for monetary policy amid speculation for the central bank to revert back to its easing cycle.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long NZD/USD since May 19, with the ratio climbing back towards extremes as it advances to +2.46.

USD/CAD

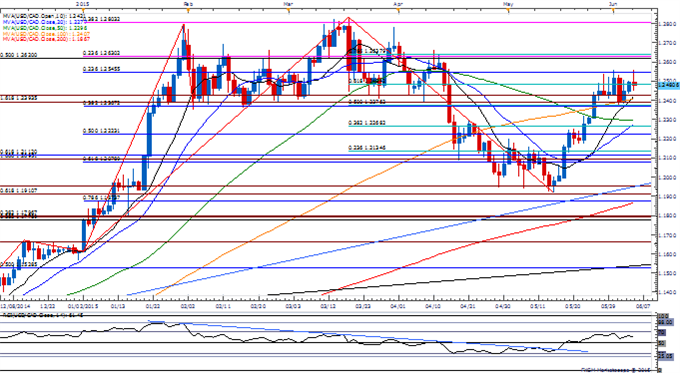

- USD/CAD looks poised to carry the range-bound price action into the week ahead as the 58.9K rise in Canada Employment boosts the appeal of the loonie; may see the Bank of Canada (BoC) turn increasing upbeat towards the economy amid the ongoing series of better-than-expected data prints.

- Nevertheless, the policy divergence should highlight a long-term bullish outlook for USD/CADas BoC Governor Stephen Poloz continue to endorse a wait-and-see approach.

- Still waiting for a break/close above 1.2545 (23.6% retracement) or below 1.2370 (38.2% retracement) to reinforce a near-term directional bias for USD/CAD.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

The Weekly Volume Report: Sterling Declines on Weak Volume

EUR/USD Drops Through $1.1100 after May US Jobs Growth Hits +280K

USDOLLAR(Ticker: USDollar):

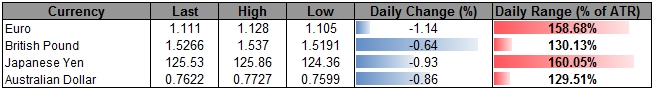

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11993.36 | 12024.2 | 11919.93 | 0.59 | 144.48% |

Chart - Created Using FXCM Marketscope 2.0

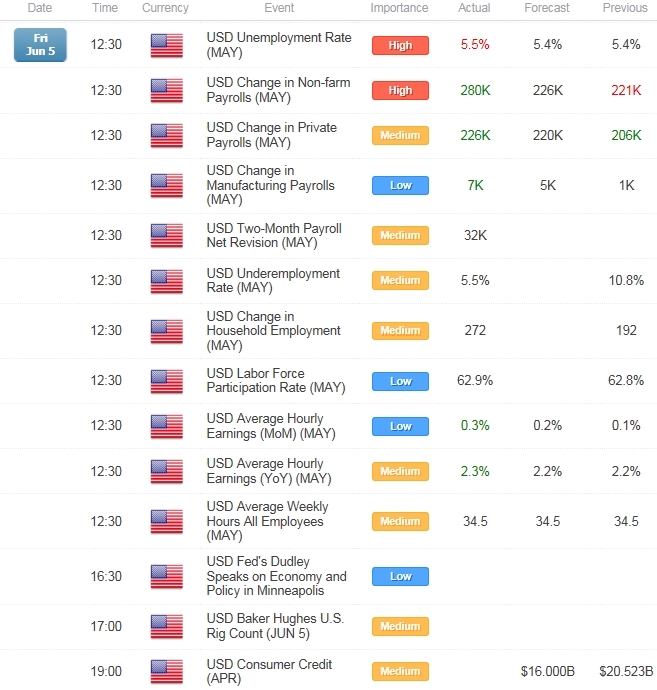

- Despite the bullish reaction to the 280K expansion in U.S. Non-Farm Payrolls (NFP), the Dow Jones-FXCM U.S. Dollar appears at risk for range-bound prices as it preserves the monthly opening range following the failed run at 12,049 (78.6% retracement).

- Uptick in Labor Participation paired with stronger wage growth raises the scope for Fed liftoff in September, but will keep a close eye on the U.S. Advance Retail Sales report amid the ongoing weakness in private-sector consumption.

- Need a break/close above 12,049 (78.6% retracement) to favor a further advance, with near-term support coming in around 11,826 (61.8% expansion) to 11,843 (38.2 retracement) on the radar.

Join DailyFX on Demand for Real-Time SSI Updates!

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums