Oil (Brent, WTI) News and Analysis

- OPEC distances itself from political request – reaffirms responsibility to global oil market

- Crude oil prices backtracked after the embargo request sent prices higher

- WTI crude flirting with resistance

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

OPEC Distances Itself from Political Request – Reaffirms Responsibility to Global Oil Market

The global oil market is a complex and multifaceted entity, often directly influenced by geopolitical events and economic policies. Recent developments in the Middle East have proven this once again, significantly impacting the oil industry. One such development is the escalating tensions between Iran and Israel, characterized by Iran's call for an oil embargo on Israel, in response to a controversial bombing incident involving a hospital.

Iran, known officially as the Islamic Republic of Iran, is a significant player in the global oil market due to its vast reserves and strategic location. The country's call to impose an oil embargo on Israel is not surprising and may have ramifications for the market as a whole due to tighter global supply. The Organisation for Petroleum Exporting Countries, otherwise known as ‘OPEC’, is committed to reducing its oil output by 2 million barrels per day (bpd) until the end of 2024, while Saudi Arabia and Russia agreed to make a further cut of 1.3 million bpd until the end of the year.

The embargo, if implemented, would affect global oil prices. For instance, during the 1973 oil crisis, an embargo led by Arab members of the Organization of Petroleum Exporting Countries (OPEC) led to a quadrupling of oil prices. The embargo against Israel however appears to be more targeted than the one in 1973 which included the United States, Canada Britain, Japan and the Netherlands – having a greater impact.

Brent Crude’s Intra-Day Spike Erased After OPEC Avoids Political Battle

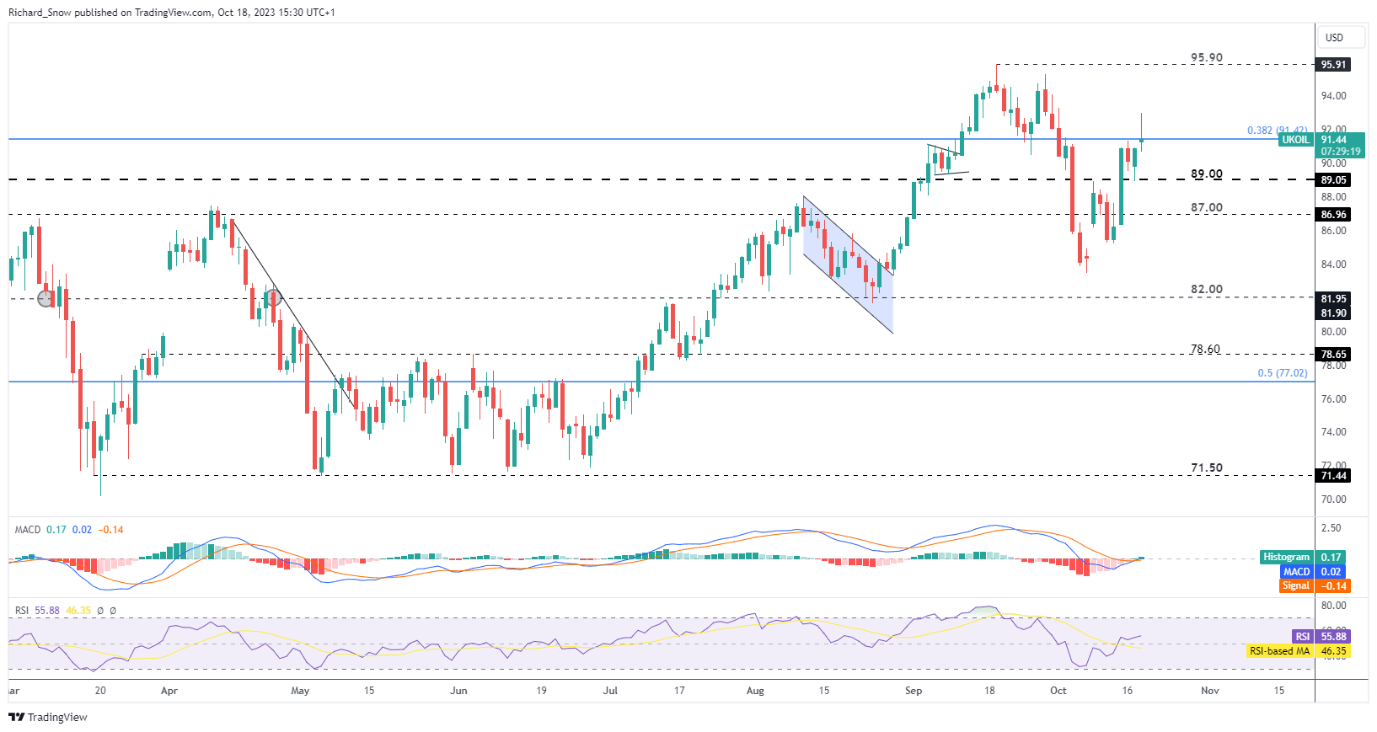

OPEC confirmed that is has no plans to schedule emergency meeting`s after Iran’s embargo calls which were made to the Organisation of Islamic Cooperation (OIC). News of the response allayed fears of rapidly increasing oil prices, sending Brent crude prices back towards levels witnessed at the open. The situation remains highly uncertain with gold and oil both witnessing rapid rises in response to the escalating conflict. The MACD favors the recent bullish momentum and the RSI still has some way to go before entering overbought territory. Immediate resistance appears at the 38.2% Fibonacci level ($91.42) followed by the swing high at $95.90. Support resides at $89.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

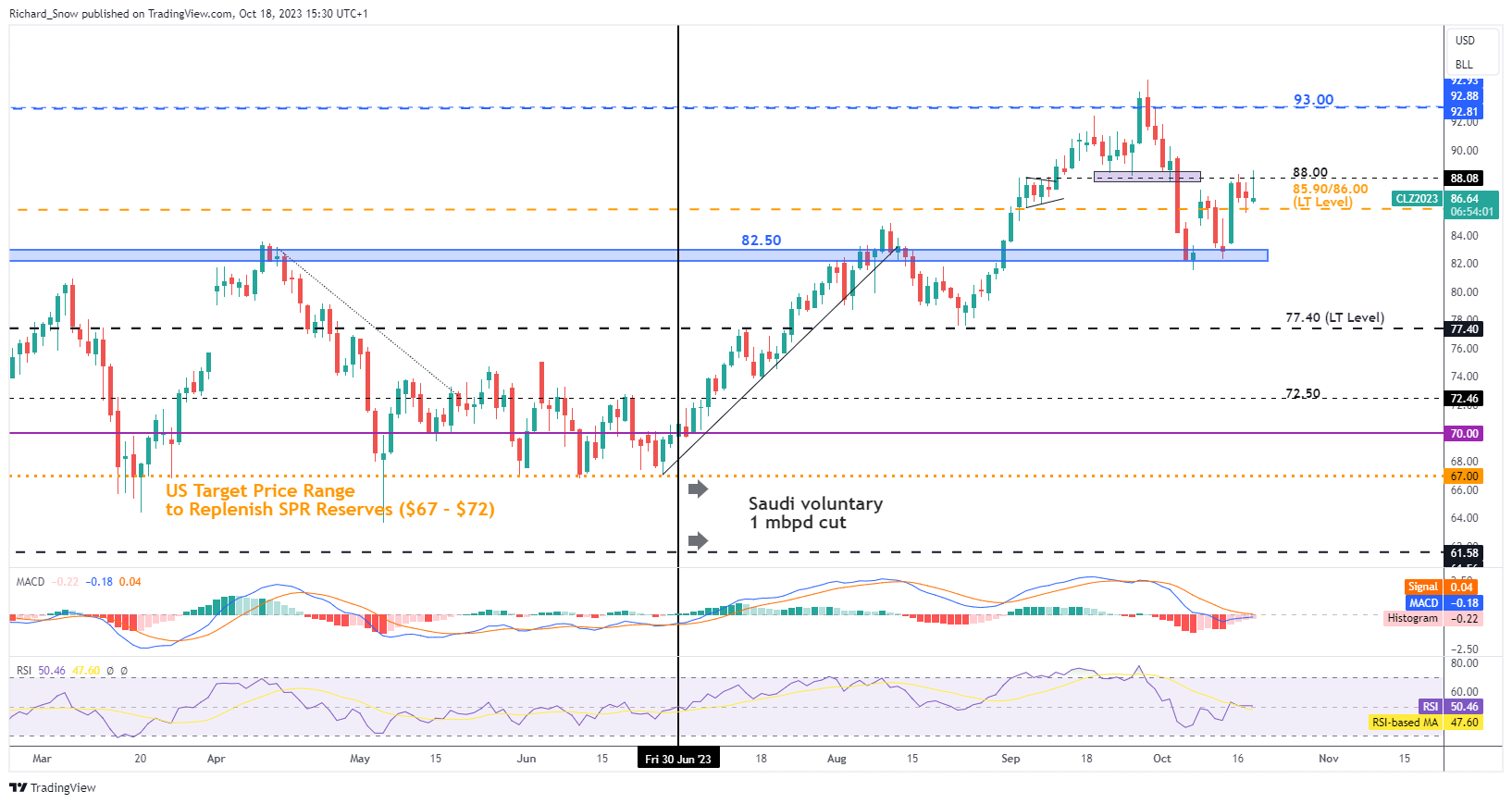

WTI oil reveals a similar backtracking after the spike to the upside. Recent prices have struggled to break above $88 – the immediate level of resistance. The intra-day dip sees prices test the longer-term level of significance at $86.

WTI Oil Daily Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX