By: Jeremy Wagner, Lead Trading Instructor, DailyFX EDU

In the midst of stock market volatility, there are pockets and places where currencies are trading sideways. When the markets tend to move sideways, I’ll look to the JW Ranger Strategy for trading opportunities. It is a day trading strategy where trades are entered and exited generally within 24 hours. The strategy usually produces a trade every 1 or 2 days on a 15 minute candlestick chart.

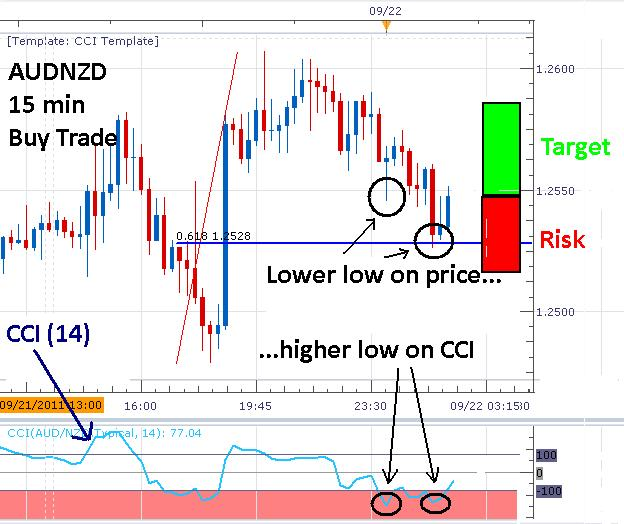

This week we have several large news events that could move the market. This volatility may produce wide ranges and additional trading opportunities on the JW Ranger strategy using cross pairs (see below for AUDNZD).

Strategy Set Up

I’ll trade this strategy when the market has a tendency to move sideways. This means support and resistance levels tend to hold and there is less likely a chance of a breakout. This type of market generally occurs during the Asian trading session (4p – 2a ET) or during the first week of a new month (with several major news announcements that week). This week, we have Reserve Bank of Australia (RBA), Bank of England (BOE), and European Central Bank (ECB) all with a target rate announcement. Then, to finish the week off, on Friday is the US Jobs report. This provides a potential for some currencies to stagnate through the week offering us an opportunity to trade the JW Ranger Strategy.

This strategy is typically traded on a 15 minute to 1 hour candlestick chart. This strategy uses divergence on the Commodity Channel Index (CCI) with an input setting of 14 to open up an entry signal. A stop is placed about 20-25 pips away and the take profit level is generally about 20-25 pips away yielding a 1 to 1 risk to reward ratio. When day trading, it is difficult to find many set ups with a stop loss large enough to give the trade enough room to breathe, yet tight enough that you are not giving up too much risk. So the 1:1 risk to reward ratio is not the ideal ratio, but for a day trading strategy, this is as realistic as possible. Insist on keeping the risk to reward ratio at 1: 1 or better.

Rules to Buy

(Created by J. Wagner)

- Identify levels of support on your chart. I have used a Fibonacci retracement level above to determine support.

- Wait for prices to create a lower low near this support zone while CCI is creating a higher low. This is also referred to as CCI divergence.

- Enter a buy trade when the CCI crosses above -100.

- Place your stop about 10 pips below the swing low.

- Set your take profit level at the same distance as your stop for a 1:1 risk to reward ratio.

Rule to Sell

(Created by J. Wagner)

- Identify levels of resistance on the chart. Above we have horizontal resistance (dark green line).

- Wait for prices to create a higher high near this resistance zone while CCI is creating a lower high.

- Enter a sell trade when the CCI crosses below +100.

- Place your stop about 10 pips above the swing high.

- Set your take profit level at the same distance as your stop for a 1:1 risk to reward ratio.

Currency Pair Selection

Currency pair selection is as important as the strategy’s buy and sells rules. Be persistent on finding a pair that has been moving at a snail’s pace making little net progress. The first pair I typically look at is the AUDNZD cross pair. You have 2 similar economies that are geographically located near each other. Therefore, they tend to be strong trading partners and their economies will closely follow each other. Therefore, the AUDNZD exchange rate tends to range most of the time. So find a pair that has been range bound (it can be other pairs since this is a range strategy).

Additional Resources

How to Trade Commodity Channel Index (CCI) in Forex

Divergence: The Other Side of the Oscillator

---Written by Jeremy Wagner, Lead Trading Instructor

To contact Jeremy, email jwagner@dailyfx.com. Follow me on Twitter at @JWagnerFXTrader.