To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- Kiwi Dollar breaks range support, hinting at deeper losses ahead

- Risk/reward setup, theme overexposure argue against short trade

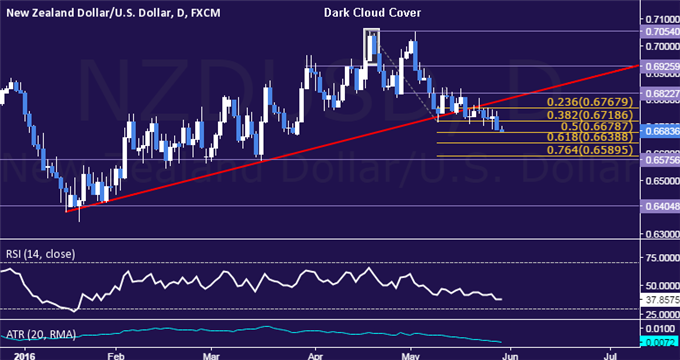

The New Zealand Dollar pushed through long-standing range support above the 0.67 figure against its US namesake, hinting at deeper losses ahead. Prices appeared to break rising trend line support to mark a pivotal reversal two weeks ago but follow-through proved lacking, with ATR-based volatility readings dropping to the lowest in eight months.

Near-term support is at 0.6679, the 50% Fibonacci expansion, with a break below that on a daily closing basis opening the door for a test of the 61.8% level at 0.6639. Alternatively, a reversal back above the 38.2% Fib at 0.6719 – now recast as resistance – paves the way for a challenge of the 23.6% expansion at 0.6768.

Expected 2016 fundamental trends argue in favor of a short position but the available trading range is too narrow to justify entering the position at this time from a risk/reward perspective.Furthermore, theme overexposure is a deterrent considering existing AUD/USD exposure given the strong correlation between the Aussie and Kiwi Dollars (0.93 on rolling 20-day studies). Opting for the sidelines seems prudent.

Losing money trading NZD/USD? This might be why.