We have passed two weeks of fireworks in volatility and event risk. Will conditions simply settle as they did in July and August; or has a permanent shift been put into motion?

US Dollar Forecast - Dollar to be Jostled by Traders Speculation and Fed Officials Forecasts

The Federal Reserve announced to the market a ‘hawkish hold’ at its policy gathering this past week, and in turn offered little resolution to the market’s conflict over the Dollar’s current richness or cheapness.

Euro Forecast - Euro Turns to ECB Policy Speeches for Direction This Week

Without exogenous interference from the Bank of Japan and the Federal Reserve, the Euro should be driven by factors more closely related to home, in particular, proving sensitive around the nine speeches by ECB policymakers between Monday and Thursday.

Japanese Yen Forecast – Bank of Japan and US Federal Reserve Keep USD/JPY Downtrend Intact

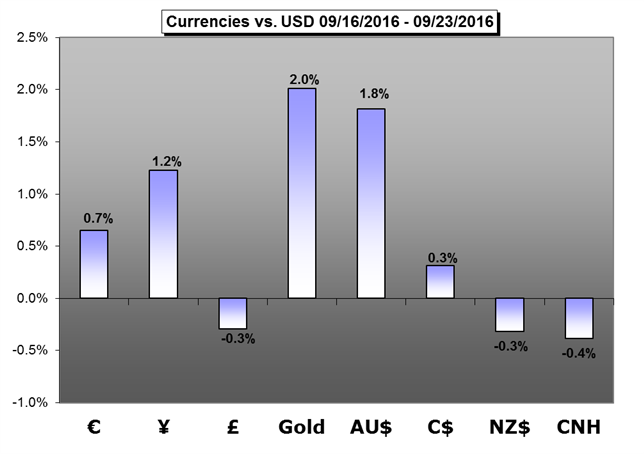

The Japanese Yen rallied for the third-consecutive week versus the US Dollar on a key disappointment from the US Federal Reserve and relative inaction from the Bank of Japan.

British Pound Forecast - GBP/USD to Face Fresh Monthly Lows on Hawkish Fed Rhetoric

With a slew of Federal Reserve officials scheduled to speak throughout the last full-week of September, the fresh batch of central bank rhetoric may generate new monthly lows in GBP/USD should they boost market expectations for a 2016 rate-hike.

Australian Dollar Forecast - Aussie Dollar to Fall as Fed-Speak, US Data Fuel Rate Hike Bets

The Australian Dollar launched an impressive recovery last week, with the lion’s share of gains coming in the wake of the FOMC monetary policy announcement.

Chinese Yuan Forecast -Yuan Likely Stable to Prepare for a Smooth SDR Entry

The Chinese Yuan will officially join the SDR basket as the fifth reserve currency on October 1st. This will likely be the dominant theme for all Yuan pairs in the coming week.

Gold Forecast - Gold Prices Post Largest Weekly Rally Since June on Patient Fed

Gold prices are markedly higher this week with the precious metal up 2.26% to trade at 1339 ahead of the New York close on Friday.

What are the Traits of Successful Traders? See what our studies have found to be the most common pitfalls of retail FXtraders.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, educational webinars, updated speculative positioning measures, trading signals and much more!