Gold, XAU/USD, Silver, XAG/USD – Outlook:

- Gold and silver have jumped on account of escalating geopolitical tensions.

- Both gold and silver are testing major resistance.

- What is the outlook and what are the key levels to watch in XAU/USD and XAG/USD?

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

The sharp bounce in gold and silver recently has raised questions on whether it is time to reassess the bearish outlook. While this could indeed be a game changer, it might be worth waiting for a confirmation before concluding a trend reversal.

XAU/USD has hit a 3-month high due largely to escalating tensions in the Middle East. The downshift in hawkish rhetoric from US Federal Reserve officials has kept a lid on the global USD, indirectly benefiting gold at the margin. If the jump in gold is largely explained by geopolitical concerns, it would be hard to argue for a case of a sustained rally in precious metals. From a fundamental perspective, the key drivers that have driven gold lower in recent months remain intact – solid US economy and rising US yields / real yields.

Granted, quite a few US Federal Reserve officials have shifted to a less-hawkish tone given the recent jump in long-term yields. The tightening in financial conditions undoubtedly reduces the need for imminent tightening, but probably not a Fed pivot, which Fed Chair Powell seemed to indicate on Thursday.

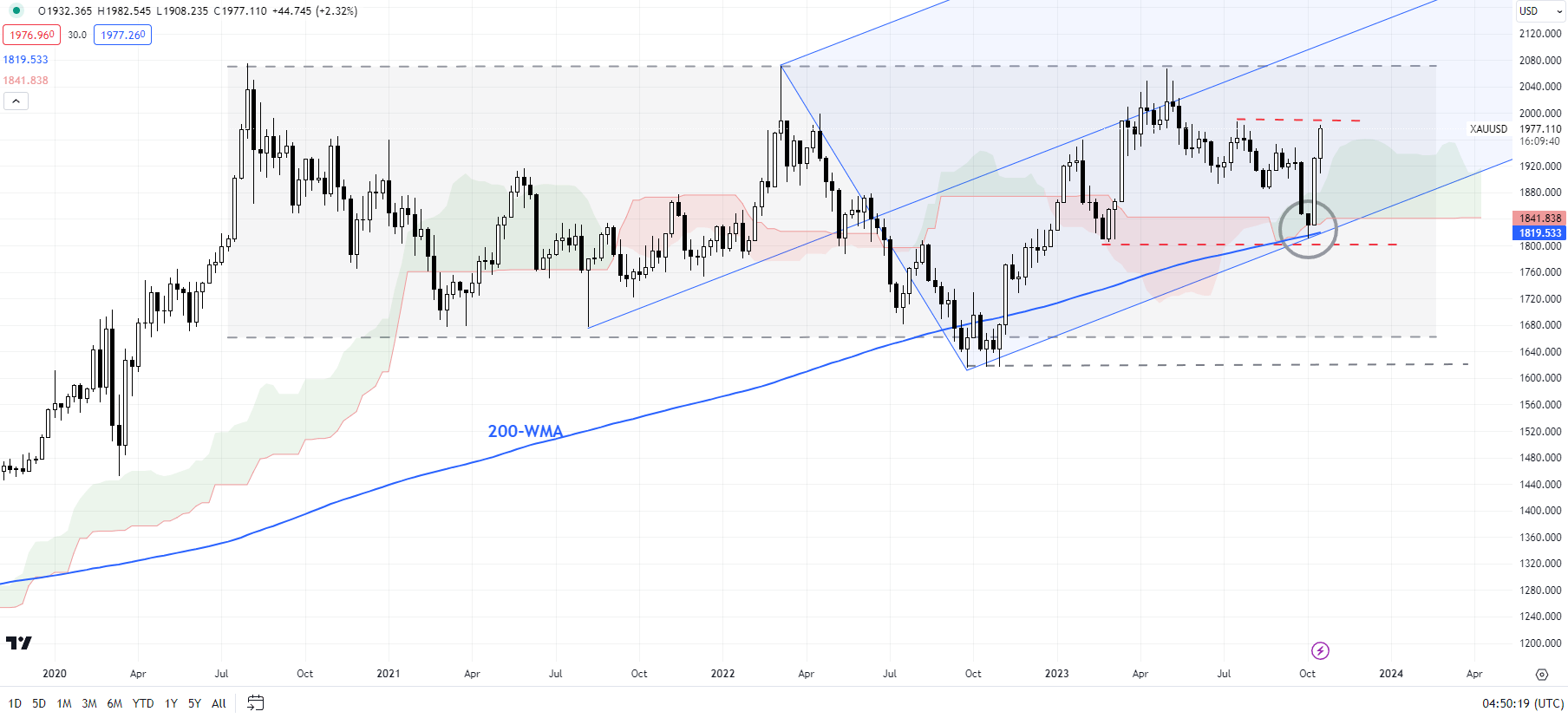

XAU/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Gold: Testing key hurdle

On technical charts, gold is testing crucial resistance at the July high of 1987. A decisive break above would confirm that the multi-week downward pressure had faded. Such a break would warrant a reassessment of the bearish outlook. Furthermore, a crack above the May high of 2072 is turning the medium-term outlook to bullish.

Deeply oversold conditions (RSI below 20) earlier this month triggered a rebound from strong converged support on the 200-week moving average, around the February low of 1805 and the lower edge of a rising pitchfork channel from 2021.

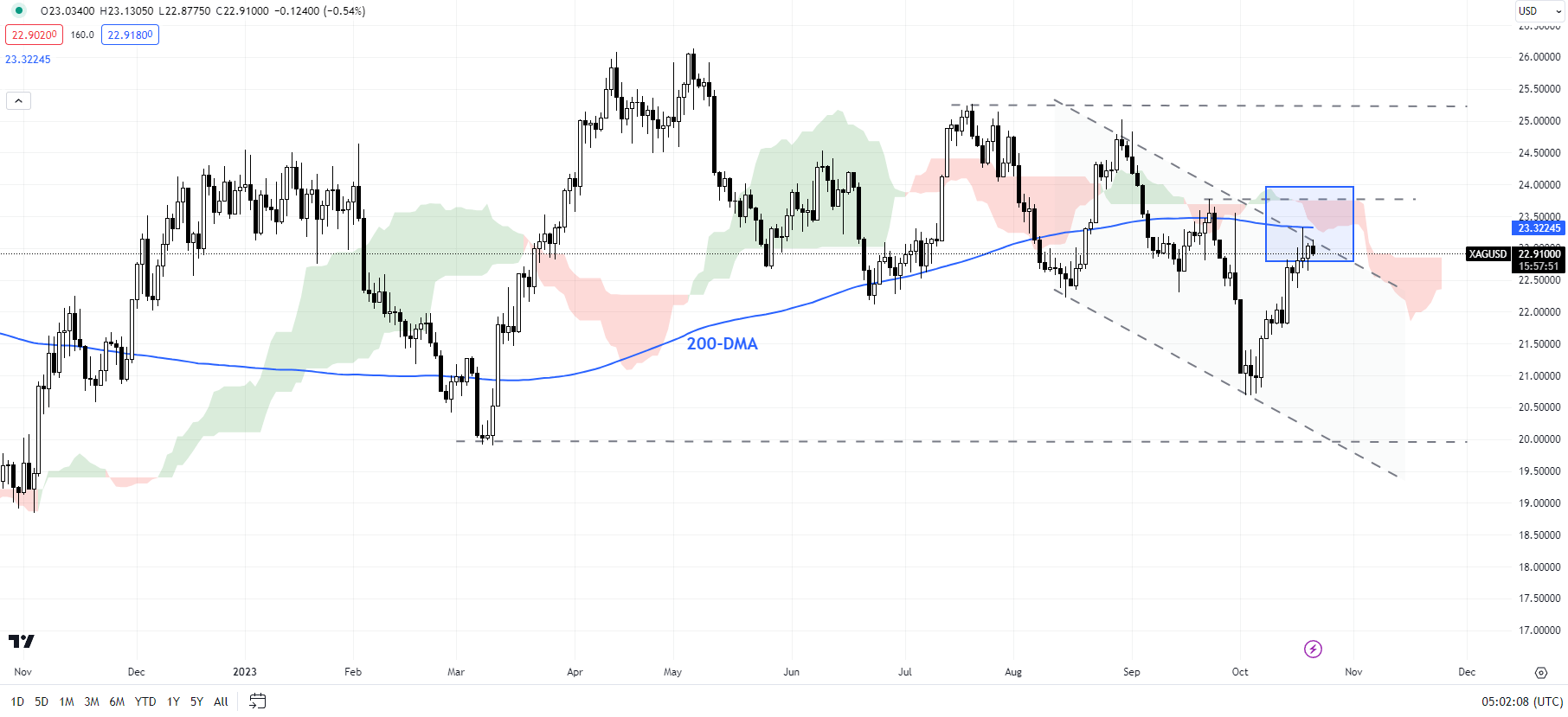

XAG/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Silver: Testing 200-DMA ceiling

Silver is testing major converged resistance on the 200-day moving average, the late-September high of 23.75, and the upper edge of the Ichimoku cloud on the daily charts. XAG/USD needs to cross the 23.25-23.75 area for the immediate downward pressure to fade.

From a slightly broader perspective, as highlighted in the Q4 outlook, XAG/USD needs to cross above 25.50-26.25 resistance for the outlook to turn constructive. See “Gold Q4 Fundamental Forecast: Weakness to Persist as Real Yields Rise Further,” published October 6, and “Gold/Silver Q4 Technical Forecast: Tide Remains Against XAU/USD & XAG/USD,” published October 1.

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish