To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

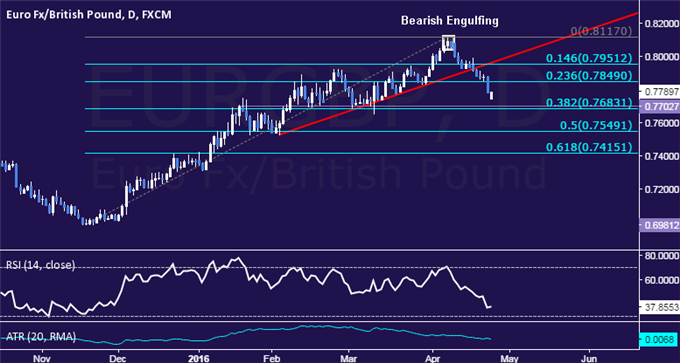

- EUR/GBP Technical Strategy: Pending short at 0.7800

- Euro accelerates lower, issuing the largest decline in six months vs. Pound

- Short entry order at 0.78 established for improved risk/reward parameters

The Euro accelerated lower against the British Pound, putting in the largest daily loss in six months and exposing the 0.77 figure. Prices established a top with the formation of a Bearish Engulfing candlestick pattern as expected, with subsequent losses hinting the long-term down trend may be resuming.

Near-term support is in the 0.7683-0.7703 area, marked by a horizontal pivot and the 38.2% Fibonacci retracement. A break below this barrier on a daily closing basis exposes the 50% level at 0.7549. Alternatively, a reversal above the 23.6% Fib at 0.7849 paves the way for a test of the 14.6% retracement at 0.7951.

Prices are too close to support to justify entering short at current levels in line with our 2016 fundamental outlook. With that in mind, we will set an entry order to sell EUR/GBP at 0.7800. If triggered, the trade will initially target 0.7703and carry a stop-loss activated on a daily close above 0.7849.

Are FXCM traders long or short the Euro and the British Pound? Find out here !