- US Dollar pulls back across the board, but watch key near-term support levels

- Next moves in the Euro and Japanese Yen could have an especially important effect

- See more information on DailyFX on the Real Volume and Transactions indicators

Receive the Weekly Volume at Price report via David’s e-mail distribution list.

The US Dollar has pulled back sharply across the board, but further Dollar losses may be limited if it can hold key near-term support levels versus the Euro and Yen.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

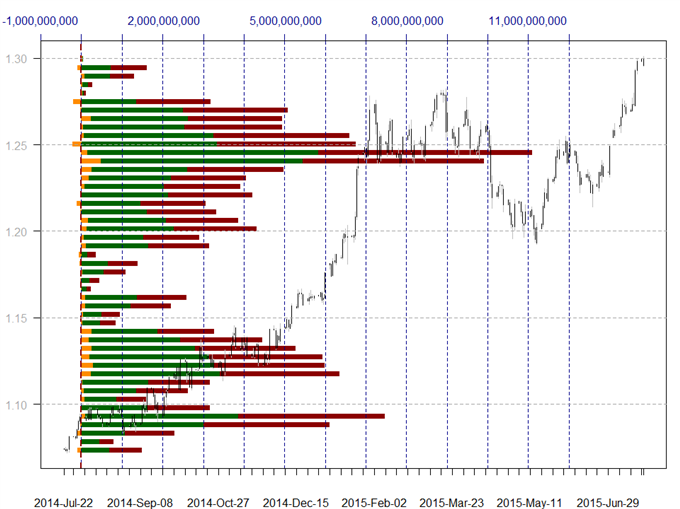

The Euro has held key volume-based support at the $1.08 mark, and a continued bounce leaves support-turned-resistance at $1.10 as the next near-term target. A break above $1.10 would shift focus towards substantial volume congestion starting near $1.1250.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The British Pound continues to hold below key volume-based resistance at $1.5650, and near-term focus remains on comparable levels near $1.54. A break above $1.5650 would leave little in the way of resistance until the year-to-date high above $1.59, but risks remain towards near-term weakness.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar continues to trade above notable congestion starting at the ¥123.50 mark against the Yen, and a hold above leaves near-term targets at major highs near ¥125.50 mark. Yet a break below ¥123.50 would shift focus to comparable congestion levels starting at ¥121.50.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

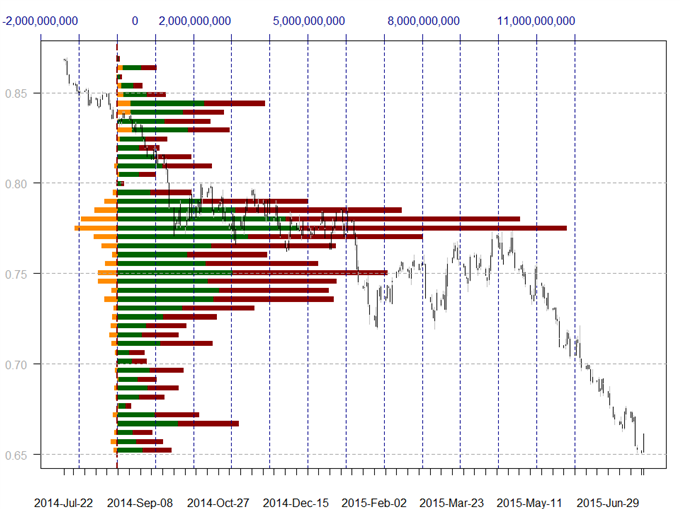

The Australian Dollar has traded back above former lows at the $0.7400 mark, and a continued bounce would make the next short-term target key resistance starting at $0.7600. A failure here would instead make downside targets to congestion levels from 2008 near $0.7250.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

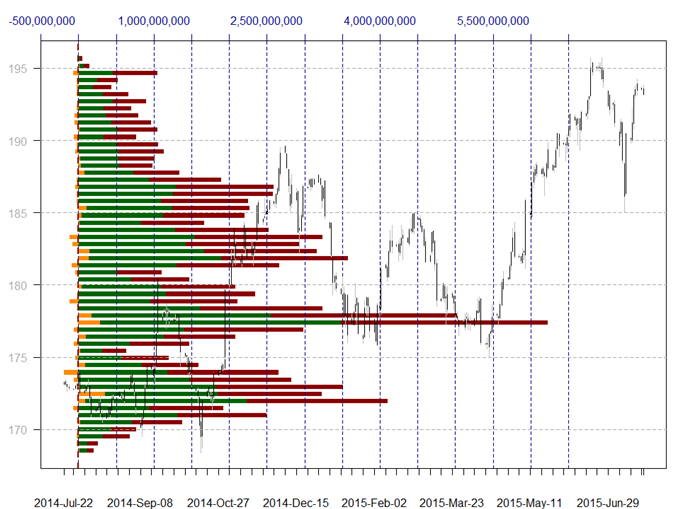

The Sterling has broken below recent lows at ¥193 versus the Yen, and the next major support level isn’t until notable volume and price congestion near ¥191.50.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Euro has traded above notable price and volume-based congestion levels near ¥135, and a continued bounce shifts focus towards significant volume-based resistance at ¥137.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar has traded above important volume-based resistance of SFr0.9500 versus the Swiss Franc, and but the USD/CHF has stopped and reversed at significant volume-based resistance at SFr0.9650. Former resistance now turns into support at 0.95.

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar continues to trade near substantial highs versus the Canadian Dollar, and a recent build in volume and price-based congestion leaves C$1.2900-1.2950 as near-term support. Yet a break below would leave little in the way of a move towards considerable congestion starting at C$1.2750.

NZDUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The New Zealand Dollar has found near-term support at a volume spike near $0.6500, and a continued hold shifts focus to support-turned-resistance at $0.6700.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Receive the Weekly Volume at Price via David’s e-mail distribution list.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX