GBP/USD AND EUR/GBP FORECAST:

- The hawkish repricing of interest rate expectations in the UK has boosted the British pound in recent weeks

- Sterling’s outlook remains constructive in the very near term

- This article looks at key GBP/USD and EUR/GBP’s technical levels to watch in the coming days and weeks

Most Read: US Dollar Hits a Fresh Two-Month Low as Future Rate Hike Expectations Ease

In recent weeks, the British pound has strengthened rapidly against its top peers, boosted by a hawkish repricing of Bank of England’s terminal rate in the face of rampant UK inflation. British CPI, which stood at 8.7% y-o-y in May – the highest level among developed economies, prompted the country’s monetary authority to embrace a more aggressive posture, raising borrowing costs by a surprise 50 basis points to 5.0% at its June meeting.

Persistently strong inflationary pressures, along with signs that the trend is becoming entrenched, will likely push the BoE to hike above 6.0% in the coming months and into 2024, perhaps as high as 6.50% according to market-implied probabilities. The institution led by Andrew Bailey will also have to maintain a restrictive stance for an extended period to prevent second-round effects on prices from spreading through the economy.

Meanwhile, the Federal Reserve and ECB will soon conclude their tightening campaigns, as inflation is expected to decline comparatively faster in the U.S. and Eurozone than in the UK. This divergence in monetary policy may favor sterling (GBP) in the short term, but could turn into a headwind if the British economy takes a turn for the worse and enters recession, buckling under the weight of multi-year highs interest rates.

Related: Trading GBP/USD - An Overview of the Pound-Dollar Forex Pair

| Change in | Longs | Shorts | OI |

| Daily | -9% | 6% | 0% |

| Weekly | -31% | 36% | -2% |

GBP/USD TECHNICAL ANALYSIS

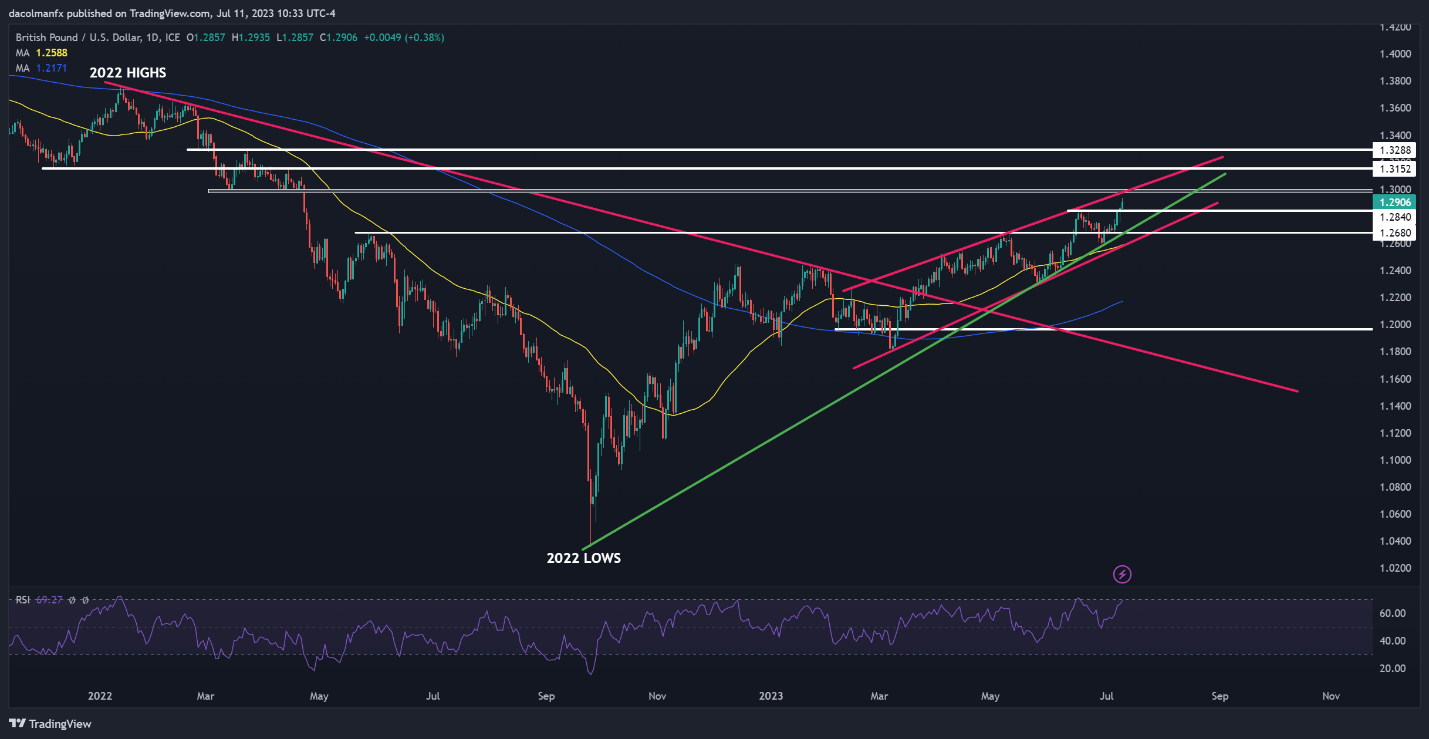

After its recent rally, GBP/USD is steadily approaching the upper boundary of a rising wedge at 1.2975. With the market getting stretched and the RSI indicator flirting with overbought conditions, cable may struggle to clear this resistance, but in the event of a breakout, it could gather bullish momentum to charge toward 1.3150 and 1.3290 thereafter.

On the flip side, if sellers regain control and trigger a bearish reversal off current levels, initial support appears at 1.2840, followed by 1.2675. On further weakness, we could see a pullback toward 1.2600, just a touch above the 50-day simple moving average and the lower limit of the rising wedge.

GBP/USD TECHNICAL CHART

GBP/USD Chart Creating Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 10% | -19% | -4% |

| Weekly | 30% | -30% | -3% |

EUR/GBP TECHNICAL ANALYSIS

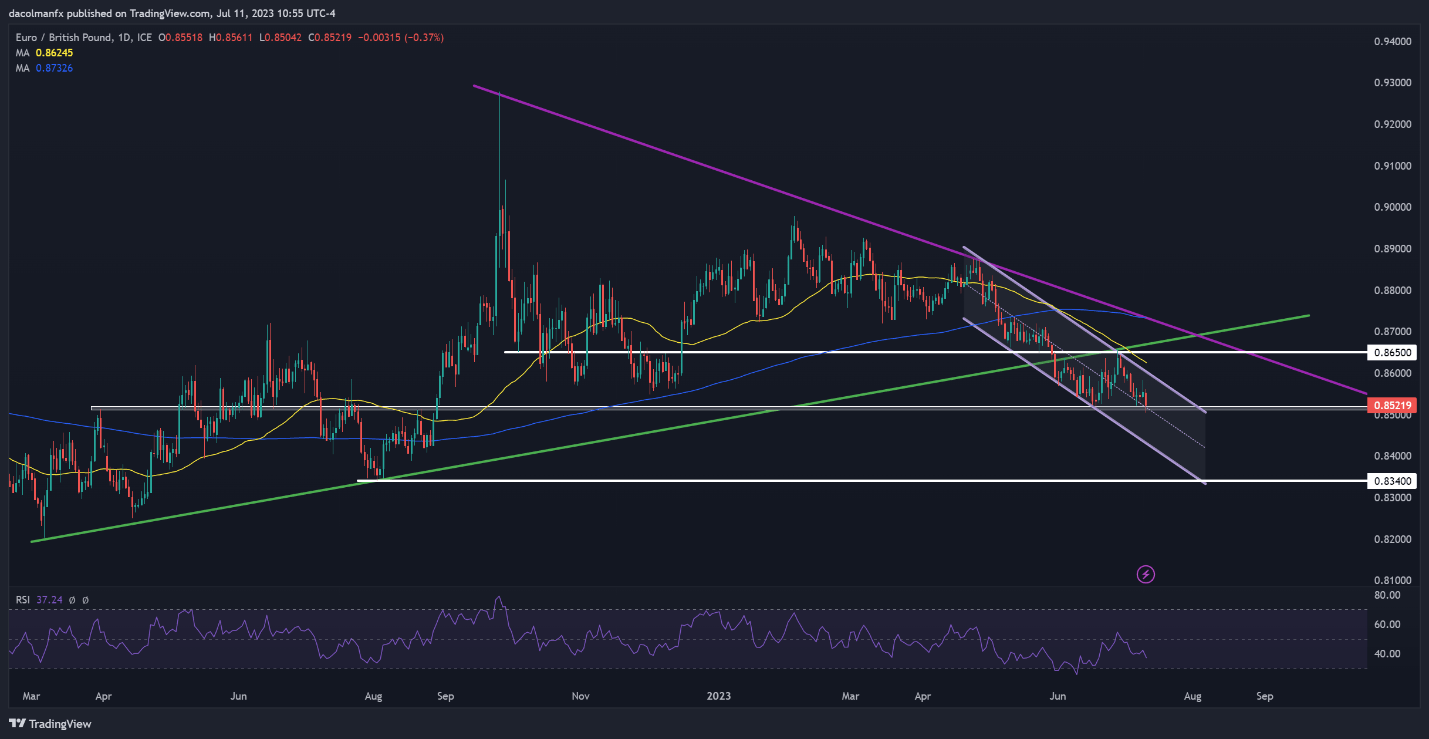

After Tuesday’s selloff, EUR/GBP has fallen toward an important floor area around the psychological 0.8500 level. If bulls can’t fend off the current assault on technical support and prices break down below this zone, sellers could become emboldened to launch an attack on 0.8435, followed by 0.8340.

In contrast, if EUR/GBP recovers its poise and manages to bounce off present levels, the first resistance to keep an eye is located slightly below the 0.8600 handle. Upside clearance of this ceiling could attract new buyers into the market, creating the right conditions for a rally toward 0.8650.

EUR/GBP TECHNICAL CHART