Talking Points:

- USD/CAD Retail Crowd Remains Heavily Net-Short Despite Fresh 2015 High.

- USD/JPY Bullish Outlook Mired by Wait-and-See Bank of Japan (BoJ) Policy.

- USDOLLAR Risks Fresh 2015 Highs as Fed Looks to Normalize Further in 2016.

For more updates, sign up for David's e-mail distribution list.

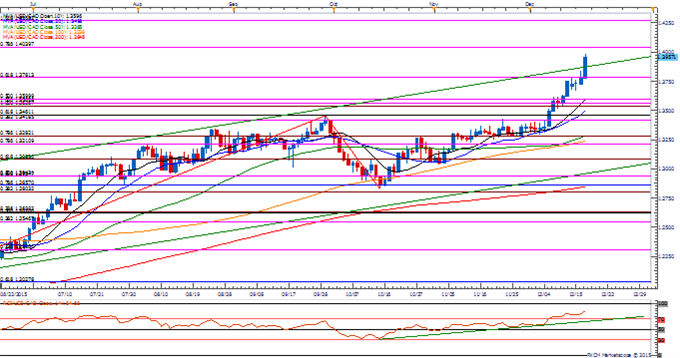

Chart - Created Using FXCM Marketscope 2.0

- USD/CAD extends the advance from earlier this month, with the pair climbing to a fresh yearly high (1.3970), and the near-term advance may gather pace over the coming days as the Relative Strength Index (RSI) pushes deeper into overbought territory.

- Even though the Bank of Canada (BoC) adopts an improved outlook and endorses a wait-and-see approach for monetary policy, the persistent weakness in oil prices may prompt Governor Stephen Poloz to further insulate the economy amid the ongoing readjustment in the region.

- Despite the fresh 2015 high, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short USD/CAD since November 4, with the ratio hold around recent extremes as it sits at -3.41, with 23% of traders long.

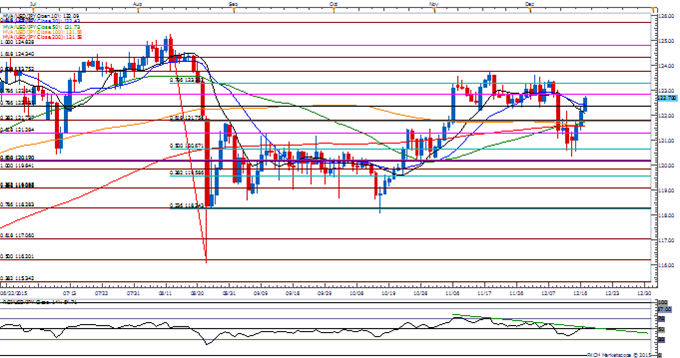

USD/JPY

- USD/JPY may continue to retrace the decline from the December high (123.66) as the pair climbs back above former support around 122.40 (78.6% retracement), while the RSI appears to be threatening the bearish formation carried over from the previous month.

- Despite expectations of seeing the Bank of Japan (BoJ) further expand its asset-purchase program in 2016, Governor Haruhiko Kuroda and Co. may continue to endorse a neutral outlook for monetary policy and talk down bets for an imminent move.

- With USD/JPY coming off of former resistance around 120.70 (50% retracement), will keep a close eye on the topside targets, with the key topside hurdle coming in around 123.80 (50% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

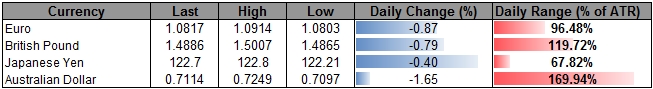

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12196.56 | 12207.17 | 12137.77 | 0.59 | 129.22% |

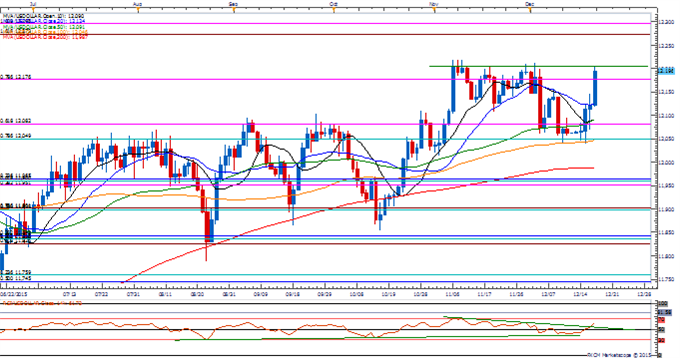

Chart - Created Using FXCM Marketscope 2.0

- The USDOLLAR looks poised to extend the advance following the Federal Open Market Committee (FOMC) rate-hike as Chair Janet Yellen and Co. appear to be on course to implement higher borrowing-costs in 2016.

- With market participants looking for the next Fed rate-hike in March, with Fed Funds Futures pricing a 41% probability, the bullish sentiment surrounding the greenback may gather pace over the remainder of the year as the Fed looks to a more standardized approach to normalize monetary policy.

- With USDOLLAR holding above former-resistance around 12,049 (78.6% retracement) to 12,082 (61.8% expansion), the next region of interest comes in around 12,273 (161.8% expansion) to 12,296 (100% expansion).

*As we approach the holidays and thus illiquid markets, it's worth reviewing principles that help protect your capital. We call these principles the "Traits of Successful Traders."

Three Factors Warn of Perfect Storm in FX Markets - Caution Advised

Read More:

USD/CAD Technical Analysis: Catching The Falling Knife of CAD Futile for Now

Price & Time: S&P 500: Transparency Run Amok?

People’s Bank of China Lowers GDP Forecast, Signs New Currency Deals

US Dollar Technical Analysis: Priced-In Rate Hike Keeps USD Steady

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand