US Dollar Weekly Forecast: Neutral

- The US Dollar paused a 3-week winning streak with tepid performance

- Still-strong labor data keeps path open for the Fed to resume tightening

- Bullish Golden Cross between DXY moving averages offers some support

Fundamental Analysis

The US Dollar (DXY) fell about -0.2 percent last week, ending what was a 3-week winning streak. Granted, the past 5-day performance was rather timid. A rather rosy week for market sentiment dampened the demand for haven assets, such as the US Dollar. Keeping the currency afloat was a push higher in Treasury yields towards the end of last week.

The latter was caused by the latest non-farm payrolls report. At face value, it was rather mixed. The country added 339k jobs in May, much higher than the 195k estimate as last month’s addition was revised higher to +294k from +253k. The downside of the report was that the unemployment rate unexpectedly ticked higher to 3.7% from 3.4%. Economists were eyeing a hold of 3.5%.

If you look at the market reaction, financial markets took the data as another robust sign of a still-tight labor market. Earlier in the week, figures showed that there are about 1.8 job openings per unemployed person. The surge in Treasury yields that day reflected cooling Federal Reserve rate cut expectations. Most expectations point to a Fed pause in June, with about a 75% chance of at least one hike in July.

This is what is likely keeping the US Dollar afloat despite a lack of demand for haven assets: a robust economy. The week ahead notably dies down in terms of prominent economic event risk. Initial jobless claims remain some of the timeliest data we have on the labor market. Aside from that, factory orders could be another source of event risk.

As such, the focus for the US Dollar may shift to general risk appetite, especially given that a debt ceiling deal was reached between government officials. With a Fed pause in the cards, and robust economic data driving momentum, the Greenback may mark time in the week ahead, especially if sentiment remains robust and Wall Street continues pushing higher, unperturbed by steady Treasury yields.

Technical Analysis

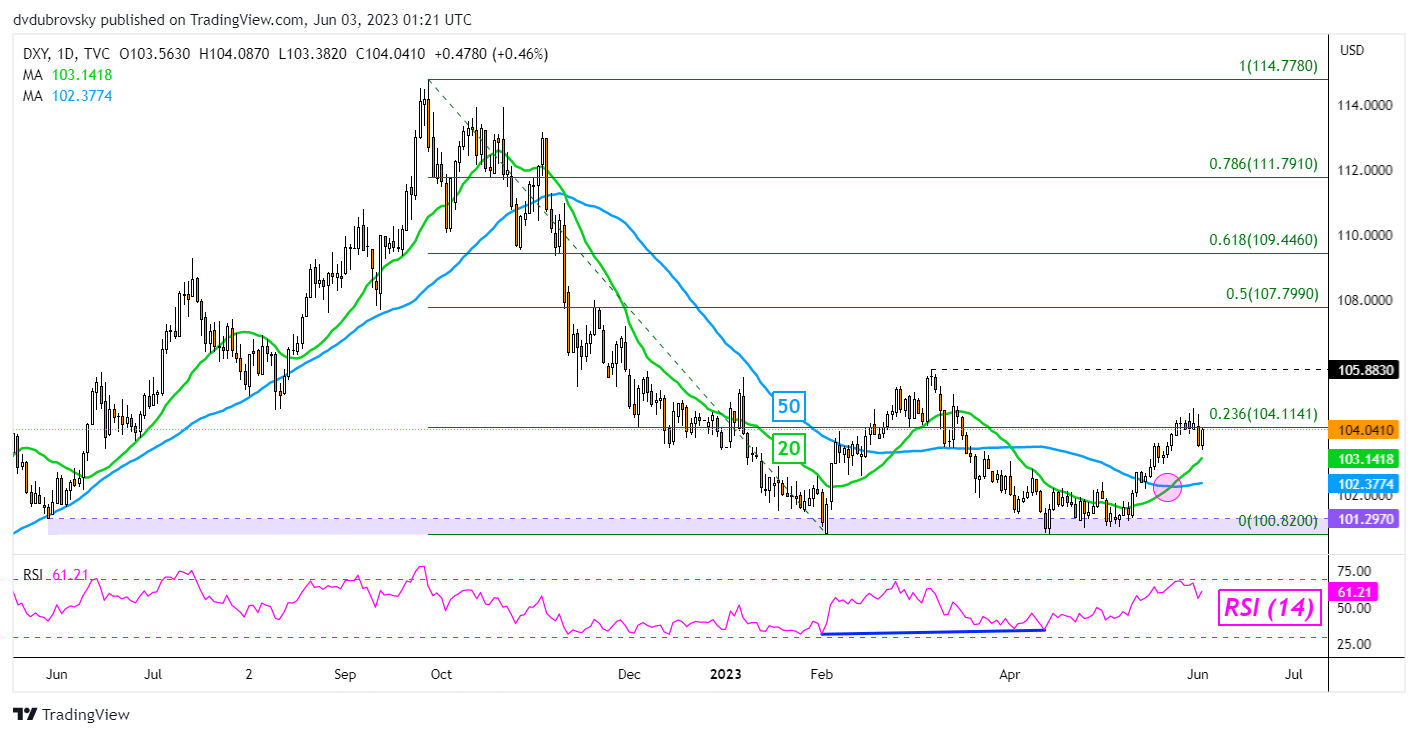

Technically speaking, a bullish Golden Cross recently formed between the 20- and 50-day Simple Moving Averages on the DXY chart below. That is offering a slight upward directional bias. Immediate resistance seems to be the 23.6% Fibonacci retracement level at 104.11. Further gains beyond that expose the March high of 105.88. In the event of a turn lower, the moving averages may hold as support. Otherwise, extending lower exposes the 100.82 – 101.29 range.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

DXY Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com