Japanese Yen (USD/JPY, GBP/JPY, EUR/JPY) Analysis

- Japan’s top currency official mentions FX intervention in response to yen weakness

- USD/JPY tentative above the crucial 150 mark

- GBP/JPY breakout already struggling for momentum

- EUR/JPY tests zone of resistance but both currencies

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japan’s Top Currency Official Mentions FX Intervention in Response to Yen Weakness

Late last night and in the early hours of this morning, Japanese officials attempted to come to the yen’s defence, but stern warnings proved ineffective, for now. Japan’s top currency diplomat Masato Kanda communicated his displeasure around rapid yen moves which he says could have an adverse effect on the economy. Mr Kanda even went as far as to suggest deploying FX intervention as a potential solution to the matter.

Japanese officials previously intervened in the FX market in September and October 2022 when it sold dollars and bought yen to strengthen the value of the local currency. It is reported that nearly $20 billion was deployed in an effort to strengthen the yen – which it ultimately did. It was the first dollar, yen intervention in 24 years and it could soon be upon us again should Tokyo tire of repeated warnings.

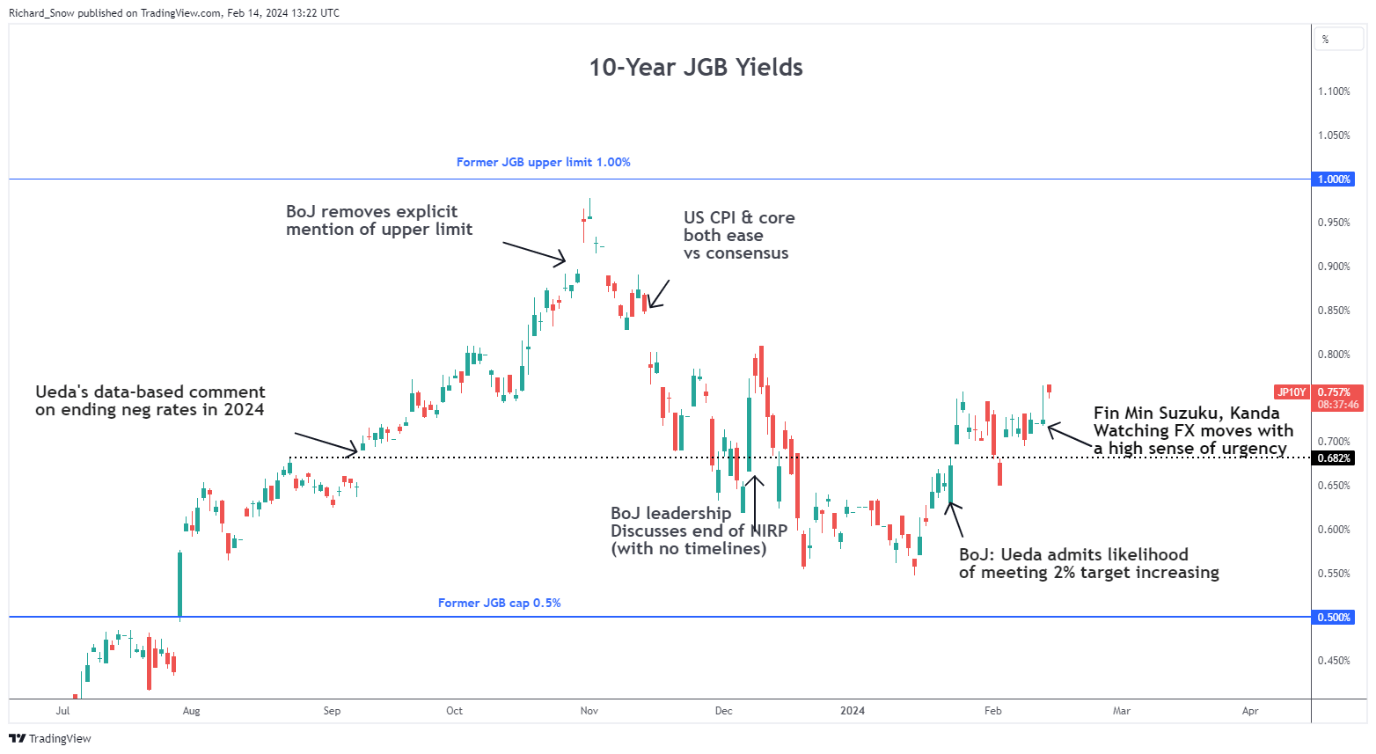

The Japanese Finance Minister Shun’ichi Suzuki weighed in on the matter by reiterating the importance for currencies to move stably and reflect fundamentals and that he is watching FX moves with a strong sense of urgency. However, he stopped short of mentioning FX intervention directly and when asked about it directly, offered no response. The 10-year Japanese Government bond yield gapped higher this morning but the yen has hardly responded.

Japanese Government Bond Yield (10-Year)

Source: TradingView, prepared by Richard Snow

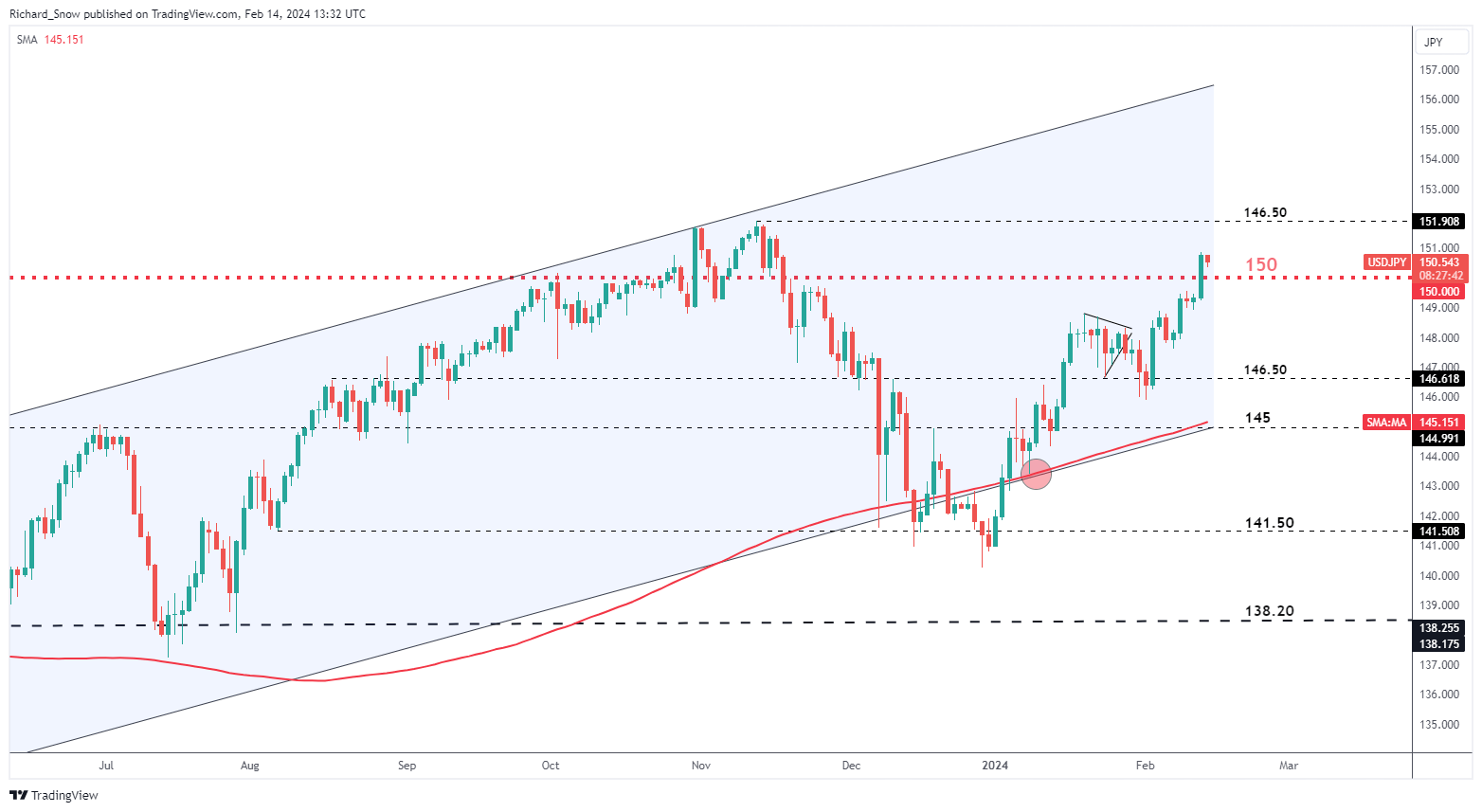

USD/JPY tentative above crucial 150 mark

USD/JPY received a lift from yesterday’s hotter-then-expected CPI print, sending the pair above 150, where it trades cautiously. Today, trading has been light, seeing a modest move lower as markets await US retail sales data and consumer sentiment updates on Friday.

USD/JPY failed to acknowledge the FX intervention warnings, appearing to take it in its stride. The pair, despite remaining above 150, hardly made a move lower and the bullish posture remains intact.

146.50 is the next level of resistance but may prove difficult to reach unless given a helping hand from US data in the coming days. The RSI is on the cusp on overbought territory meaning a short-term return to 150 is not out of the question. If Japanese officials decide to intervene in the market, the pair could move by as much as 500/600 pips if history repeats itself. So the potential volatility around FX intervention is massive.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

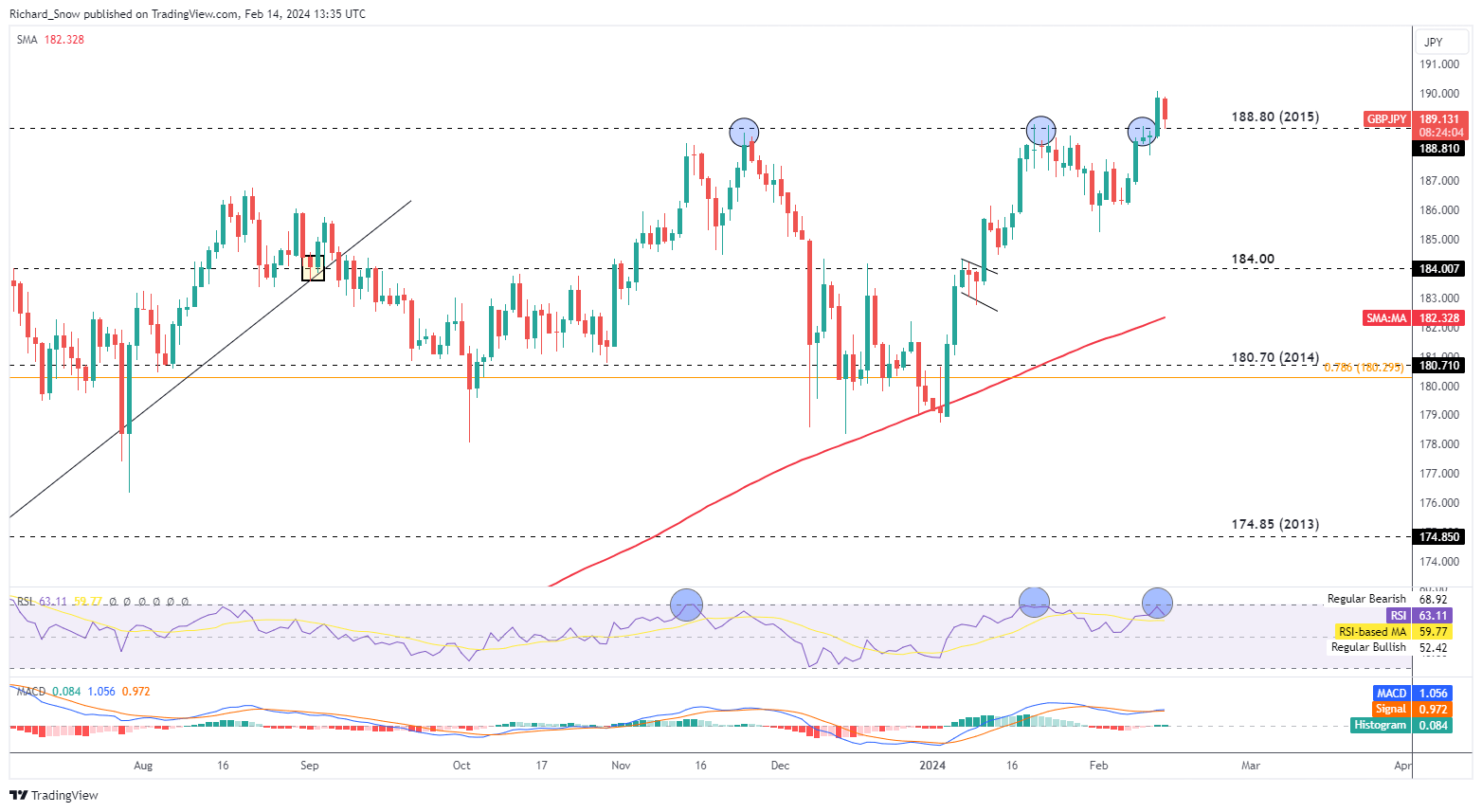

GBP/JPY breakout already struggling for momentum

GBP/JPY printed a fresh yearly high yesterday but is already appearing vulnerable to a move back to 188.80. Sterling is broadly weaker today after CPI data remained unchanged for both the headline and core measures despite estimates pointing to slight moves higher.

The RSI approached overbought territory – a mark that previously preceded a move lower and remains something to keep in mind. However, the bullish case remains constructive from a technical perspective but the threat of FX intervention poses a massive threat.

Tomorrow morning UK GDP is due and could potentially confirm a technical recession in the UK which could see the pair surrender the remainder of its recent gains.

GBP/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

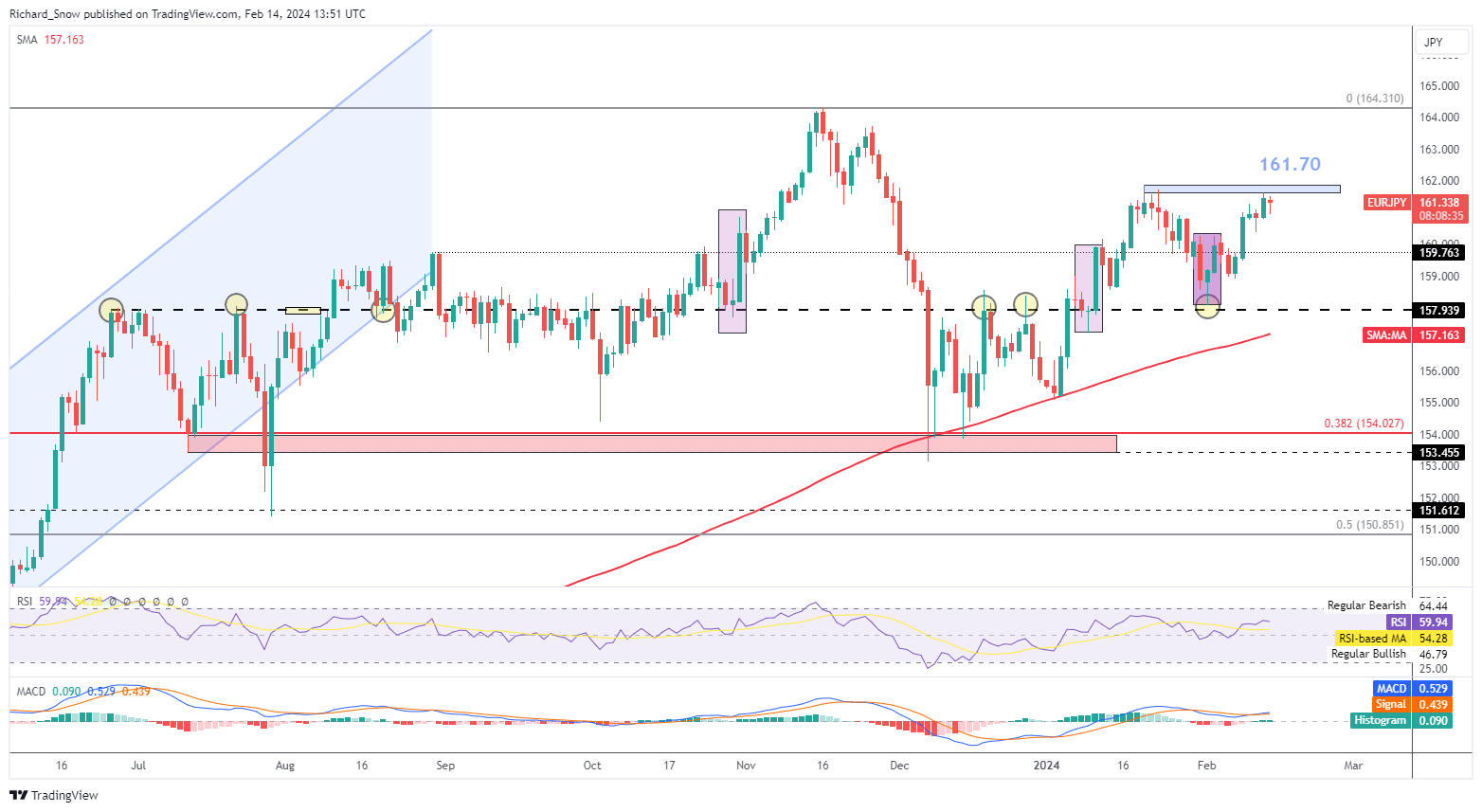

EUR/JPY tests zone of resistance but both currencies

EUR/JPY finds itself pressed up against an immediate zone of resistance at 161.70. The euro has struggled to appreciate and is likely to remain weaker against its peers as rate cut expectations still envision more than 100 basis points worth of cuts this year.

However, the yen has proven to be even weaker than the weak euro, allowing the 200 day SMA to act as dynamic support on the way up. 161.79 stands in the way of a bullish continuation towards 164 while support resides back at 157.94.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls:

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX