GOLD OUTLOOK & ANALYSIS

- Hawkish Fed speak and resilient US jobs market keep gold upside limited.

- Fed speakers in focus later today.

- Threatening signs as triangle breakout coupled & death cross develops.

XAU/USD FUNDAMENTAL BACKDROP

Gold prices have dropped to levels last seen in March as the Fed’s hawkish narrative gains traction through Fed speakers. Minneapolis Fed President Neel Kashkari (a known hawk) added stated that the Fed may need hike one more time as well as maintain rates at elevated levels throughout 2024. This has translated through to the higher US Treasury yields and consequently real yields (see graphic below), weighing on the non-interest bearing metal.

US REAL YIELDS (10-YEAR)

Source: Refinitiv

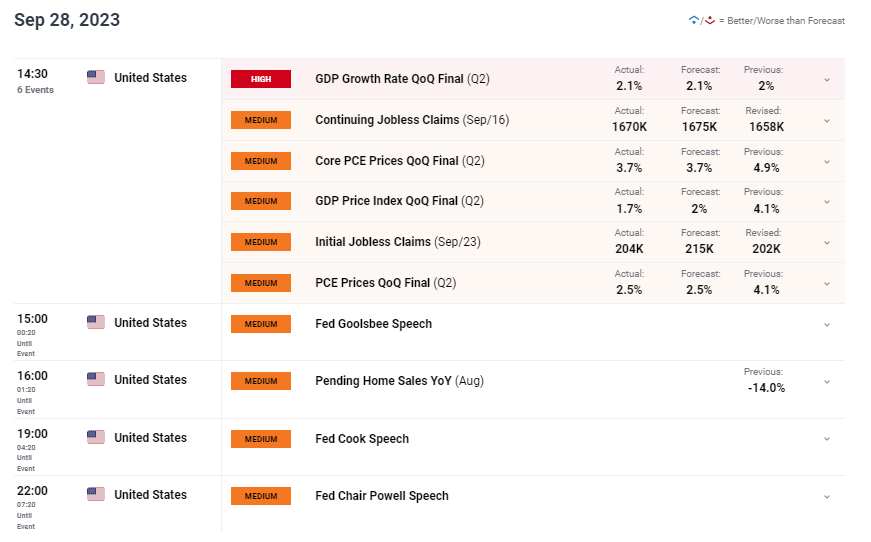

US GDP printed roughly in line with expectations but the miss on initial jobless claims data reinforced the robust US labor market narrative. One positive from a dovish perspective was the decline in core PCE prices that could relive some of the short-term inflationary concerns plaguing the US. That being said, until cracks start appearing in the jobs market, the Fed may need to maintain a restrictive policy for a longer period.

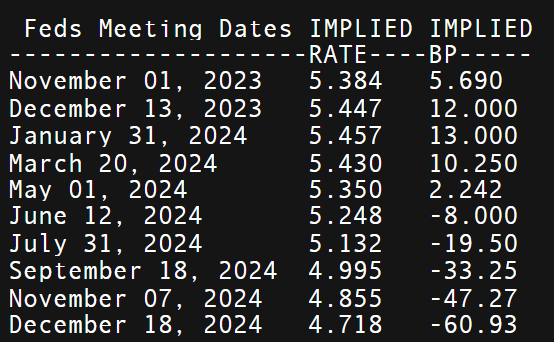

The rest of the trading day will be centered around Fed guidance including the Fed Chair Jerome Powell. After Neel Kashkari stoked volatility in the markets by reinforcing his views on sustained aggressive monetary policy, it will be interesting to see whether or not other Fed officials have the same viewpoint.

GOLD ECONOMIC CALENDAR

Source: DailyFX

Money market pricing for the rate announcement as shown in the table below, suggests a pause by the central bank but the messaging provided by Federal Reserve Chair Jerome Powell will be key for gold. Any indication of additional rate hikes and sustaining elevated interest rate levels for a longer period could weigh negatively on gold. Any talk around rate cuts will be valuable information with current forecasts between June/July 2024.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

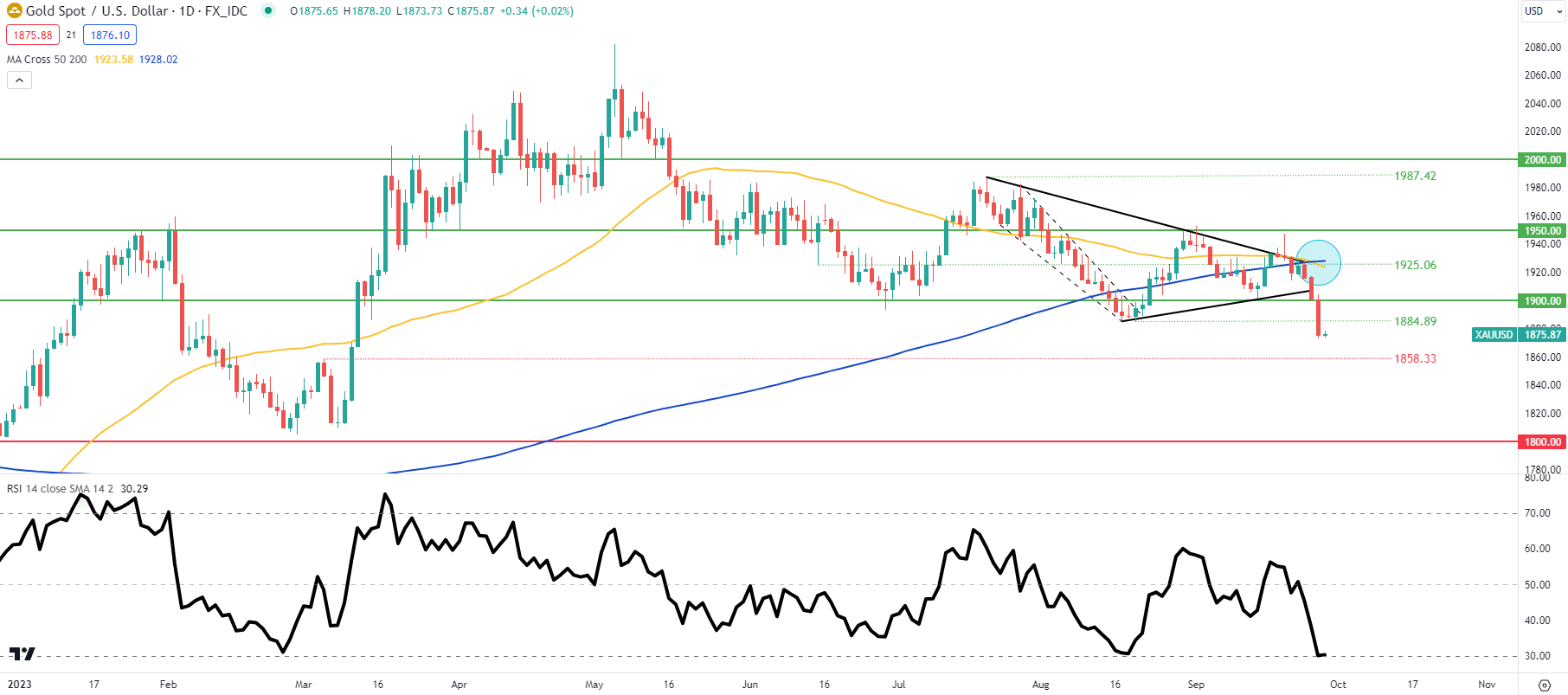

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action above shows two significant bearish indications. The first being the recent symmetrical triangle (black) breakout that pierced beneath the 1900.00 psychological handle as well. Secondly, the 50-day moving average (yellow) crossing below the 200-day moving average (blue) confirms a death cross formation that is ominous for the yellow metal. Although the Relative Strength Index (RSI) reading sits in the oversold zone, there is still room for further downside to come, exposing the 1858.33 swing low.

Resistance levels:

- 1925.06/50-day MA/200-day MA

- 1900.00

- 1884.89

Support levels:

- 1858.33

- 1800.00

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 81% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas