Gold (XAU/USD), Silver (XAG/USD) Analysis, Prices, and Charts

- Dovish Fed speak suggests US interest rates have peaked.

- Gold eyes resistance, Silver reacts to oversold conditions

Download our Brand New Q4 Gold Forecast for Free...

Gold and silver are pushing higher, fueled by a growing feeling that US interest rates have peaked and haven flows as the Middle East crisis intensifies. US PPI, the FOMC minutes, both released today, and Friday’s inflation report will give more clarity to the state of the US economy and if further Fed Fund rate hikes are needed.

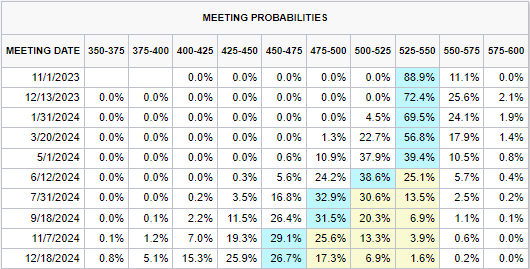

The latest CME Fed Fund probabilities are further pricing out any further US rate hike. Over the next three meetings, the probabilities for Fed Funds show at best a one-in-four chance of a hike, while when we get to the end of Q1 2024, the likelihood of a rate cut rises to nearly 23%.

CME FedWatch Tool

Learn How to Trade Gold With Our Expert Guide

The growing expectation that US interest rates have peaked has sent US Treasury yields lower, albeit from elevated levels. This move lower in yields is being helped by flight-to-safety flows as the crisis in the Middle East escalates and investors trim their risk exposure. With peak yields now seen behind us, non-interest-bearing assets including gold and silver come back into vogue. Add the haven value of gold and silver into the mix and the recent move higher in both the precious metals is likely to continue.

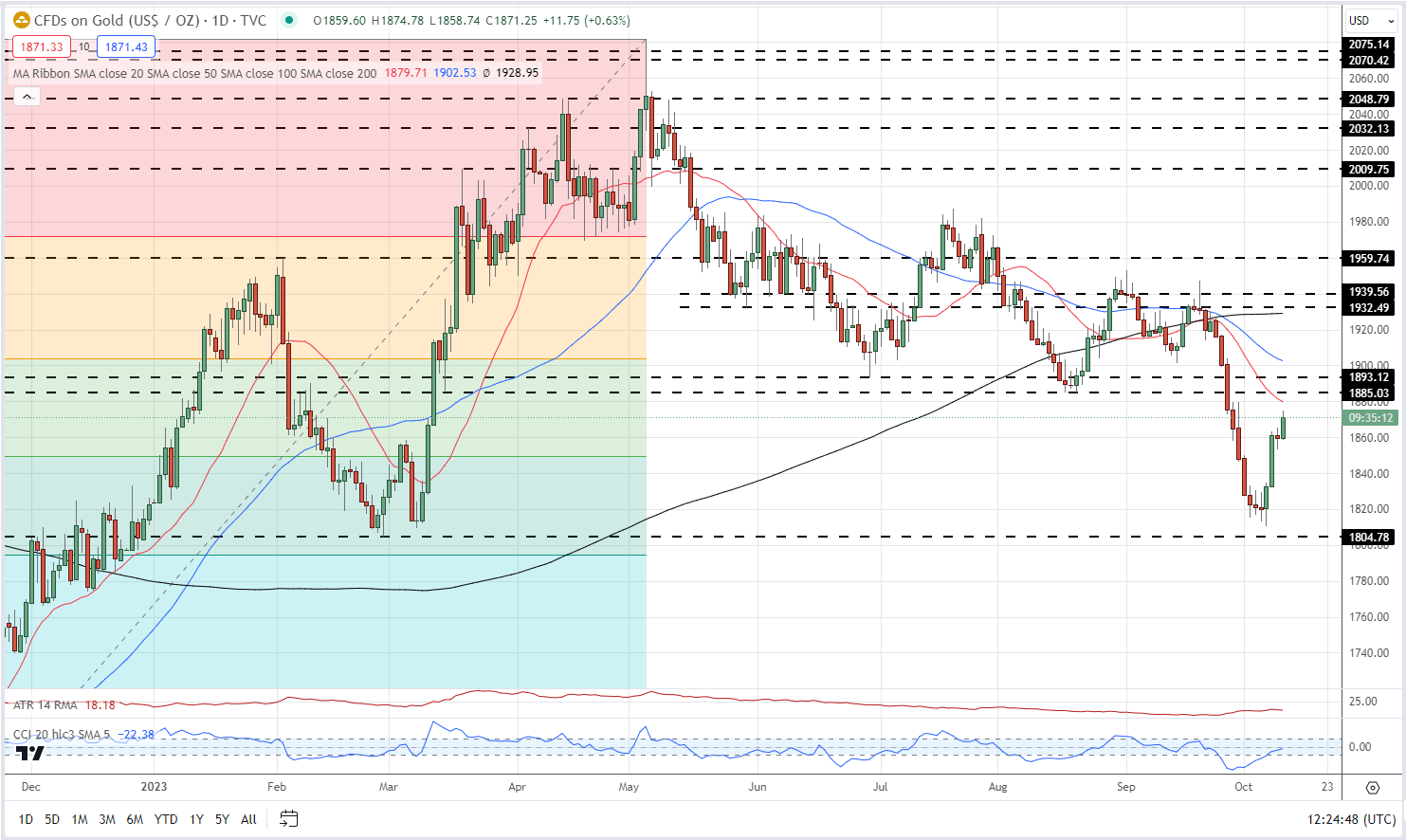

The path of least resistance for gold is higher although a short-term period of consolidation, perhaps sparked by this week’s US data releases, cannot be ruled out. Gold is neutral – neither oversold or overbought using the CCI indicator – and is seen testing the $1,885/oz. to $1,893/oz. area. On either side of this resistance zone lie the 20- and 50-day simple moving averages, and both of these will need to be broken convincingly if the precious metal is to move back toward $1,932/oz. With a positive rates backdrop, gold’s downside should be limited.

Gold Daily Price Chart – October 11, 2023

The IG Client Sentiment Guide Can Help You When Trading Gold

| Change in | Longs | Shorts | OI |

| Daily | -12% | 7% | -4% |

| Weekly | -6% | 3% | -2% |

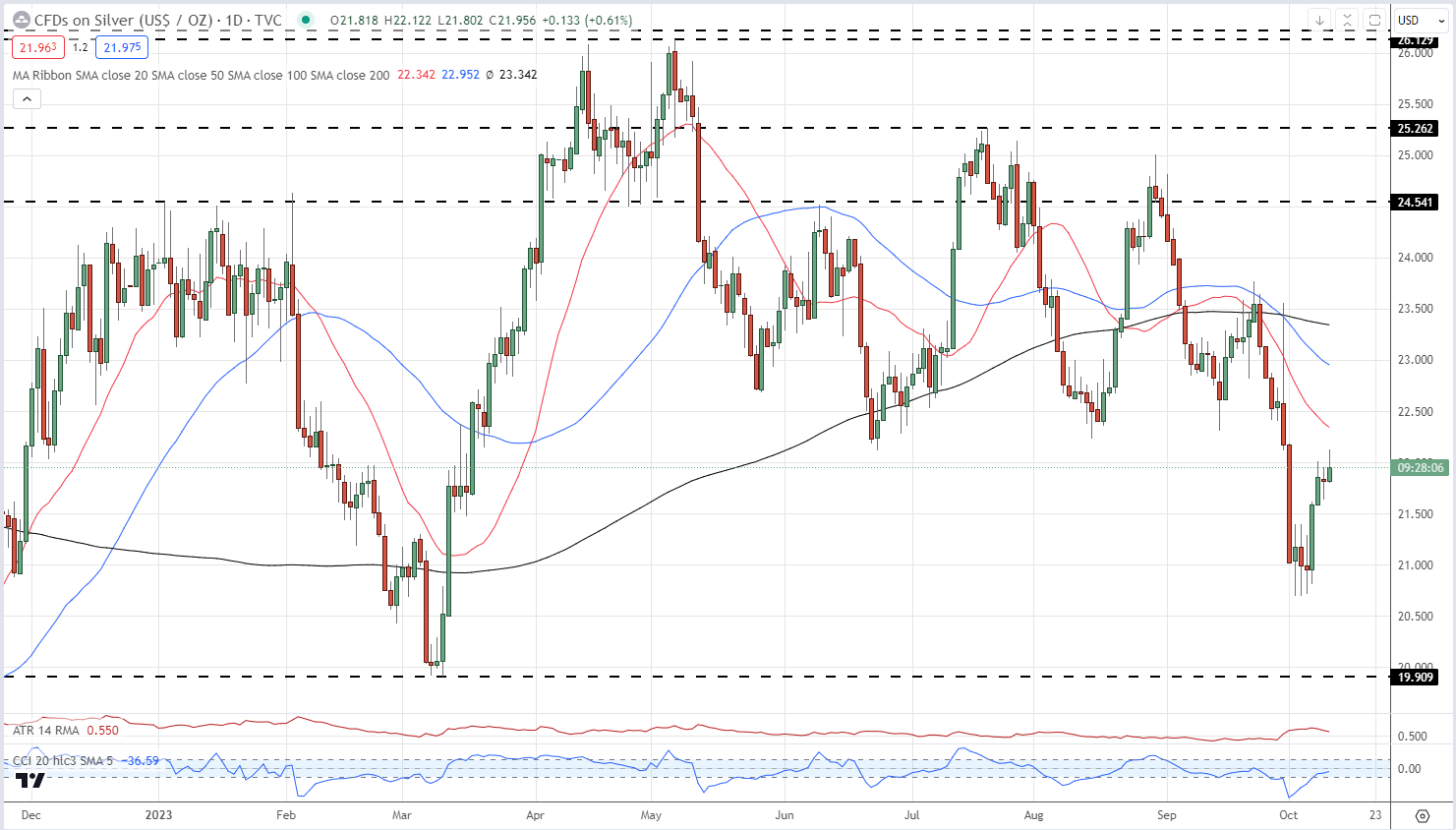

Silver has reacted higher after hitting an extremely oversold level at the start of the month. The precious metal is stuck printing lower highs and lows since mid-July and needs to move back above the $23.75 level to break out of this series. This looks a stiff ask as all three simple moving averages need to be broken and these will likely hold any move higher back. A cluster of recent lows around $20.65 should stem any sell-off in the short term.

Silver Daily Price Chart – October 11, 2023

Charts via TradingView

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.