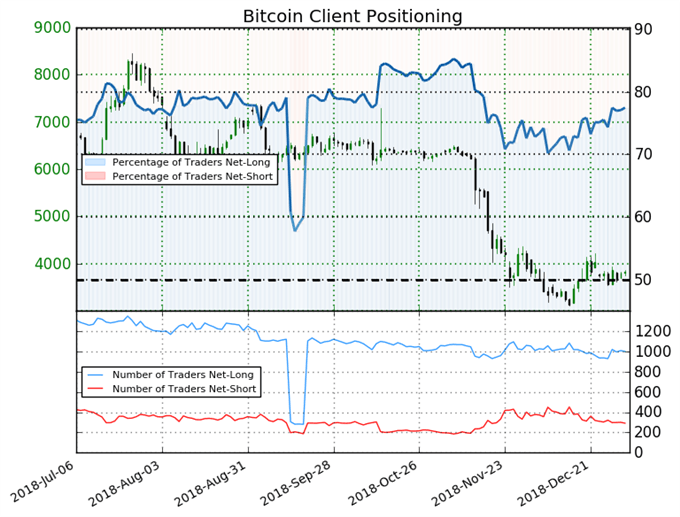

77% of Traders are Net-Long

Bitcoin: Retail trader data shows 77.5% of traders are net-long with the ratio of traders long to short at 3.44 to 1. The number of traders net-long is 0.4% lower than yesterday and 6.2% higher from last week, while the number of traders net-short is 2.7% lower than yesterday and 6.4% lower from last week.

Be sure to check out our Bitcoin Trading Guide if you're new to cryptocurrencies!

Bitcoin Sentiment Suggests a Stronger Bearish Bias

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias.

--- Written by Fan Xu, DailyFX Research