POUND STERLING ANALYSIS & TALKING POINTS

- UK jobs report reiterates tight labor market conditions.

- Bank of England under pressure to hike once more in May.

- All eyes shift to UK inflation data tomorrow.

- GBP/USD hesitancy is evident around the 1.24 level.

GBPUSD FUNDAMENTAL BACKDROP

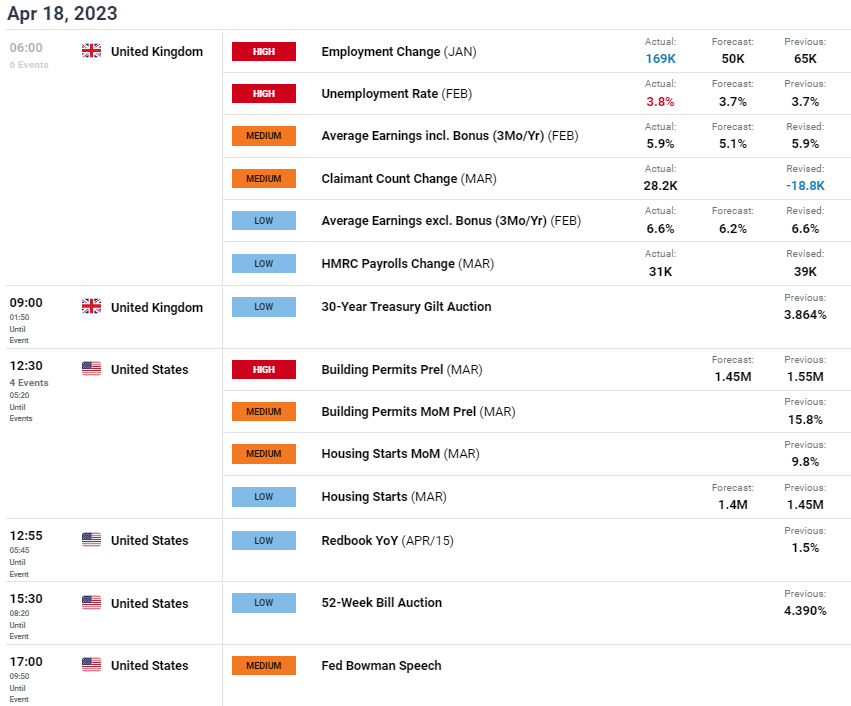

The British pound has managed to creep higher this morning after jobs data beat estimates on multiple metrics. While employment change caught the headlines, average earnings both including and excluding bonuses could heighten inflationary pressures and prompt the Bank of England (BoE) to continue with it’s hiking cycle in their next meeting. Some key highlights from the labor market overview include – Source: Office for National Statistics

- The economic inactivity rate decreased by 0.4.

- In January to March 2023, the estimated number of vacancies fell by 47,000.

- Although earning growth came in higher than expected, total and regular pay fell on the year in December 2022 to February 2023, by 3.0% for total pay and by 2.3% for regular pay. That is, the rise in wage growth is less substantial than it was a few months ago and shows some sign of positivity for the BOE but may not be enough to prompt a pause to their monetary tightening.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

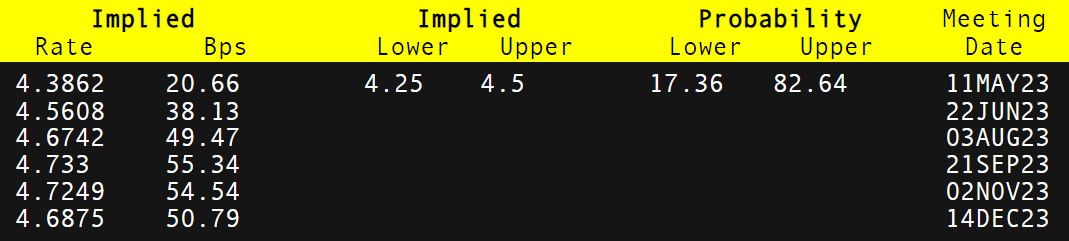

Money market pricing for the May meeting now suggests an 82.67% probability of a 25bps interest rate hike from the BoE. That being said, unless tomorrow’s UK inflation figures significantly undershoot, the BoE is most likely to remain steadfast on another rate hike.

Later today, the US building permits report for March is due and after February’s upside surprise, another beat could give the USD some support. To close out the trading day today, the Fed’s Bowman is scheduled to speak on the latest data and views on monetary policy.

BANK OF ENGLAND INTEREST RATE PROBABILTIEIS

Source: Refinitiv

TECHNICAL ANALYSIS

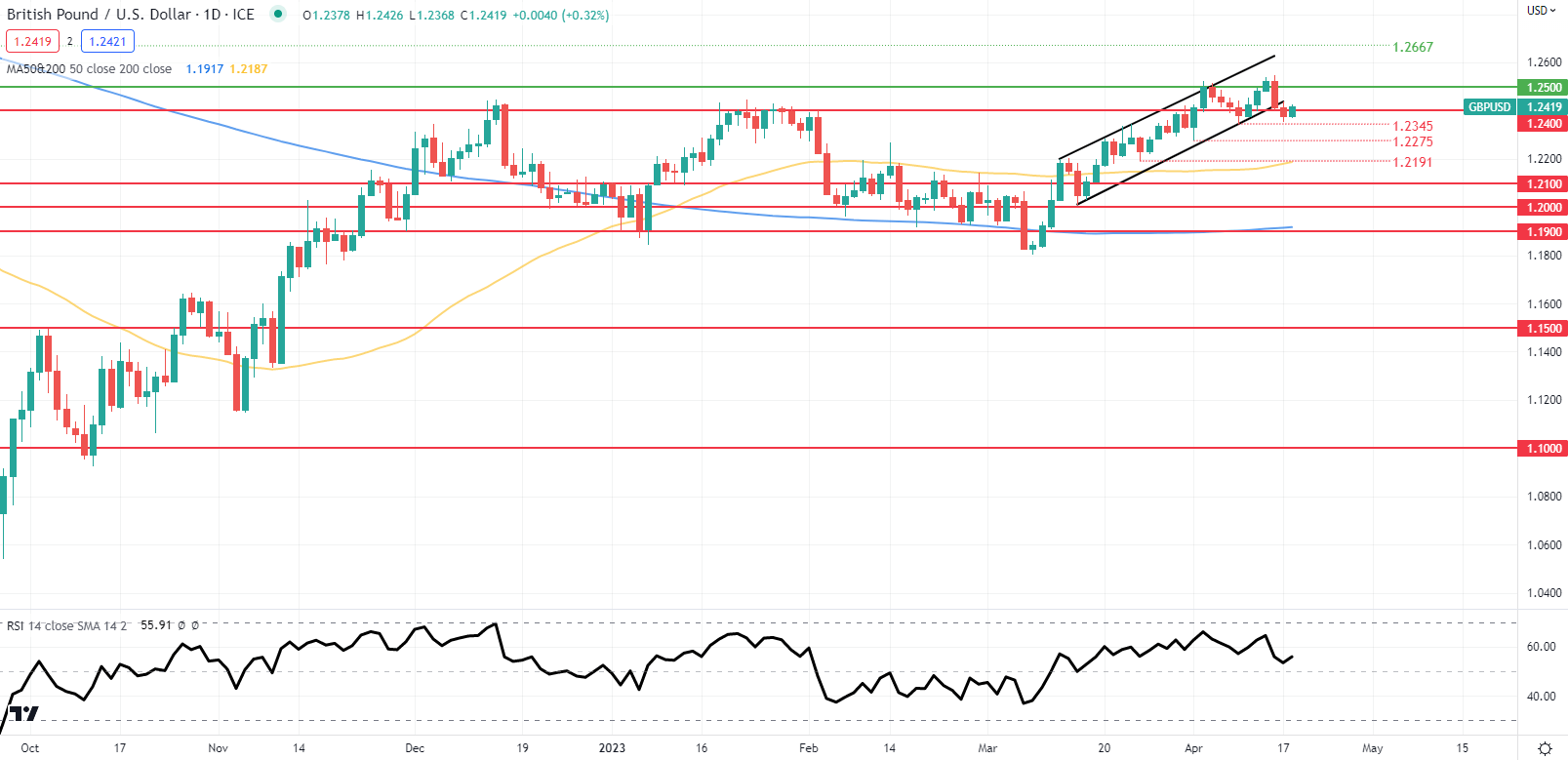

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action is flirting with the 1.2400 psychological handle after yesterday’s channel break. The market reaction thus far to labor data shows a more cautious approach due to UK inflation data tomorrow. There should be a more concrete short-term directional bias post-inflation tomorrow.

Key resistance levels:

- 1.2667

- 1.2500

Key support levels:

- 1.2400

- 1.2345

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently equally LONG and SHORT on GBP/USD (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short-positioning, we arrive at a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas