AUD/JPY Analysis

- Risk sentiment goes quiet ahead of major US tech earnings

- Sentiment gauge (AUD/JPY) flashed red, as the pair attempts bearish breakdown

- Australian inflation data up next before the RBA meet next week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Risk Sentiment Goes Quiet Ahead of Major US Tech Earnings

The mood music appears to have changed as global markets look to some of the most influential companies in the world as they release earnings for the period spanning January to March 2023. Also on the docket this week is Q1 GDP data in the US which is anticipated to confirm a continuation of the global growth slowdown.

The Atlanta Fed’s GDPNow tool, which forecasts the likely GDP figure on incoming data ahead of the official print, suggests that US GDP could be 2.5% instead of the 2% expected by analysts. Either way, growth will still be heading lower. In contrast, Australia’s neighbour China is seeing positive GDP growth after the end of Covid lockdowns which typically supports the Aussie dollar – something that has not quite held up in recent trading sessions.

Aisan equities like the SSE composite or Heng Seng Index have posted multiple declines in recent trading sessions, at the same time US and EU indices appear to have stalled and entered a period of uncertainty or simply a period of consolidation. Earnings from UBS and First Republic Bank also haven’t helped risk sentiment, revealing that the wounds of last month’s banking turmoil have not yet healed. First Republic Bank revealed that $100 billion worth of deposits made its way out of the institution as faith in US regional banks declined by the minute.

Sentiment Gauge (AUD/JPY)

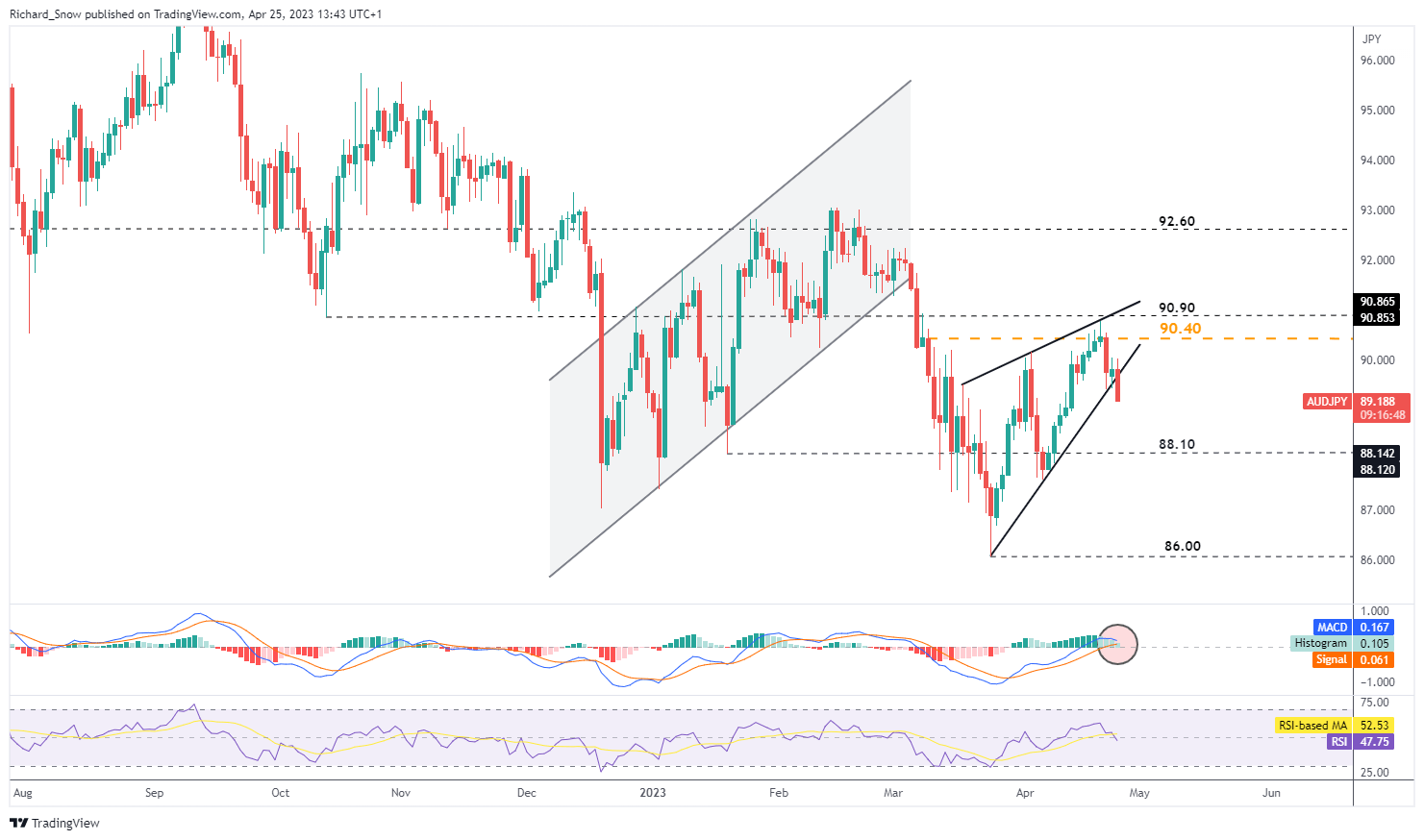

The AUD/JPY chart below is generally a good indicator of risk sentiment with the pair moving higher on increasing optimism and declining when risk sentiment takes a knock. It appears that the latter is taking shape as the pair has accelerated to the downside, ahead of the New York session.

The pair has broken beneath the ascending trendline that had connected prior higher lows and follows on from Friday’s move, in what could become a breakdown of the rising wedge. The latest drop highlights 88.10 as support with the 2023 low at 86. However, it wouldn’t be unusual to see a retest of the ascending trendline, this time as resistance, before any further downside may emerge. On the upside, 90.40 and 90.90 appear as nearest resistance.

AUD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Major Risk Events Ahead

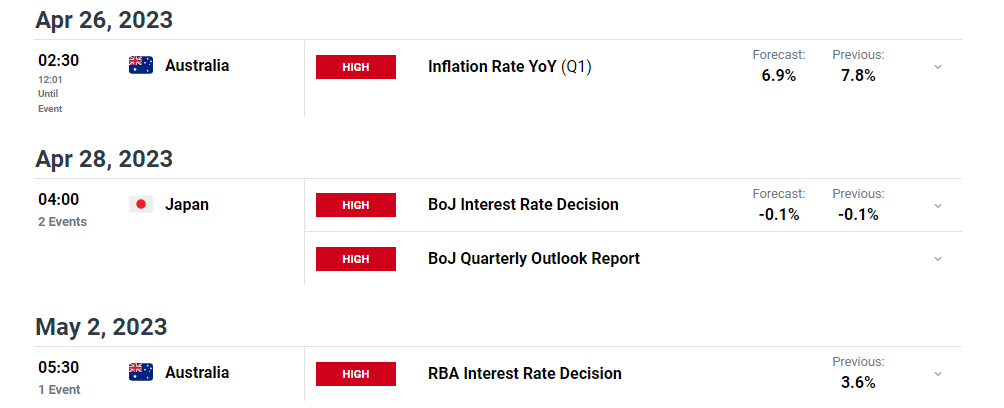

Australian inflation for the first quarter is out in the early hours of tomorrow morning where expectations are for a lower print of 6.9%. The RBA will certainly look to the inflation data but have essentially paused their hiking cycle pending incoming data. It must be said that core inflation, like in other parts of the world, is still showing a reluctance to head lower.

The BoJ is then due to meet to discuss monetary policy but it is largely anticipated that the new BoJ Governor Ueda is to stick to the status quo for now. Lastly, its still worth noting that the US and EU report Q1 GDP this week and major US earnings are too.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX