US Dollar Forecast (DXY), USD/JPY - Prices, Charts, and Analysis

- 10-year US Treasury yields a whisker away from 5.0%.

- Chair Powell speaks at the Economic Club of New York.

- USD/JPY remains below 150.00.

Download our Brand New Q4 US Dollar Outlook

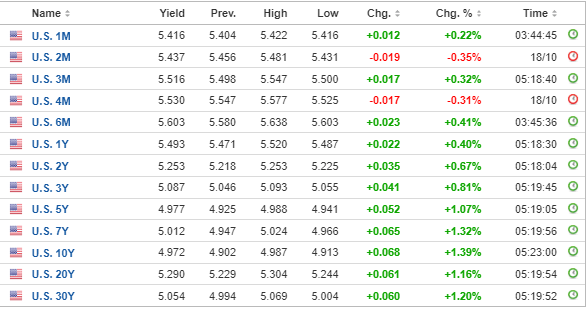

Sellers are in complete control of the US Treasury market at present, sending yields across the curve sharply higher. Apart from the US 5yr and 10yr, US bonds with a maturity between one month and 30 years have a ‘five handle’ as buyers sit on the fence and let the sell-off continue.

This week has seen a slew of Federal Reserve members giving their views on the US economy with a common mantra being that interest rates are likely to remain at current levels (525-550) for longer. Recent US data has shown that the US economy continues to recover strongly with Q3 GDP now seen at 4%+. With inflation falling, but not at a fast enough rate for the Fed, Chair Powell will likely reiterate that the Fed remains steadfast in its fight against inflation. Chair Powell’s speech to the Economic Club of New York at 17:00 UK will be the next volatility point for the US dollar, as will the thoughts of the five other Fed speakers scheduled for today.

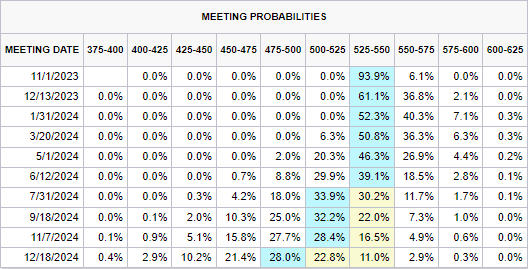

The latest CME FedWatch Tool suggests that US interest rates will remain untouched through the first half of 2024 with the first cut seen at the July 31st meeting, but only just.

CME FedWatch Tool

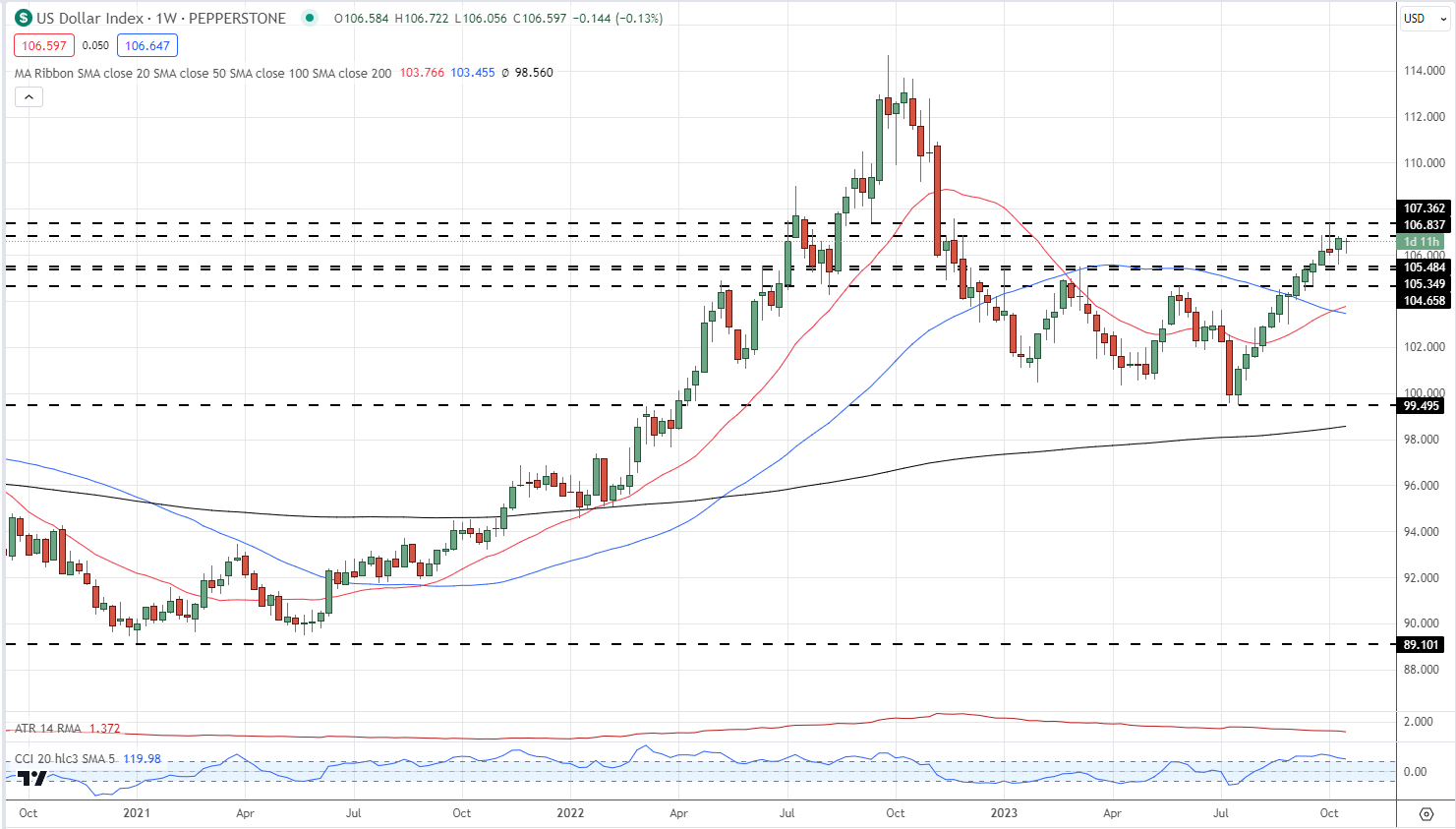

The US dollar is pushing higher for the second day in a row after bouncing off the 106.00 area earlier this week. The technical outlook for the greenback remains positive with 106.84 the next level of short-term resistance. Above here, 107.36 comes into play.

US Dollar Index Weekly Price Chart – October 19, 2023

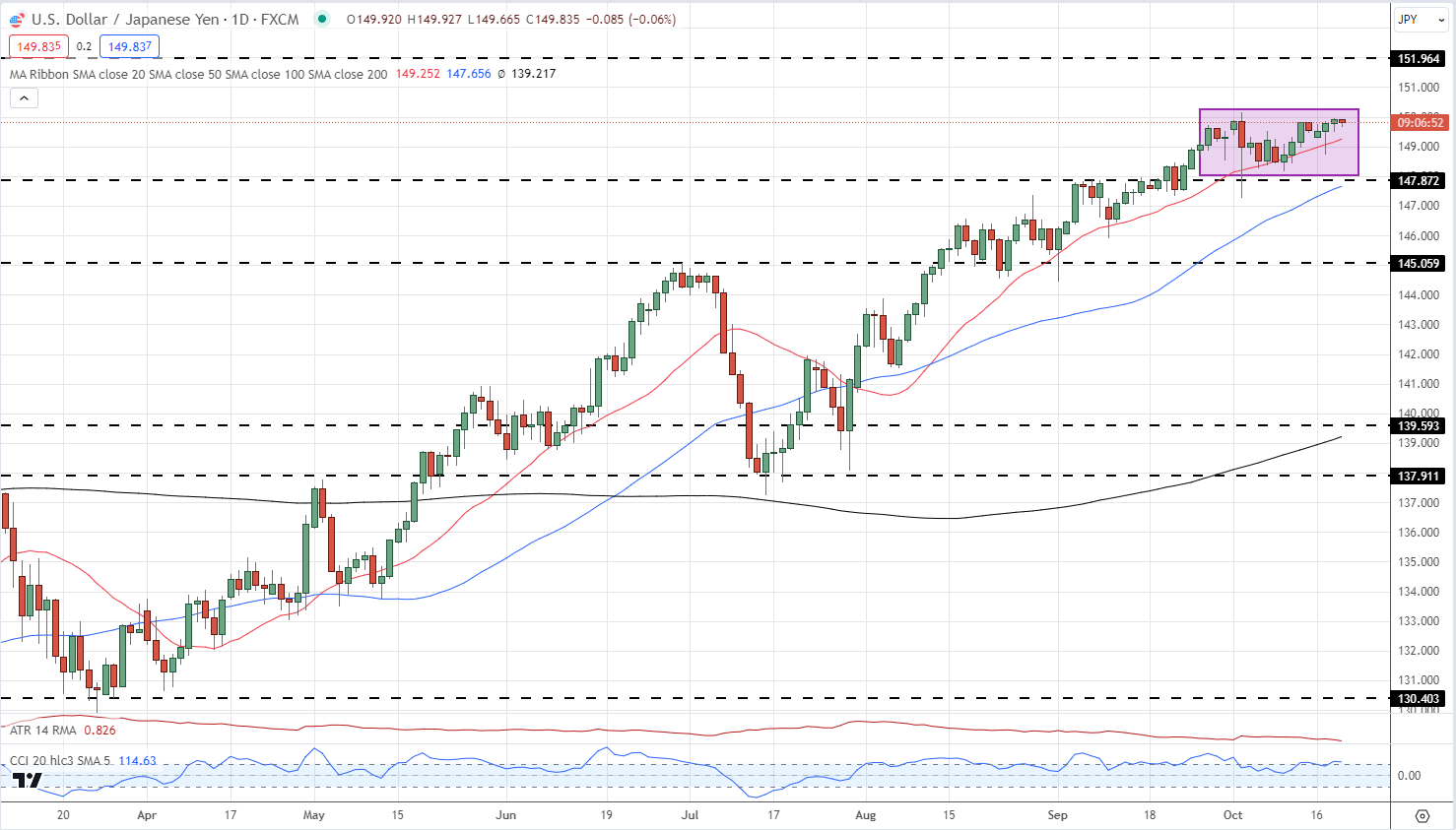

One pair that is not dancing to the US dollar’s tune is USD/JPY. The 150.00 area is acting as stiff resistance as the market backs away from testing the resolve of the Bank of Japan. The Japanese central bank is seen using this level as a line in the sand to prevent the Japanese currency from weakening further. A confirmed break above this level is unlikely, despite the strength of the US dollar, and USD/JPY may soon drift lower into the Bank of Japan policy meeting at the end of the month.

USD/JPY Daily Price Chart – October 19, 2023

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

All Charts via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.