Gold and Crude Oil Talking Points:

- Gold prices were a little lower but still close to last week’s tops

- The coronavirus’ spread keeps risk appetite in check, with feeble Japanese GDP having the same effect

- Crude oil markets can still scent production cuts from traditional producers

Crude oil prices were very little changed on, Monday after recording their first weekly gain on the year to Friday.

Although the International Energy Agency now predicts weaker energy demand in the first quarter, partly as a result of the coronavirus, the market still seems convinced that the Organization of Petroleum Exporting Countries and its allies such as Russia will shortly agree to deepen production cuts, lengthen them, or both.

The end of last week the number of oil rigs operating onshore in the US increased for a second time straight, adding to the impression that global markets remain very well supplied, whether by OPEC or by other producers.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 3% | 0% |

| Weekly | -2% | 8% | 0% |

Meanwhile gold prices were steady at the near-two-week highs of last with the ongoing spread of coronavirus combining with news of feeble Japanese growth to underpin countercyclical, haven assets.

Chinese authorities have reportedly said that both air and rail travel in the country have taken big hits as trips are cancelled. However, Finance Minister Liu Kin wrote on Sunday in a Communist Party magazine that targeted tax cuts are planned to add to the economic support already provided. The People’s Bank of China may also take steps to increase liquidity to try and offset some of the virus’ economic impact.

It added more medium-term funding for commercial lenders on Sunday, and cut the interest rate charged

Meanwhile Japan’s official Gross Domestic Product was revealed to have crashed in the final quarter of 2019. Annualized, seasonally adjusted it was down 6.3%, well beyond the 3.8% slide expected and the weakest print since 2014. Worryingly for Japan and the wider region, this weakness was clocked up before the coronavirus began to spread.

Gold prices had risen quite strongly last week but, with the US President’s Day break on Monday, trade was perhaps inevitably more cautious as the week got under way.

| Change in | Longs | Shorts | OI |

| Daily | -14% | 12% | -2% |

| Weekly | -8% | 13% | 2% |

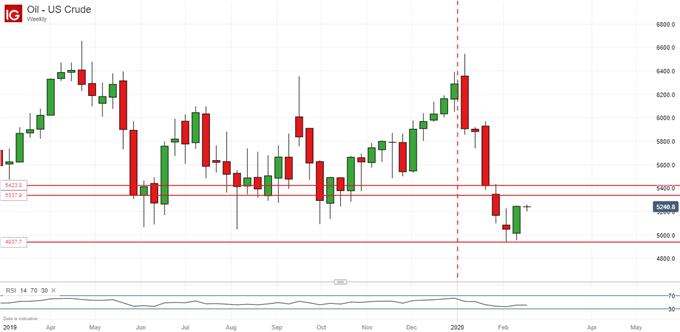

Crude Oil Technical Analysis

US crude oil’s weekly chart clearly shows the bounce seen in the last couple of weeks, with a floor now apparently under the market and likely to remain there for as long as production cuts are held to be a near-term prospect.

As with gold bulls have yet to overcome important close resistance, with the lows of the week of January 20 now providing resistance. The falls seen this year have been remarkably steep, however, and it seems unlikely that they’ll all be clawed back even if major cuts are forthcoming.

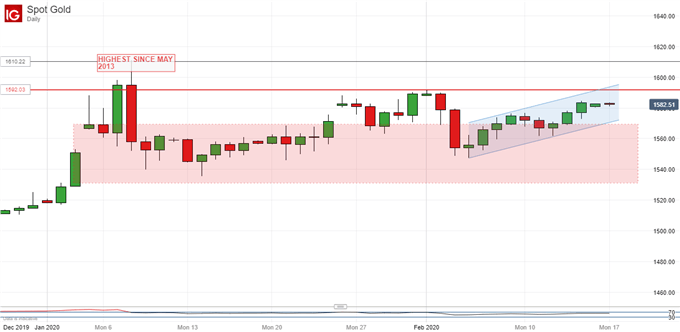

Gold Technical Analysis

The newly minted daily-chart uptrend from February 5 remains in play and quite well respected.

However, it’s notable that the bulls remain unable to quite get back to the highs seen earlier this month. They’ll need to do that sustainably if they’re going to have another try and early January’s major highs. If they can’t manage it this week the market may fade back towards its former trading band. However, this would still put it at relatively high altitude and support there is likely to linger for at least as long as coronavirus dominates the headlines.

Commodity Trading Resources

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!