Copper Prices, Global Coronavirus Recovery Path, Talking Points:

- Copper prices have risen from their March lows as the global economy struggles to reopen

- But they’ve done so less impressively than stock market more broadly

- As a very ‘real world’ indicator, they merit close watching

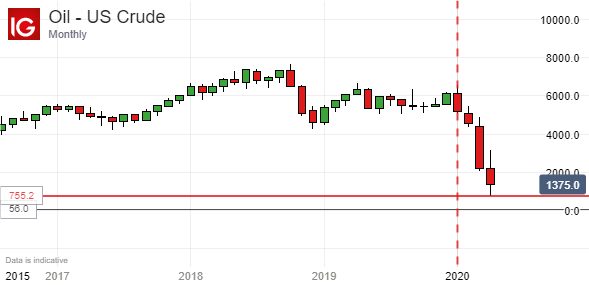

As the world staggers out of induced economic coma forced on it by the coronavirus, crude oil prices may offer on overly gloomy prognosis of its chances. Copper could rather promise the better steer.

While no one thinks that contagion will be anything other than a hammer blow to the global economy, it probably isn’t as hard a one as you might pardonably think if you merely eyed crude oil’s collapse.

While an obvious global bellwether, the oil market has its own dynamics. And the actions of producers since March, when production cuts could not be agreed, to the present day, when they have been but too late to stop a petroleum glut sloshing round a locked-down world with no use for it, are playing a huge part in the daily oil market fire sale.

| Change in | Longs | Shorts | OI |

| Daily | -4% | 3% | -3% |

| Weekly | 29% | -18% | 16% |

Copper meanwhile is a key industrial metal and, while it has its own dynamics too, may be a purer indicator of world chances. And sure enough, in the copper world things do look much better than they did.

On the London Metal Exchange prices have risen to six-month highs this week as investors look to the partial reopening of some national economies. Benchmark three-moth copper has hit $5,260/tonne, it’s best showing since March 17. The most-traded June contract on the Shanghai Futures Exchange has made 42,880 Yuan ($6,058.15), a near-two week high.

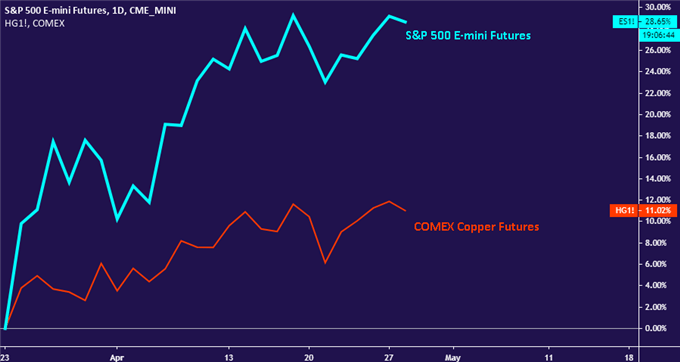

The bad news is that, while copper may be a more optimistic market than crude oil, it’s still less optimistic than US equity. Copper prices’ gains are much less impressive than US stocks big bounce from their March lows.

S&P 500 vs Copper prices daily chart created with TradingView

Indeed, equity markets broadly have recovered markedly, buoyed up by a range of monetary and fiscal stimulus programs put in place around the world.

These programs have been successful in reassuring financial markets that a calamitous ‘credit event’ such as the subprime implosion of 2008 can be avoided. And that’s important. However, they’ve clearly been less so in reassuring investors in the real economy that things will be returning to normal anytime soon. Hence copper’s lag.

Between the overwhelming gloom of the oil markets and the infectious optimism of the stock exchanges probably lies a more nuanced truth. The copper price could be much closer to it.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!