To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Talking Points:

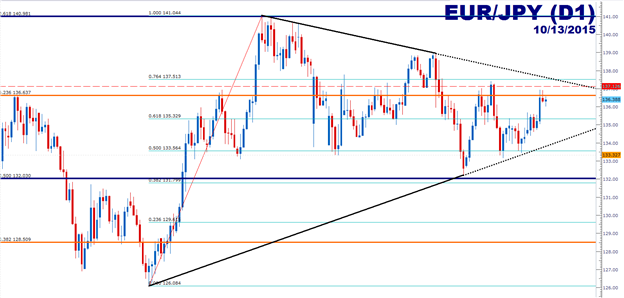

- EUR/JPY Technical Strategy: Flat, short setup identified

- EUR/JPY has popped higher after four consecutive days of consolidation last week.

- The longer-running symmetrical wedge still highlights congestion, but a short-term mean-reversion setup may be available.

In our previous piece, we looked at the double-sided breakout setup in EUR/JPY after four consecutive days of consolidation around a confluent support/resistance zone in the 135-neighborhood. We also highlighted the longer-running symmetrical wedge formation that’s defined price action since the first half of the year, and how this would likely continue to contain near-term price action until a more definitive stance on risk-trends becomes apparent.

The double-sided breakout triggered to the long side, as the identified resistance level of 135.70 yielded to surging prices on Friday as EUR/JPY topped out at 136.94. Since that move, we’ve seen three consecutive days of resistance around a key Fibonacci level, and this could be opening the door for short positions to play mean-reversion while the symmetrical wedge is still active in the pair.

The current resistance level of interest is 136.63, which is the 23.6% Fibonacci retracement of the ‘secondary move’ in the pair and can be found by taking the July 2012 low to the December 2014 high. This is a level that has previously offered numerous instances of resistance, and this could be used for stop placement on mean-reversion plays.

Traders can look to lodge stops above 137 to get risk levels outside of last week’s price action, as well as above this Fibonacci level. This could open the door for profit targets at 135.32 (the 61.8% Fibonacci retracement of the most recent move, taking the April 2015 low to the June 2015 high), and then 135 (major psychological level), followed by 134 (projected support trend-line).

Outside of that, traders can wait for the symmetrical wedge to break before a cleaner trend becomes available. Should prices break below 133.50, traders should construe the trend bearishly, and longer-term targets could be cast towards 132 (50% Fib retracement of the ‘big picture’ move, taking the 2008 to the 2012 low). Alternatively, breaks above 137.50 should be construed bullishly, and this could open the door for targets at 139 (prior price action swing high), and then 140 (major psychological level).

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX