Japanese Yen Prices, Charts, and Analysis

Download our Free Q4 Japanese Yen Forecast

The Federal Reserve, Bank of England and the Bank of Japan all announce their latest monetary policy decisions next week and it is the latter that is most likely to spark a fresh bout of volatility. While the Fed and the BoE are expected to leave all policy dials untouched, the BoJ may well tweak their current yield curve control policy and allow JGB yields to move higher. The Japanese central bank currently caps the benchmark 10-year bond yield at 1%, and intervenes if this threshold comes under pressure, but market talk at the moment suggests that the BoJ may allow market yields to rise to 1.5%, a hawkish twist and one that would strengthen the Yen.

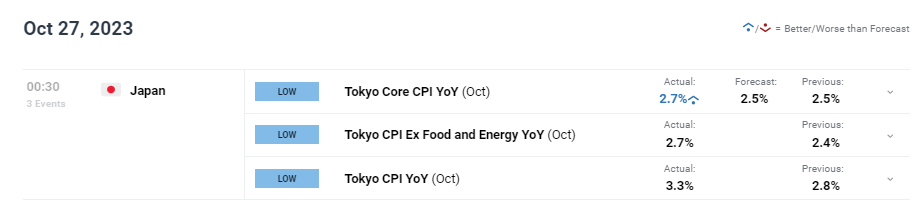

Earlier today the latest Tokyo CPI reading beat market forecasts and showed price pressures rising. This reading is seen as a proxy for national inflation trends and may nudge the BoJ towards acknowledging that inflation in Japan is finally starting to become entrenched. If the Bank of Japan revises its inflation outlook higher, the Japanese Yen will strengthen across the board.

BOJ intervention

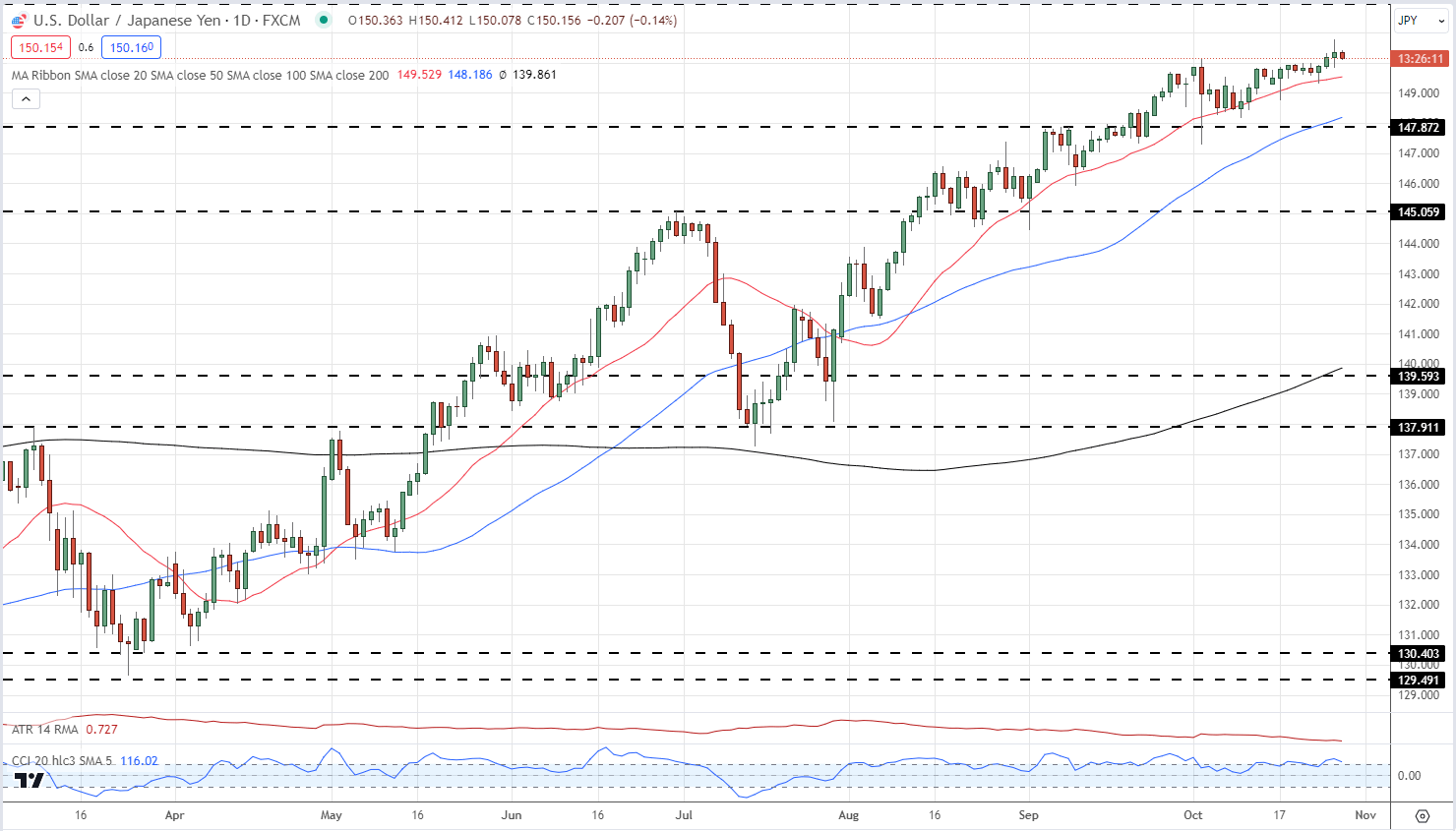

USD/JPY is trading at, or very close to, highs seen one year ago before BoJ intervention sent the pair spiraling lower. The 150 level has been seen as the line in the sand for USD/JPY for many weeks now with any test of this level met with rumors of Japanese official intervention. The pair currently trade just above 150 but a further move higher is very unlikely ahead of next week’s central bank meeting. While the BoJ meeting should be closely watched, the post-Fed decision press conference will also be key for the US dollar’s outlook.

USD/JPY Daily Price Chart – October 27, 2023

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.