British Pound, GBP, UK Election, UK GDP – Talking Points

- British Pound may edge lower on softer GDP, industrial data

- This may incite Bank of England rate cut bets, pressure GBP

- Volatility could be tamed by traders waiting for UK election

Learn how to use politicalrisk analysis in your trading strategy !

Asia-Pacific Recap: Chinese CPI Boosts Australian Dollar

Early into Tuesday’s Asia Pacific trading session, Chinese CPI and PPI data came in better-than-expected at 4.5 and -1.4 percent, beating the 4.3 and -1.5 percent forecasts, respectively. In fact, consumer price growth had reached its highest point since January 2012. However, this failed to elicit a major reaction from the Australian Dollar, because traders are likely waiting for Washington to decide on the December 15 tariff hike.

British Pound Eyes Industrial Data Cascade, UK Election Polls

The British Pound may suffer if soft manufacturing and GDP data inflame Bank of England easing expectations ahead of the UK election on December 12. Recent polls have Prime Minister Boris Johnson ahead of his Labor counterpart Jeremy Corbyn by 14 points, up 5 points from last week’s survey. Something to note: volatility may be curbed by traders waiting to place their bets until after the election outcome is known.

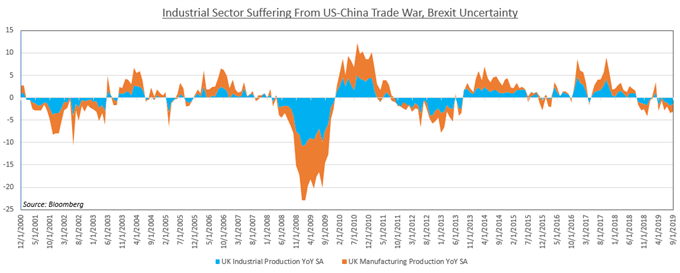

Industrial and manufacturing production statistics on a year-on-year basis are expected to show a contraction of 1.2 and 1.4 percent, respectively. The highly-vulnerable sector of the UK has been plagued by political uncertainty from Brexit and the growth-hampering side effects of the US-China trade war. The UK is not alone – global manufacturing is in an industrial recession largely due to the Sino-US economic conflict.

The impact of these factors on the Bank of England’s outlook has become increasingly more apparent. At the most recent Monetary Policy Committee meeting, two out of the 9 board members voted to cut rates; the remaining 7 supported keeping the benchmark at 0.75 percent. Looking ahead, if downside risks continue to materialize – especially those pertaining to Brexit – it may tilt BoE official towards more dovish inclinations.

BRITISH POUND TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter