Talking Points:

- Crude Oil Prices Continue to Trend Lower in the Short Term

- 200 Day MVA Support Found at $50.27

- Looking for more trade ideas for crude oil and commodities markets? Register for our Q2 price forecast HERE.

Crude oil prices are set to close this week’s trading lower, despite key members of OPEC favoring an extension of their ongoing production cut. Technically this decline in price now has crude oil prices back below the key. $52.00 handle. This point has previously been a value of support for the commodity, but as a new short term downtrend develops, this point may now graphically be seen as resistance.

Traders tracking the momentum of crude oil price, should note that the commodity is set to close beneath its 10 day EMA (exponential moving average) for the 3rd consecutive session. A move of this nature typically suggests weakness in the market in the short term. Also with today’s decline, prices are now set to test the 200 day MVA (simple moving average) at $50.27. A decline below this point would suggest a change in crude oil prices long term trend. However if prices remain supported above $50.27, traders may look for crude oil prices to bounce back towards points of daily resistance.

Crude Oil Price, Daily Chart & Averages

Want to learn more about trading with market sentiment? Get our Free guide here.

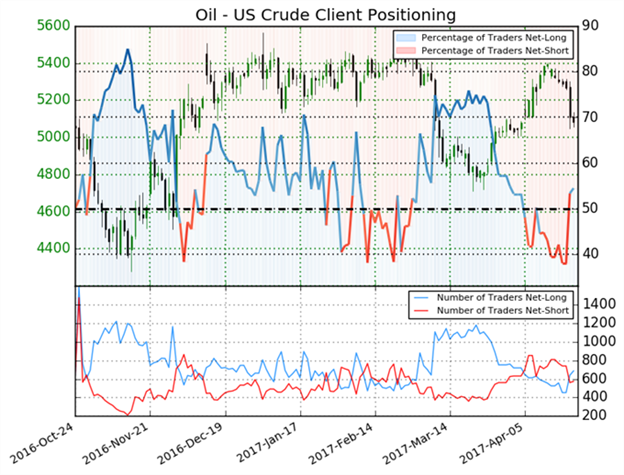

Sentiment for crude oil prices (Ticker: US Crude) remains slightly positive to end the week. Currently IG Client Sentiment totals read at +1.2 with 54.4% of trader’s long crude oil. It should be noted that sentiment figures have flipped net positive earlier in the week as crude oil began to trend lower in the short term. If prices breakout below the previously mentioned 200 day MVA, it would be expected to see sentiment totals move towards a positive extreme of +2.0 or greater. Alternatively, if prices bounce near present levels, it would be expected to see sentiment neutralize or even flip back to a negative reading next week.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.