Australian Dollar Talking Points

AUD/USD breaks out of the monthly opening range as the US-China trade war appears to be coming to an end, and the Australian Dollar may stage a larger correction as the trade truce encourages the Reserve Bank of Australia (RBA) to revert to a wait-and-see approach for monetary policy.

AUD/USD Breaks Out of Monthly Opening Range on US-China Trade News

AUD/USD extends the advance from the monthly-low (0.6671) as President Donald Trump announces ‘phase one’ of the trade deal, with more details to be revealed over the coming weeks as the US and China pledge to sign a written agreement around the Asia-Pacific Economic Cooperation (APEC) meeting in Chile scheduled for November 15-16.

It remains to be seen if Chinese officials will retaliate to the US blacklist as Vice Premier Liu Heinsists that “we are making a lot of progress towards a positive direction,” but the progress towards a US-China trade deal may push the RBA to the sidelines as it instills an improved outlook for the Asia/Pacific region.

The trade truce may encourage the RBA to retain the current policy at the next meeting on November 5 especially as Governor Philip Lowe pushes for “a renewed focus on structural measures to lift the nation's productivity performance.”

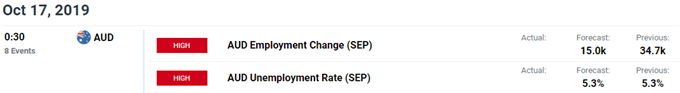

With that said, the RBA may be on track to conclude its rate easing cycle in 2019 as updates to Australia’s Employment report is anticipated to show the economy adding 15.0K jobs in September.

A further improvement in the labor market may prompt the RBA to change its tune, but the central bank may have little choice but to retain the dovish forward guidance for monetary policy as International Monetary Fund (IMF) Managing Director Kristalina Georgieva warns of a “synchronized slowdown” in global growth.

In turn, the RBA may reiterate its pledge “to ease monetary policy further if needed,” and AUD/USD may continue to track the downward trend carried over from 2018 if the central bank prepares Australian households and businesses for lower interest rates.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

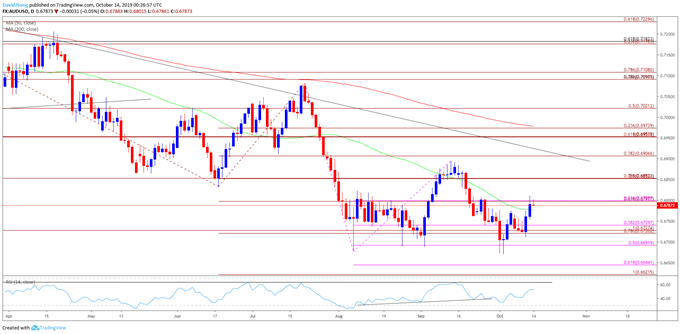

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.6977), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- More recently, AUD/USD has taken out the September-low (0.6688) as it continues to track the downward trend carried over from late last year, with the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the bullish formation from August.

- However, the string of failed attempts to close below 0.6690 (50% expansion) brings the September range in focus, with the move above the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6740 (38.2% expansion) keeping the 0.6800 (61.8% expansion) handle on the radar.

- Need a close above the 0.6800 (61.8% expansion) handle to open up the 0.6850 (78.6% expansion) region, with the next area of interest coming in around 0.6910 (38.2% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.